(Bloomberg) — Russian investors appear to continue to conduct transactions in Bitcoin and other cryptocurrencies even with tightening sanctions.

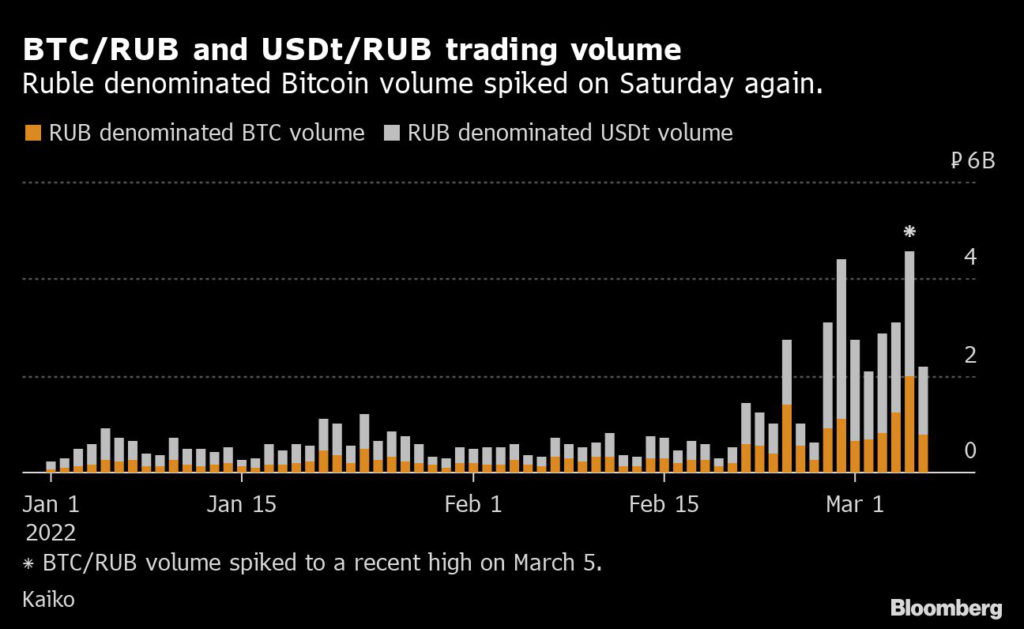

While the overall flows appear to be relatively small, data from blockchain analytics firm Kaiko show that ruble-denominated Bitcoin trading volume rose Saturday to its highest level this year.

Meanwhile, the majority of the ruble-denominated crypto trading volume appears to be conducted with the Tether stablecoin, which claims to be backed one-to-one with fiat.

Ruble denominated Bitcoin trading pairs saw a higher growth by “magnitude” on March 5, according to Kaiko.

The average trade size of Bitcoin ruble transaction on Binance hit a 10-month high of roughly $580 on Feb. 24, when Russia invaded Ukraine.

“Perhaps more Russian retail investors are looking to get out of fiat exposure altogether in favor of BTC,” said Andrew Tu, business development manager of crypto algorithmic trading firm Efficient Frontier.

“While technically, U.S. dollar sanctions probably cannot be realistically applied to USDT holders, I imagine that some people are simply taking additional precautions.”

The trading from Russia only counts as a fraction of the total volume of Bitcoin’s globally.

Bitcoin’s average daily trading volume varies between $20 billion to $40 billion. On March 5, the total trading volume of BTC/RUB was about $14.2 million, Kaiko said.

Only three global crypto exchanges, Binance, Yobit, and LocalBitcoins, offer ruble-denominated crypto trading pairs, according to Kaiko’s newsletter dated on March 7.

While exchanges including Binance and Coinbase said that they would not ban ordinary Russians from using their service, there have been a growing effort to block users related the sanctioned individuals and entities.

Coinbase, for example, reported that they blocked over 25,000 addresses related to the sanction list.

Small Amounts

Caroline Bowler, chief executive of Australian crypto exchange BTC Markets, said her company is blocking Russian entities that are under sanctions.

At the same time, it’s noticed an increase in trading by individuals associated with Russia.

“This uptake in Bitcoin in particular relates to retail, who are out there aggressively buying in small amounts,” she said in a Bloomberg Television interview, without providing specifics.

The efforts to cut off crypto as a sanctions workaround follow the sweeping penalties imposed on Russia by the U.S.

and its allies, including a move to bar some banks from the SWIFT messaging system that connects financial institutions worldwide. The moves also underscore the significant role that digital assets are playing in a conflict testing global security.

Paolo Ardoino, chief technology officer of USDT issuer Tether, said on Twitter on March 4 that USDT, as a centralized stablecoin, “has to comply with requirements of central authorities.”

(Updates with comment from BTC Markets CEO in eighth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.