(Bloomberg) — Bond traders are delivering a swift, punishing verdict on the expected hit to Russian corporations from the Ukraine war. In short, it’s turning the country into a nation of junk bonds.

With Russia increasingly isolated by sanctions and widespread international condemnation, the prices of bonds issued by a broad spectrum of companies have tumbled as investors race to the exits.

The result is a massive disconnect between the market’s pricing and the corporate credit ratings assigned by companies like S&P Global Ratings Inc. and Moody’s Investors Service. More than three-quarters of the bonds issued by still investment-grade, non-financial corporations in Russia are now trading at distressed levels or carry risk in line with junk-rated debt, according to Bloomberg’s market-based default risk model. Among them are energy giant Gazprom PJSC and chemical maker PhosAgro PJSC, both of which still have a high-grade score from at least one rating company.

The scale of the credit risk priced into Russian assets just a week after the invasion shows how badly its corporations are expected to be affected by the sanctions that are severing the country from the global economy and sending its currency tumbling. It also shows how rapidly credit ratings can be rendered outdated by fast-moving events like war that far outstrip the measured pace of traditional financial analysis.

“It is impossible for rating agencies to keep up with markets. War was unexpected. Heavy sanctions too,” said Gilles Pradere, a portfolio manager at RAM Active Investments, which oversees 2.5 billion Swiss francs ($2.7 billion). “You have a huge discount in notional terms as the solvency risk is elevated, even if factually Russia and Russian corporates were, up to now, a solid BBB credit.”

The speed of financial-market movements almost always exceeds that of rating companies, especially in times of fast-moving events like the financial and sovereign debt crises or the onset of the pandemic. But the magnitude of the gulf that has opened between the two in Russia has been particularly stark as investors rapidly reprice the risk associated with its corporations.

While the Russia government has been downgraded to junk, such moves have so far been rare for corporation-bond issuers, with most non-financial debt still rated as investment grade. Bloomberg’s analysis is based on a sample of almost 140 bonds issued by 25 different Russian companies.

Gazprom, the nation’s largest foreign-currency borrower, still has a high-grade rating at all three major rating companies. But its market-implied rating stands at BB+, one step into junk, according to data compiled by Bloomberg. Bonds maturing next week traded at about 55 cents on Thursday, according to the TRACE reporting service, a level reserved for deeply distressed debt.

Russian Railways JSC, which has borrowed in dollars and Swiss francs, is rated two steps above junk at BBB. But its implied rating is four levels lower at BB-. Meanwhile, Rosneft Oil Co PJSC, which has borrowed mostly in rubles and is rated BBB-, also has market an implied rating of BB-.

Fallen Angels

The gaps indicate expectations for a Russian wave of so-called fallen angels, borrowers downgraded from high-grade to junk. Rating companies have already hinted at that, with Moody’s placing ratings of 51 companies on review for downgrade on Wednesday and S&P saying in a report after the invasion that geopolitical risk tilts its baseline “sharply to the downside.”

S&P slashed Russia’s long-term foreign currency debt rating by eight levels on Thursday to CCC-, just three levels above default, from BB+ and said it may cut further.

Representatives at S&P declined to comment. Moody’s and Fitch Ratings didn’t respond to requests for comment.

The tumbling values of Russian corporate bonds has been exacerbated by the uncertainty over whether companies will be able to cover their interest bills and even whether investors will be able to legally receive the payments, given the sanctions piling up as the war takes a growing toll on Ukraine. There’s also been a mass exodus as investors sold whatever they could to cut risks, prompting deep discounts even in bonds that are close to maturity and typically have minimal default risk.

A Russian telecommunications company paid a coupon due Thursday on dollar bonds — the first foreign-currency coupon payment by a company headquartered in Russia since the sanctions, raising hopes that it may set a precedent.

‘Just Sell’: Russia Bondholders Jump Right Before Repayment

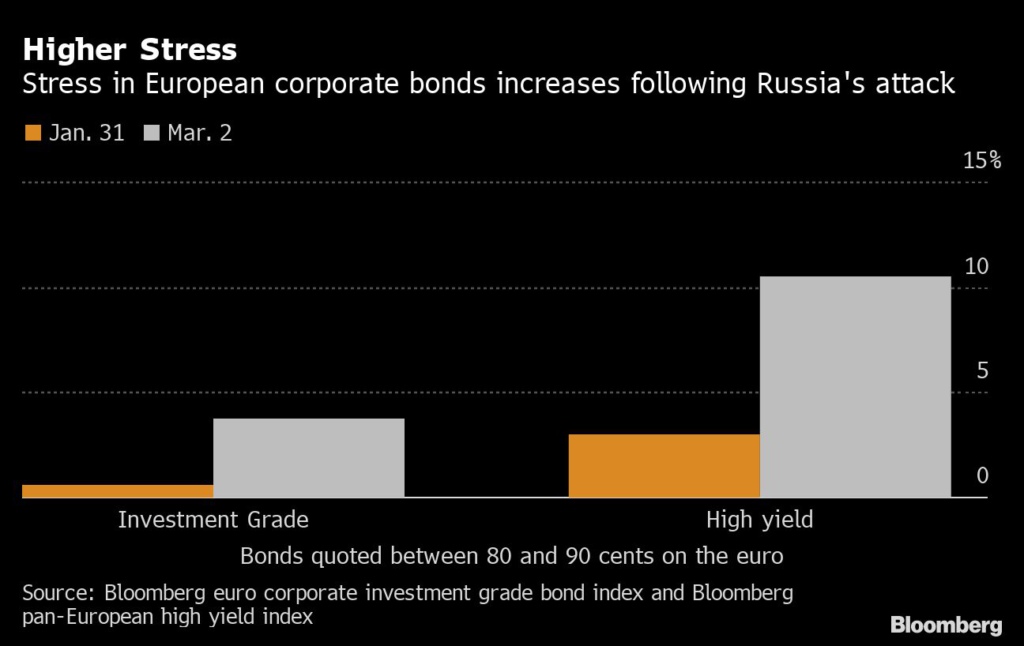

Such dislocations between the market’s view and credit ratings have opened up outside of Russia, too. The percentage of euro-denominated high-grade bonds trading at stressed price levels has jumped from 0.6% at the end of January to 3.7% this week, according to data compiled by Bloomberg. Among those firms are Wintershall Dea GmbH, which makes a large part of its revenue in Russia, and EP Infrastructure AS, which has been flagging its exposure to Russia and Ukraine for years.

To be sure, Russian bonds have lost so much value since the invasion that any downgrades to junk — which usually cause forced selling — may have little additional impact. Moreover, such price drops typically happen ahead of rating cuts, with fund managers offloading their holdings in anticipation.

Still, the forthcoming rating actions will shed more light on how vulnerable Russian companies’ fundamentals really are, especially if they have to rely on state support as foreign markets are shutting down for them fast.

Moody’s said its sweeping review, which covers companies including Gazprom, Rosneft and Lukoil PJSC, “could or would lead to downgrades of the affected corporates’ ratings, because of their strong interlinkages with the sovereign rating.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.