(Bloomberg) — The need to finance more environmental projects in Africa is driving two entrepreneurs to start the first exchange dedicated to green bonds.

The Green Exchange, to be based in Ghana’s capital Accra, aims to enable companies to issue billions in green bonds and for investors to trade the debt in a secondary market, said Orla Enright, its chief executive officer.

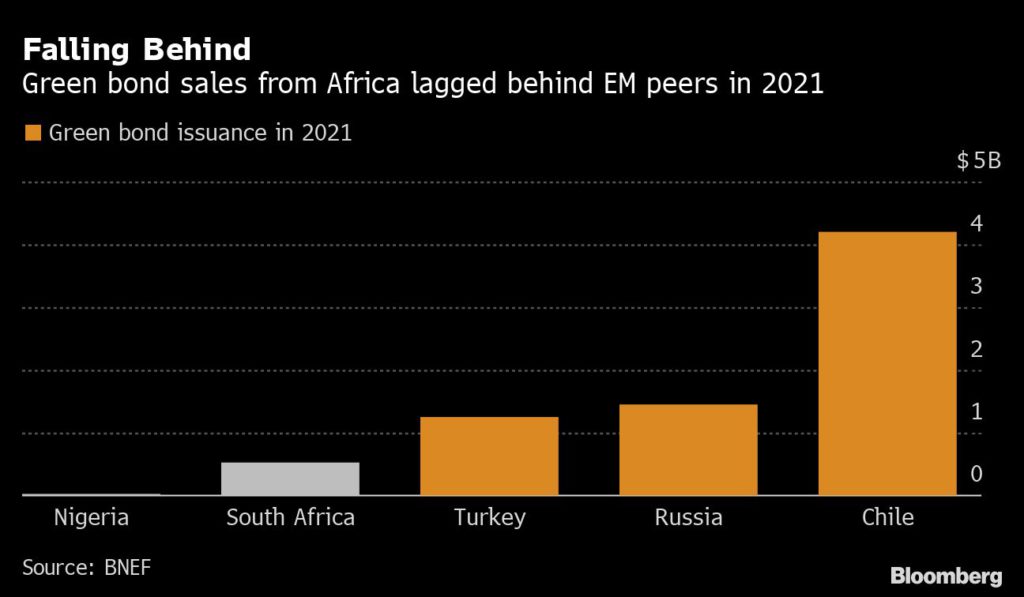

So far Africa has missed out on a global boom in borrowing to fund projects that help mitigate climate change.

“The reaction from companies in the region to the opportunity to issue a corporate green bond has been highly positive,” Enright said in an interview in Accra.

“They’ve seen the potential of green bonds and that the time is now.”

Sub-Saharan Africa urgently needs to mobilize $50 billion annually to address climate adaptation in agriculture, power and urban infrastructure, and green bonds offer part of the solution, the Overseas Development Institute said in a research note.

The continent is among the most at risk from climate change yet suffers from a high cost of finance.

That was one of the key issues at the United Nations climate summit in Glasgow last year, which was criticized for not doing enough to raise financial support from rich countries.

Discussions on financing will resume at the next UN gathering in Egypt later this year.

So far there’s only been limited green issuance from Egypt, Nigeria and South Africa, though in other regions China and Chile have been major sellers.

Green Markets Put World’s Poor at Mercy of Higher Funding Costs

“While global investment in green bonds is expected to reach $1 trillion by the end of 2022, the African market contributes only 0.4% of the global market base for green bonds,” said Enright, who was previously a partner at fintech-focused venture capital firm GOODsoil.

Issuers could get borrowing rates of between 4% and 6% to raise debt in hard currency, she said, which compares to an average local-currency lending rate in Ghana of about 20%.

The exchange plans to provide the tools required to issue a green bond, including third-party verification. That in effect means it’s replacing the usual role of banks.

“In emerging markets, there is a knowledge gap in the financial ecosystem,” said Esohe Denise Odaro, head of investor relations at the International Finance Corp.

and chair of green, social and sustainability-linked bond principles at the International Capital Markets Association. “Banks need to be enabled to support new issuers.”

Enright’s Ghanaian co-founder Diana Boadu Amoatin also has experience in the fintech industry, including the development of a digitized premium renewal platform for the country’s National Health Insurance Scheme.

The duo are raising $2 million to build the virtual marketplace by July for both debt and equity fundraising, through crowdfunding on the equity side and green bonds on the debt side.

Their target is to spur $5 billion in green bond sales within five years, including from Kenya, Nigeria and Ghana to fund wind turbines, electric vehicle charging stations, sustainable housing and solar panel installations.

They see no shortage of investor demand.

“We will be targeting an increasing number of North American and Scandinavian institutional funds incorporating ESG as one of their main criterion of investment,” Enright said, pointing to greater U.S.

interest following Joe Biden’s focus on the climate and funds such as the Investment Fund for Developing Countries already investing in Africa.