(Bloomberg) — U.S.-listed Chinese stocks declined for a fourth straight session Tuesday as concerns over Beijing’s regulation of its technology sector resurfaced.

Shares in e-commerce giant Alibaba Group Holding Ltd. fell 5.1% following a report that Chinese authorities told banks and state-owned companies to report their financial exposure to Ant Group Co. Alibaba owns a third of the fintech giant.

READ: China Tells Banks, SOEs to Report Exposure to Jack Ma’s Ant (3)

Worries over Beijing’s possible regulatory plans for the sector hit shares of other Chinese tech stocks, with JD.com Inc. dropping 1.2%, while Pinduoduo Inc. slumped 2.9% and Baidu Inc. fell 3.9%, mirroring moves in Hong Kong’s Hang Seng Index, which closed down 2.7% at the lowest level in almost seven weeks. Concerns over geopolitics and escalating tensions in Ukraine also weighed on risk assets more broadly.

The renewed regulatory interest in Ant comes more than a year after authorities blocked the fintech firm’s plan for a $35 billion initial public offering in November 2020. Since then, Beijing has gone on to target nearly every part of its business landscape, including the education sector, property firms, ride-hailing and video games.

While it remains unclear if the latest move will result in any regulatory actions, it stands as a stark reminder of just how quickly things can change. Earlier this month, Chinese stocks listed in the U.S. got a boost after reports that China’s so-called “national team” had bought mainland shares following the Lunar New Year holiday. That burst of positive news was cut short last week after authorities issued fresh guidelines asking food-delivery platforms to reduce their fees.

Investors will soon have to turn their focus to the release of quarterly earnings by many of China’s largest tech firms. Names including Alibaba, Baidu, NetEase and Pinduoduo are all expected to report results in the next few weeks.

Another looming catalyst for shares could be China’s annual National People’s Congress session, widely considered the nation’s highest-profile political meeting of the year. The week-long gathering is set to kick off on March 5 and has previously been a time when state-backed funds were said to intervene in order to ensure stability in the local market.

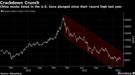

U.S.-listed Chinese stocks, which are predominately tech names, are also facing pressure as investors sell shares in growth stocks amid expectations of rising interest rates, denting the appeal of highly valued shares. The Nasdaq Golden Dragon China Index — which tracks firms in the U.S. that conduct a majority of their business in China — has fallen 9.6% this year, following a 43% plunge in 2021.

(Updates pricing throughout)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.