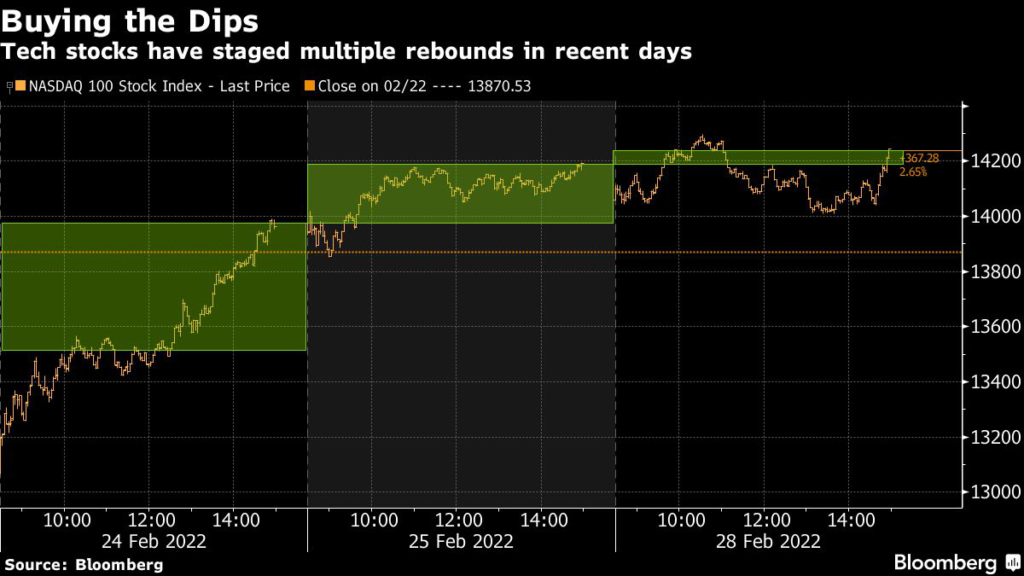

(Bloomberg) — Technology stocks have led the advance in U.S. stocks since Russia’s invasion of Ukraine began, with early declines turning to gains each day.

The turnarounds reflect a shift in sentiment: While the war may curb growth globally, the conflict also has prompted investors to pare back their expectations for how quickly the Federal Reserve will raise interest rates.

That means a more favorable environment for high-growth stocks such as Palo Alto Networks Inc. and Crowdstrike Holdings Inc. that are valued on future earnings. After the tech-heavy Nasdaq 100 Index’s worst two-month stretch since the pandemic’s onset, investors are stepping in to buy now that valuations have come a down a bit.

“There’s been real relief on the rate front,” said Leo Grohowski, chief investment officer at BNY Mellon Wealth Management. “We were already seeing a buy-the-dip mentality from weak sentiment in an oversold market, but the idea of a less-aggressive Fed is a main reason for the turnarounds in the Nasdaq.”

On Monday, the Nasdaq 100 fell as much as 1.3% before closing with a gain of 0.3%. More dramatically, Thursday’s session began with a drop of 3.2% that ended with a 3.4% gain, the biggest intraday swing since March 2020.

According to BofA Global Research, “buying of this dip by retail was more aggressive than during other 10% pullbacks post-crisis,” which the firm suggest could be due to a fear of missing out “on what has generally been a continually successful strategy post-crisis.”

The Nasdaq 100 fell 0.2% on Tuesday. Among the biggest components, Apple Inc. rose 0.3% and Alphabet Inc. advanced 0.4%, while Microsoft Corp. slipped 0.1%, Amazon.com Inc. dropped 0.3%, and Meta Platforms Inc. fell 0.6%.

High inflation, supply-chain issues, and slower growth have pulled stocks down from their record levels of recent months, souring investor sentiment so much that any would-be big sellers of tech stocks have already lightened up. The weakness also has brought tech valuations back near their long-term averages.

“This doesn’t mean that tech will start working right away, but at this point it’s hard to see who is still waiting to sell,” said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute. “We’re back in the ballpark for valuations being reasonable and some names are getting pretty compelling.”

Tech Chart of the Day

Cathie Wood’s ARK Innovation ETF has bounced off lows as rate hike bets have cooled. The poster child for hyper-growth stocks had fallen about 60% from its peak as some of its holdings suffered from the end of the pandemic boom, while others were hurt by concern over higher interest rates.

Top Tech Stories

- Baidu’s revenue beat estimates after efforts to monetize artificial intelligence technology helped offset losses in ad sales triggered by China’s economic slowdown

- Washington is expected to lean on major Chinese companies from SMIC to Lenovo to join U.S.-led sanctions against Russia, aiming to cripple the country’s ability to buy key technologies and components

- Sea Ltd.’s Shopee is pulling out of France, retreating from a major market just months after launching its maiden foray into Europe

- Networking gear maker Zyxel has stopped shipping from China to Europe by rail, as war in Ukraine threatens to snarl a key land route at the heart of Xi Jinping’s Belt-and-Road initiative

- Zoom projected sales for the current quarter that fell short of Wall Street’s estimates, ramping up pressure on the software vendor to show it can continue to grow beyond the pandemic boom

- EV maker Lucid Group fell as much as 15% in U.S. premarket trading after lowering its production target for 2022. The company cited “extraordinary” challenges with logistics and its supply chain

(Updates trading prices, adds comments from BofA Global Research.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.