(Bloomberg) — Russia’s annexation of Crimea in 2014 was the moment when many global banks sharply cut their exposure to Vladimir Putin’s regime. But firms from some European nations weren’t put off for long.

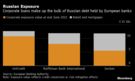

Enticed by the profits on offer, lenders from Italy and Austria have actually increased their combined business in Russia since the start of 2015, according to data from the Bank for International Settlements compiled by Bloomberg Intelligence.

French banks have reduced their Russian loans over the same period, but Societe Generale SA still has a significant presence in the country.

Italy’s UniCredit SpA and Austria’s Raiffeisen Bank International AG are the other European banks with the biggest Russian operations.

Between 2017 and the first half of 2021, Raiffeisen and SocGen increased their loans to Russian retail and corporate clients, while UniCredit lowered them slightly.

After Putin this week recognized two self-proclaimed separatist republics in eastern Ukraine, those local businesses of SocGen, UniCredit and Raiffeisen look increasingly exposed to the knock-on effects of financial retaliation.

On Tuesday President Joe Biden unveiled measures targeting two of Russia’s largest financial institutions, VEB.RF and its military bank. The Kremlin denies it has plans to invade Ukraine.

Previous decisions by Deutsche Bank AG, Finland’s Nordea Bank Abp and others to retrench in Russia may have been prudent.

Deutsche Bank’s credit exposure there was 7.9 billion euros ($9 billion) in 2012 but that had fallen almost 70% by the end of 2016 after it shuttered a securities unit amid a money-laundering scandal.

Morgan Stanley gave up its Russian banking license in 2019.

“Putin has laid a marker down,” said Jon Corzine, who ran Goldman Sachs Group Inc. until 1999, became a U.S. senator and now runs a hedge fund.

“That will make it very difficult to have any confidence in doing any serious business there for a very long period of time for most U.S. and western investors.”

SocGen boss Frederic Oudea told staff on Friday that U.S.

banks had approached his firm for possible help managing Russian financial transactions in the event of fresh sanctions, according to Bloomberg News. But his comments came before Putin’s dramatic escalation on Monday.

Read More: Wall Street Firms Approach SocGen to Manage Russia Transactions

At least two Wall Street banks have poured cold water on the idea that they’d seek a workaround to any Russia bar, according to people familiar with the firms who preferred to remain anonymous.

Most large U.S. lenders have only a small exposure to Russia now so the direct effect of sanctions would be limited, the people said.

Of greater concern will be the broader impact of the crisis on financial markets and any harm to trading.

Investment banks are worried about the effect of sanctions on futures linked to Russian oil and gas, or credit-default swaps on Russian debt, according to Danforth Newcomb, counsel at law firm Shearman & Sterling.

Several senior bankers say there’s fear, too, about retaliatory cyberattacks on U.S. finance firms by Kremlin-linked hackers.

Firms whose wealth managers have dealings with Russian elites and family members will worry more about a potential next tranche of sanctions that targets private banks.

“We have exercised a lot of care and diligence on on-boarding Russian entities and Russian clients,” Barclays Plc’s chief executive officer, C.S. Venkatakrishnan, said on Wednesday.

Direct Presence

Citigroup Inc.

is the New York bank with the largest Russian direct presence. However, its $5.5 billion worth of loans, investment securities and other assets tied to the country were just 0.3% of the group total at the end of the third quarter, and it plans to exit retail banking there.

The Russian businesses of SocGen, UniCredit and Raiffeisen are much bigger, European Banking Authority data show.

Russia’s chief attraction is the profit on offer, especially for European firms whose margins have been squeezed elsewhere.

At the December unveiling of CEO Andrea Orcel’s new strategy for UniCredit, the bank said Eastern Europe, including Russia, would have the highest profitability of any of its regions. Orcel, who has 4,000 staff in Russia, did due diligence on taking over Russian lender Otkritie Bank FC but the Ukraine situation made it untenable.

In a 2019 presentation SocGen highlighted Russia’s attractions as a fast-growing market for retail and digital banking, where revenues were expanding by 9% a year.

This could all be made moot by political risk.

Austria’s Raiffeisen leans heavily on Russia. It has about 11.6 billion euros of its loans there (11% of its total) and makes more than 30% of its pretax profit there, Bloomberg Intelligence says.

Shares in Raiffeisen, which has set aside money for Russian loans going bad, have dropped more than 13% this week.

UniCredit’s and SocGen’s loans to Russia represent less than 2% of their books, limiting risk.

While the European Central Bank has urged lenders to prepare for the crisis fallout, it acknowledges that European banks’ retail operations in Russia and Ukraine often rely on local funding, making them less vulnerable to cross-border retaliatory measures.

Nevertheless, the ECB is working with lenders active in Russia to assess risks to their liquidity, loan books, trading and currency positions as well as their ability to keep operations running, according to people familiar.

The regulator’s most pressing challenge is making sure banks properly enforce sanctions.

SocGen, which operates in Russia through its Rosbank PJSC unit, has got this kind of thing wrong before.

In 2018 it had to pay $1.3 billion for violating U.S. sanctions laws against Cuba, Iran and Sudan. It isn’t alone. Since late 2009, 11 major European banks have paid more than $19.6 billion in fines and settlements with U.S.

authorities over sanctions violations and weak money-laundering controls, according to Bloomberg Intelligence.

For now the European lenders appear sanguine about the first wave of new sanctions.

One bank executive said his international firm has seen an increase in Russian deposits as clients move funds from state-owned banks.

SocGen said it “continues to operate in a normal manner within the existing oversight framework.” UniCredit is assessing the new sanctions.

“We’ve gone through a number of successive iterations of sanctions and ups and downs,” Orcel said last month.

Raiffeisen CEO Johann Strobl was even more phlegmatic on his bank’s February earnings call: “We have, over the years, unfortunately got quite a lot of experience how to deal with sanctions.”

(Updates with details of ECB’s risk assessments in fifth from last paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.