The JSE managed to eke out a 0.12% gain to end the day higher but still below the 76,000-point mark after jumping almost a percent in intraday trading on optimism that geopolitical tensions in the Russia Ukraine saga were receding.

Counters in the Resources (-2.49%) and Precious Metals & Mining (-3.78%) indices weighed the most as metals gave up overnight gains to trade significantly lower on a report that Russian troops would return to their regular bases after completing drills.

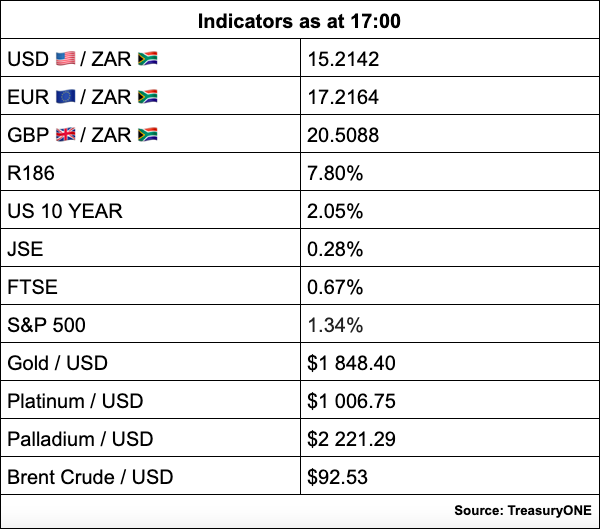

Gold fell as much as 1.4% and was last trading 1.33% lower at $1,846.71/oz and platinum pared losses to last trade 1.07% weaker at $1,020,00/oz. But palladium saw the biggest plunge, with the metal last changing hands down 5.91% at $2,230.42/oz.

The troop news also impacted oil prices, with Brent crude slipping over 3% to last trade at $92.93 a barrel.

Leading the losses was Sibanye-Stillwater with a 6.83% drop as the miner also faces strike action. Other commodity counters stacking up big losses were Harmony (-6.52%), Sasol (-4.54%), Implats (-3.79%), Gold Fields (-3.46%), African Rainbow Minerals (-2.99%) and Angloplat (-2.74%).

Thungela Resources (-3.21%) and Kumba Iron Ore (-2.78%) added to the gloom as iron ore prices crashed 11% amid a Chinese crackdown. The latter awarded a R1.6bn mining contract to a community-based venture in the Northern Cape.

Glencore bucked the trend, gaining 1.69% after the diversified miner said it has set aside $1.5bn in provisions related to penalties it believes may be imposed by anti-graft authorities which are currently running investigations into the group’s trading activities in South America and Africa.

Buoying the bourse were banks, with Standard Bank (4.68%), FirstRand (4.34%), Nedcor (3.48%) and Absa (2.91%) all gaining after Nedbank said the group expects profits (headline earnings per share, HEPS) to be up to 118% higher on the back of a stronger than expected performance in the last few months of 2021 as operating conditions for the bank and its clients continued to improve. Basic EPS is expected to increase by up to 228% for the year to end-December compared to the previous twelve-month period. Capitec (-1.11%) and Investec Ltd (-0.44%) were exceptions.

The financial sector has been one of the best-performing equity asset classes in the past 12 months, with banks’ earnings driven mainly by two factors: fees it charges for its services and the interest it earns on its assets. All of this is tied to the repo rate, the rate at which the central banks lends to commercial banks, Biznews writes in an analysis piece on the high-flying banking sector.

Among the other top gainers were Bytes Technology (+8.15%), Steinhoff (+4.30%) after it moved a step closer to starting payouts in its R25bn settlement, and Remgro (+3.97%) as shareholders cheered Heineken’s buyout of Distell.

Spar gained 3.70% after the retailer said it benefited from the end of the ban on alcohol sales, with trade at its nationwide TOPS liquor stores surging 56% in the 18 weeks through the end of January.

Discovery added 1.59% on news that the local healthcare and insurance group and AIA Group’s new Asian health-insurance technology business will look to bulk up through acquisitions and sees a valuation of several billion dollars over the next decade.

On the forex front, the rand had a see-saw day, trading firmer during the morning but mostly on the back foot during the afternoon, writes TreasuryONE. “Testing stronger on the back of Russia pulling their soldiers back to base camp, the rand saw glimpses of exchanging below the R15.00 handle. This positive sentiment did not last long, and we have since seen the ruble and rand track weaker. This week, the rand continues to find resistance at the R15.00 handle and support around the R15.25 mark.”