The JSE trended weaker in line with global equity markets as the risk-off sentiment over Russia-Ukraine tensions weighed on the stock indices. Both losses and gains were broad based, but losses in top-value stocks tilted the JSE 0.45% into the red to end the day on 76,154.69 points.

Naspers and Prosus, which accounts for 12% of the All Share index, were both down, 0.14% and 0.43% respectively. Sasol slipped 2.13% as investors took profits and oil dipped below the $93-mark at local market close. BusinessLive reports that a bumper oil price means Sasol is spinning cash, but for the petrochemicals giant to see its stock above R500 again it may be necessary for it to split its local and offshore businesses.

Other heavyweights adding to the gloom were Anglo American (-1.23%), Richemont (-1.10%), Absa (-2.79%) and FirstRand (-1.38%).

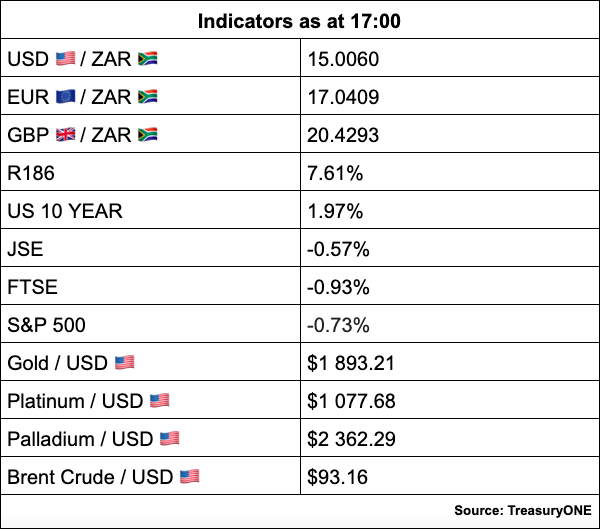

On the forex front, the rand broke below the technical R15.00-level against the dollar, hitting an intraday best level of R14.91 before backtracking to last trade at R14.96/$ as the dollar weakened on economic data releases. Weekly jobless claims and January housing starts both came out worse than expected.

“We’ve seen the rand disconnect from the concerns over tensions on the Ukraine border to trade close to the 200-day moving average on a couple of occasions. The Russian ruble, on the other hand, has lost close to 2% during the same time and remains on the back foot,” comments TreasuryONE.

According to the forex trading house the 200-day moving average was last touched at the end of October when the US Federal Reserve announced that it would start looking at tightening monetary policy during the first half of this year.

On the commodity desk, the potential Russian threat over Ukraine caused supply jitters and had investors fleeing for safety into precious metals. Gold surged 1.40% to last trade at $1,895.98, platinum 3.00% to $1,095.37 and palladium 3.12% to $2,362.50/oz. Copper was also trading at over $10,000 a tonne, while Brent crude last trading at $93.21 a barrel.

Back on the JSE, leading on the upside were commodity counters Sibanye-Stillwater (+4.21%), Harmony (+3.96%), Implats (+3.66%) and Northam (+2.86%).

Truworths soared 9.57% after the fashion retailer posted bumper profits despite stock shortages.

Looking forward, Fin24 reports that banks will likely make more money than retailers in the coming year amid rising interest rates, while mining companies remain at the mercy of the movement of commodity prices. The news outlet reports Old Mutual Investment Group is buying banking and telecommunication shares, and holding on to mining companies and retailers that have proven over the years that they can produce sustainable earnings, even in tough times.