The JSE added 0.55% during trade on Wednesday to see the All Share Index close at 77,536 points as traders ran to safe-haven currencies like gold and the US dollar.

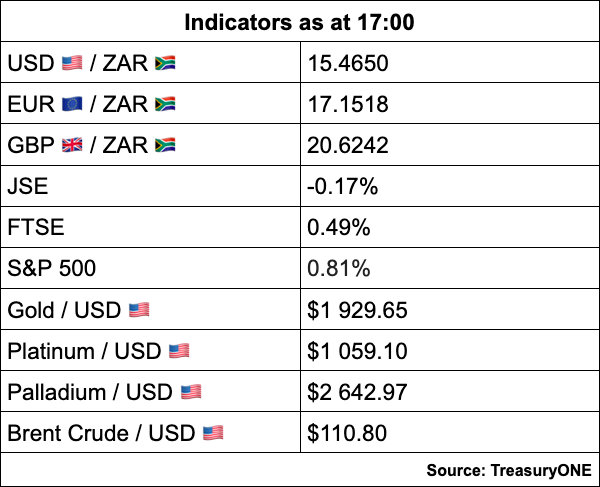

Gold is trading over $1,930 while palladium is up 5% and trading at $2,649 with coal also on the front foot having doubled its price over the last six days.

The rand lost some ground today with a stronger dollar driving some weakness in the local unit while there has been limited fallout from emerging market currencies due to the Russia-Ukraine situation.

“The resilience of the R15.50 level has been surprising, but it looks more likely that the break of the Rand could be to the topside as resistance can only hold for that long. Looking across the EM sector, we have seen most EM currencies trading in unison, suggesting that the significant direction giver at the moment is the US dollar,” comments TreasuryONE.

Brent crude climbed as high as $114 a barrel reaching a seven-year high as the Russia-Ukraine conflict continues and the global oil supply issues mount this despite the US and other major economies deciding to deploy emergency oil stockpiles to arrest the rising prices. The price of oil has retreated to $111 a barrel.

Sasol surged a further 7.53% with the chemicals and energy company share price up over 1,130% since its pandemic low in 2020, reports Business Insider.

Vivo Energy, which owns Shell and Engen in 23 African countries, added 0.76% and said sales increased by 7% to year end-December with lockdown restrictions easing. The group said revenue rose by 22% to $8.4 billion, which has been boosted by rising international oil prices.

Glencore (2.56%), the world’s largest commodity trader, said it was reviewing its business ties to Russia as the fallout in Ukraine intensifies across global commodities markets, reports Bloomberg.

Glencore didn’t say it was exiting its investments but did say it would be reviewing its shareholding of two Russian companies as well as its operations within the country.

Peers Tharisa (3.43%), South32 (5.17%), and BHP (4.04%) all added, while Kumba Iron Ore (-1.88%), Alphamin (-2.83%), and Anglo American (-0.91%) were all down.

Woolworths recorded its strongest balance sheet in eight years despite turnover declining 1% to R39.2 billion. Woolies also reduced its debt by R7 billion over the past year. The interim financial results cover the year-ended up to December 26.

Woolies closed the day having added 6.03% to its share price.

Retail peers Mr Price and Truworths added 0.31% and 2.39% respectively while The Foschini Group lost 2.50%.

Building retailer Cashbuild recorded a steep decline in profits as DIY sentiment brought on by the onset of the coronavirus begins to wear off. The retailer saw a 27% drop in profits with the group saying 36 of its stores were also affected during the July riots last year.

Cashbuild lost 0.05% by the end of the day.