(Bloomberg) — Bitcoin fell on Friday as reports of a Russian attack on a nuclear plant in Ukraine drove risk aversion in financial markets.

The largest cryptocurrency dropped as much as 2.4% to $41,093. The second-largest, Ether, fell as much as 4.1% to $2,691. Most other top tokens were also down over the past 24 hours to 10:50 a.m. in Hong Kong, according to pricing from CoinGecko.

Ukraine’s government said Europe’s largest nuclear power facility, the Zaporizhzhia plant in the city of Enerhodar, was on fire after being hit with Russian shells, raising safety concerns and escalating the stakes of Vladimir Putin’s invasion.

“Ongoing geopolitical conflict and macro uncertainty could result in continued volatility,” said Sean Farrell, head of digital-asset strategy at Fundstrat, in a note Thursday. “If we see another significant bout of downward pressure on prices, recent precedent gives us some confidence that there will be buyers that step up” in the $33,000 to $35,000 range, he said, referring to Bitcoin.

Bitcoin and other cryptocurrencies rose earlier in the week on the expectation that they might gain traction during Russia’s invasion of Ukraine. The advance was then stymied by concern about the effect of international sanctions against Russia.

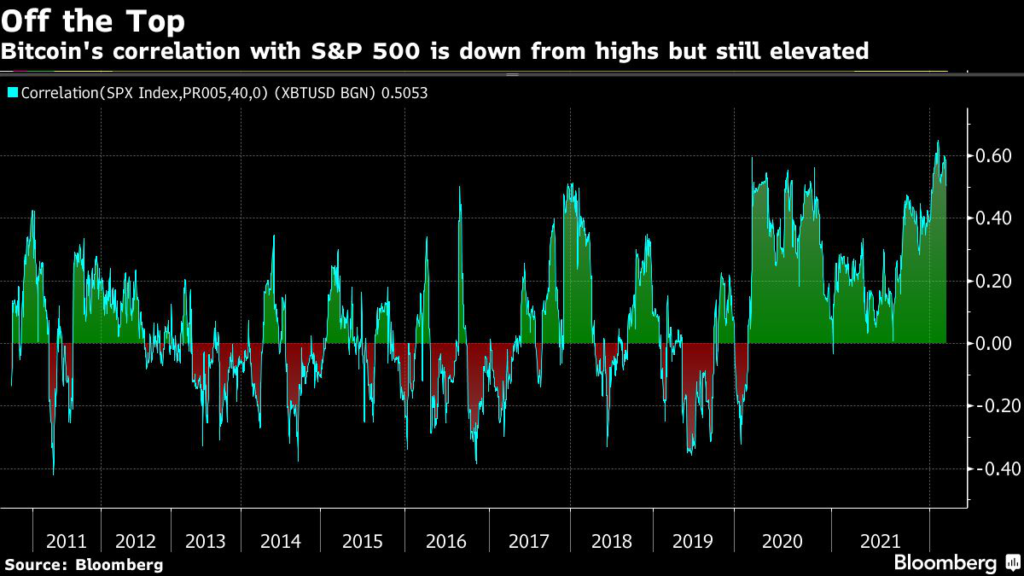

While some tout Bitcoin as a haven investment, it’s traded more in line with risk assets like U.S. stocks in the past couple of years. The correlation between Bitcoin and the S&P 500 is off its highest levels from about a month ago, though is still elevated relative to history.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.