(Bloomberg) — S&P Dow Jones Indices will remove Russian stocks from its gauges, joining a growing cohort of global index compilers in shunning the nation after it was sanctioned for invading Ukraine.

The benchmark provider joins the likes of MSCI Inc. and FTSE Russell in excluding Russian assets from products, leaving Russia increasingly isolated economically as its securities become almost impossible to trade. Bloomberg said Friday that it will remove Russian debt from its fixed-income indexes, according to a statement.

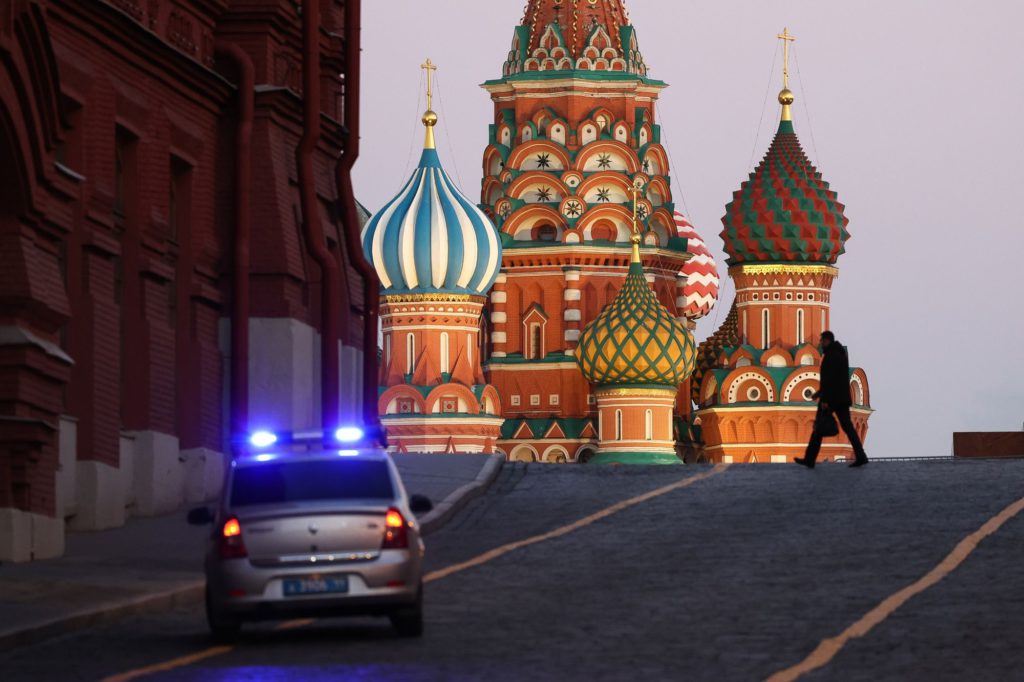

The exclusions are yet another sign that Russia’s links with global markets are disintegrating. With foreign reserves frozen, capital controls in place and a ban on foreigners selling local securities, international investors are searching for an exit that has slammed shut. That has money managers trying to determine their next steps in a volatile and uncertain environment.

“When this happens, the positions become off-benchmark,” said Malcolm Dorson, a portfolio manager at Mirae Asset Global Investments in New York. “If you’re an index tracker, you won’t have exposure. If you’re index agnostic and OK with taking active risk, then it’s a different story — but it’s difficult to hypothesize this situation right now if one can’t operationally buy Russian assets.”

S&P is excluding Russian assets due to “deterioration in the level of accessibility of the Russian market,” which could affect the ability of market participants to replicate its gauges, according to a statement. The decision will be effective prior to the open on March 9, and will include all stocks listed or domiciled in Russia, including American depositary receipts and global depositary receipts.

The securities will be pulled from all of S&P’s benchmarks at a price of zero, and Russia will be cut to “standalone” classification, from emerging market status previously. A return to that status would involve Russia going through the standard country classification review process.

S&P said subject to compliance with applicable law and pricing availability, it would keep publishing some of the country gauges on a standalone basis — separate from broader indexes and designed for a Russia-based investor perspective. These may include some assets that are ineligible for money managers in the U.S., U.K. or EU, according to the statement. S&P Russia BMI and Dow Jones Russia Index are among those that will be maintained.

Since the Moscow Exchange’s equity trading was last open on Feb. 25, Russian stocks listed in London lost more than 90% of their value before getting suspended, and European companies with business exposure to the country have erased more than $100 billion in market value.

Stoxx Ltd. also said this week it will delete Russian companies from its indexes, as did Bloomberg, which announced changes to both its stock and bond gauges. The shifts in Bloomberg’s bond gauges will take place at month-end and include high-yield and emerging-market measures.

Bloomberg LP, the parent of Bloomberg News, is also the parent company of Bloomberg Index Services Limited (BISL), which administers these indexes.

(Adds Bloomberg index announcement, investor comment and context throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.