The ongoing conflict in Ukraine continued to send foreign listed shares in Russian companies tumbling on Tuesday as Russia kept its stock exchange closed for the second day to mitigate the fallout.

On the local front, Barloworld lost 6.61% but said its Russian operations have sufficient facilities to remain operational while heavy-duty equipment multinational said it does not use banks that are currently barred from using the SWIFT banking system.

Oil surged to its highest level since 2014 with Brent climbing 6.1% to $104 a barrel while the European Union debates further sanctions on Russia that include exclusion from the SWIFT system for seven Russian banks.

“Consultant OilX said the probability of heavy disruption of seaborne Russian crude and products is growing, which could push prices above $150 a barrel,” reports Bloomberg.

Brent crude was last trading at $103.60 a barrel.

Sasol added a healthy 5.29% to its share price amid rising prices.

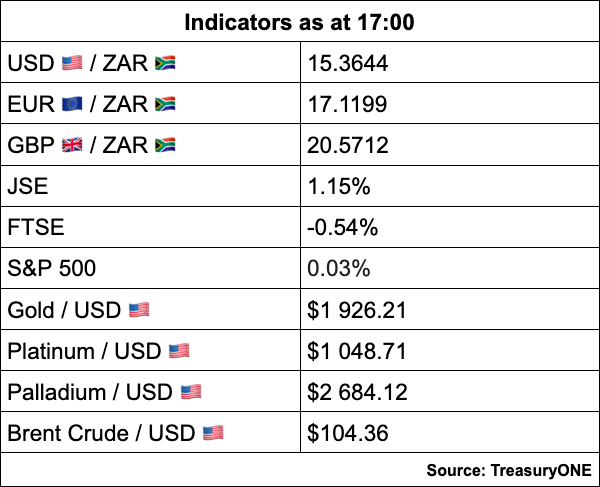

In commodities, trading has been a rollercoaster ride all week, gold is just above $1,900, palladium changes hands at $2,675, while copper is above $10,000 a per tonne.

On the currency front, “Russia remains the talk of the town, and therefore we should remain headline-driven for the next few days. The rand is consolidating below the 100day-moving average and struggles to close above this technical level at the moment,” comments forex trading house TreasuryONE.

The local unit started moving towards the mid-R15.20’s but with a stronger dollar today, the rand gave up those gains and is currently trading at R15.36/$

The All Share Index closed the day 1.34% up/down to end 77,111 points.

The big winner today was the PSG Group with shares rocketing as much as 30% in morning trade following news that the investment firm intends to delist from the stock exchange.

The group said it intended to unbundle its business interests and remove itself from the JSE due to the large discount its shares trade at. PSG believes the move will unlock enormous value for shareholders and intends to repurchase all PSG Group shares held by its shareholders before delisting.

PSG Group closed 18.72% up. Private school provider and PSG Group subsidiary, Curro lost 7.21%.

Other top performers included Exxaro (8.81%), Thungela (5.66%), Alphamin (5.26%), Tiger Brands (3.83%) and Bidvest (4.91%).

Exxaro said headline earnings for the year ended December 2021 were expected to increase by between 50% and 64% compared to the previous year-end.

Tech counter Alviva Holdings (3.38%) released interim financial results for the year ended December that saw company revenue grow by 52% to R11,4 billion.

MTN Ghana reported service revenue growth of 28.5% following the release of its year-end financial results. Parent company MTN Group added 3.17% to its share price on the JSE.

Peers Vodacom (1.22%), Telkom (2.08%), and Blue Label Telecoms (2.45%) all gained.