(Bloomberg) — Military policy looms as a risk for South Korean stocks as one of the leading contenders in its presidential election calls for the expansion of a missile defense system that in the past angered Beijing and led to consumer boycotts.

Analysts see shares of companies spanning cosmetics and confectionery to arts, entertainment and tourism as the first to suffer if Korea draws China’s ire again, like it did the last time a conservative party candidate won office. These sectors went from market darlings in 2015 to laggards the following year when Chinese travelers shunned the destination and its shoppers turned away from Korean products.

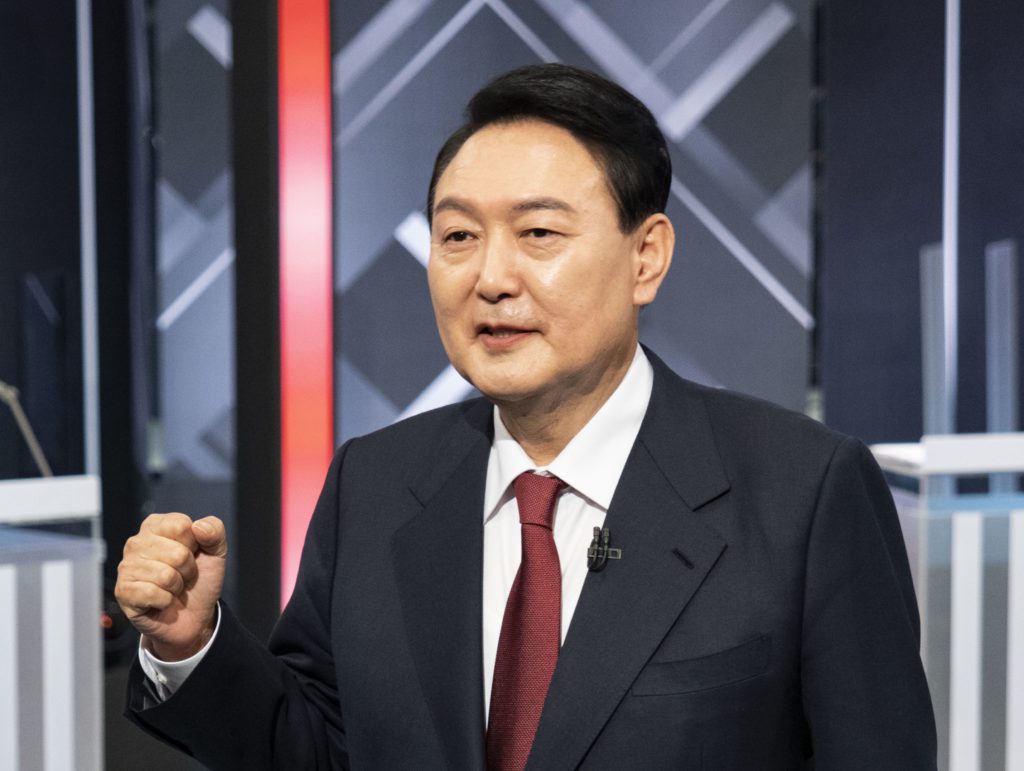

This time around the People Power Party’s Yoon Suk-yeol advocates expanding the missile shield and joining in talks with the Quad grouping of the U.S., Japan, India and Australia. He also wants to participate in the Biden administration’s new supply chain initiative that would reduce dependence on China.

Explaining Missile Shield That So Bothers China: QuickTake

“The odds of China taking economic counter-measures against South Korea could rise if a Yoon administration fulfills its military and diplomatic pledges,” Citigroup Inc.’s Kim Jinwook and Yoon Jeeho wrote in a note. “Retaliative measures could focus on Korea’s consumption goods (cosmetics, foods) and service goods (shopping, tourism and entertainment).”

Items that are important to China’s own manufacturers, such as semiconductors, displays, parts and petrochemicals, would likely be left alone, they added.

Polls have shown Yoon neck-and-neck with the progressive ruling party’s Lee Jae-myung in the March 9 election. Even if Yoon is elected, he may not follow through on all his plans, and Beijing might not react as it did before.

Here Are the Contenders to Be South Korea’s Next President

China has complained that the missile shield, known commonly as Thaad, appears to cover more of its territory than the stated target North Korea. It is also wary of the U.S. rallying allies in groups like the Quad to oppose its rising influence.

With Korea’s benchmark Kospi index down about 20% from its peak in mid-2021, equity investors are struggling for breath.

Stocks that could benefit from a post-Covid reopening of the economy and faster inflation, like tourism, food and beverage companies and consumer goods, are being watched carefully for any uptick.

The deepening economic ties to China since the last dispute highlight the vulnerabilities: Korea exported $163 billion worth of goods to its larger neighbor in 2021, from $124 billion in 2016, customs data show.

Shares of Amorepacific Corp., the Seoul-based cosmetics giant that was hurt in the fallout last time, are still down about 60% from their 2015 peak. Hana Tour Service Inc., a leading travel agency that was also damaged by the dispute with China, has dropped by a similar amount from its high that year.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.