(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

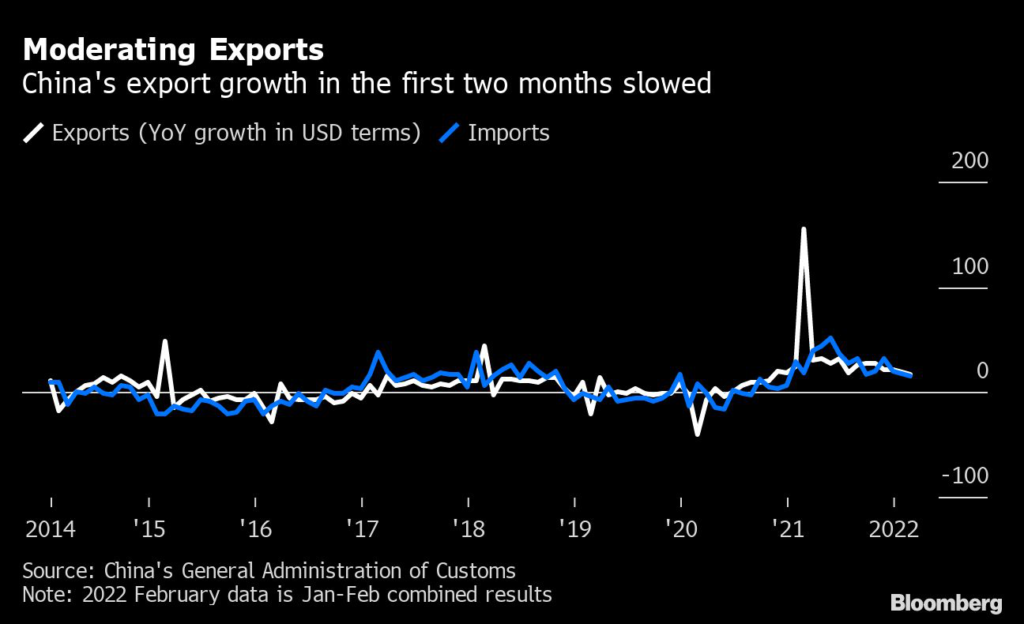

China’s export growth moderated in the first two months of the year, pointing to more stable global demand as multiple risks cloud the outlook.

Exports rose 16.3% in dollar terms in the January-February period from a year earlier, data from the General Administration of Customs showed Monday, beating the 14% median estimate in a Bloomberg survey of economists. Exports had increased 20.9% in December.

Imports increased 15.5% on year during the period, below a 17% gain predicted by economists. The trade surplus came in at $116 billion.

China’s economic activity is typically volatile in the first two months of the year due to the week-long Lunar New Year holiday. Covid outbreaks in some parts of the country also caused temporary business suspensions this year, although the commerce ministry has said the impact was manageable overall.

“China’s foreign trade saw a stable start, although the current external environment for foreign trade development is more complex and uncertain,” said Li Kuiwen, spokesperson of the General Administration of Customs, according to state media CCTV.

While steel exports declined 19% to 8.23 million metric tons in the first two months of the year from the same period last year, the value of the shipments jumped 34.4%, the data showed. Crude oil imports dropped 4.9% in volume, natural gas purchases fell 3.8% and soybean imports increased 4.1%, with the value of the commodities bought all soaring at double-digit rates.

“Given the price surge in both export and import, we might have to say the trade numbers should be much weaker in real terms,” said Zhou Hao, senior emerging markets economist at Commerzbank AG. “Export growth is set to weaken starting from the second quarter due to a high base, and import growth is rather uncertain as the Ukraine war might cause supply-chain disruption.”

Russia-Ukraine tensions and a spike in oil prices have turned the focus to energy supplies. At a separate briefing by the National Development and Reform Commission on Monday, Vice Chairman Lian Weiliang said China’s sources of crude oil, natural gas are diversified and a “very high” share are on long-term contracts.

The government will focus on addressing the problem of semiconductor supplies in manufacturing this year after global shortages in 2021, said Lin Nianxiu, another deputy head of the NDRC, at the same press conference. The import volume of diodes and similar semiconductors rose 10.7% in the first two months of the year from the same period a year ago.

Exports of cars grew the fastest in the January-February period, jumping 103.6% in value from a year ago. Those of rare earths and aluminum products also grew rapidly.

Trade Boom

Record trade last year helped to underpin China’s rapid growth, although economic momentum weakened in the latter part of the year amid a downturn in the property market. The government set a growth target of about 5.5% for this year, the lowest in more than three decades, yet above economists’ forecasts, suggesting a need for more policy stimulus, such as interest rate cuts and further loosening of property market grips.

Read More: China Signals More Policy Support With 5.5% Growth Target

What Bloomberg Economics Says…

The picture ahead doesn’t look so benign. A higher year-earlier base will cut into export growth. Progress in the global fight against Covid-19 may lead to a shift in demand to services from goods — to the detriment of demand for Chinese exports. What’s more, the Russia-Ukraine war could add headwinds to trade flows, with rocketing commodity costs damping global demand and global supply-chain snarls getting worse.

Eric Zhu, China economist

For the full report, click here.

Commerce Minister Wang Wentao warned last week of “massive pressure” in maintaining high export growth. Factors that drove overseas shipments to boom last year, such as demand for goods to control the spread of Covid, will dissipate, while firms remain squeezed by supply-chain bottlenecks, rising commodity prices and labor shortages, he said.

The European Union was China’s largest trading parter in the first two months of this year, followed by the Association of Southeast Asian Nations and the U.S. China’s exports to the U.S. grew 13.8% while imports from there only increased 8.3%.

Both government data and a private survey of Chinese manufacturing companies showed new export orders continued to contract last month. Meanwhile, manufacturing activity in Southeast Asian nations broadly improved as virus waves ebbed in the region, a sign that production orders could be diverted away from China once again.

“The support from exports is likely to diminish from the second quarter, partly because of the recovery of the global supply chain,” said Tommy Xie, head of greater China research at Oversea-Chinese Banking Corp.

(Updates with additional details and economists’ comments.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.