(Bloomberg) — Investors in mainland China boosted their stakes in beaten-down Tencent Holdings Ltd. and Meituan to the highest level in more than seven months, drawn by attractive valuations and easing concerns over government crackdowns.

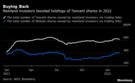

Chinese investors net purchased about 30 million Tencent shares so far this year via trading links between the mainland and Hong Kong, lifting their combined ownership to the highest level since June, according to calculations by Bloomberg of exchange data as of Monday. That’s near a record set earlier in 2021.

A similar trend occurred in delivery giant Meituan, with the traders adding more than 56 million shares this year, the data show.

“Mainland investor sentiment on big tech may be turning as Tencent, Meituan and Kuaishou led a normalization in southbound flows to start 2022,” Marvin Chen, an analyst at Bloomberg Intelligence wrote in note.

Tencent and Meituan were among the stocks dumped most by Chinese traders last year amid Beijing’s clampdown on the technology sector. Tencent’s online-game business was squeezed by new limits on the number of hours children could play. Meanwhile, Meituan saw costs rise as the government revised rules to boost the welfare of delivery workers.

Bridgewater Boosts Stakes in Alibaba, JD.com, Pinduoduo in 4Q

The renewed buying interest could signal a reversal of fortunes for these firms following the year-long selloff. It also comes as a number of Wall Street firms and brokers turn more positive toward China tech firms amid increased policy clarity and after the steep share declines.

Tencent is still down 36% from a February 2021 peak despite a 6% rebound this year, and its forward price-to-earnings ratio remains 13% below the 10-year average. Meanwhile Meituan remains down by more than 50% from a top a year ago, including a 5% decline this year.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.