It was supposed to come to an end at 5:00 this morning but on Tuesday, Eskom extended load shedding to Saturday morning.

Chief financial officer Calib Cassim said the power utility would soon reach a point where it would no longer be able to pay for emergency diesel to keep turbines running.

To make matters worse, Eskom escalated load shedding to stage 4 this morning, set to kick in at 9:00, suggesting a serious breakdown in its energy generating capacity, reports Tech Central.

Eskom regularly makes use of Open Cycle Gas Turbines (OCGTs) and burns through diesel to supplement energy supply.

If the price of oil is to double, as is predicted, Eskom won’t be able to absorb those costs says Cassim and the power utility will be limited in how much electricity it can produce.

Nersa, the energy regulator approved a 9.61% electricity price increase from April 1, but Eskom had asked for the increase to be as high as 20.5% with Eskom’s debt standing at a hefty R390 billion.

With additional charges tacked on by municipalities, it means we will soon be paying double the inflation rate for electricity.

What’s more, the SA Reserve Bank has signalled it will hike the interest rate significantly to offset the pressures of rising inflation.

Load shedding became ever-present last year and even more frequent and unpredictable.

This year it looks like the added pressures of surging oil, gas, and coal prices brought on by war in Ukraine, will only serve to place severe pressure on our electricity supply.

Meanwhile, every train operating in the Western Cape came to a screeching halt on Tuesday because the Eskom Tafel Bay substation’s electricity supply to Prasa and Metrorail was interrupted due to cable vandalism, which coincided with Stage 2 load shedding, reports Daily Maverick.

Commuters were left stranded with no way to get to their destinations (most likely they were travelling to and from work).

We can’t go on like this, rising costs and having our lives adversely affected in ways that could be detrimental is no way to live.

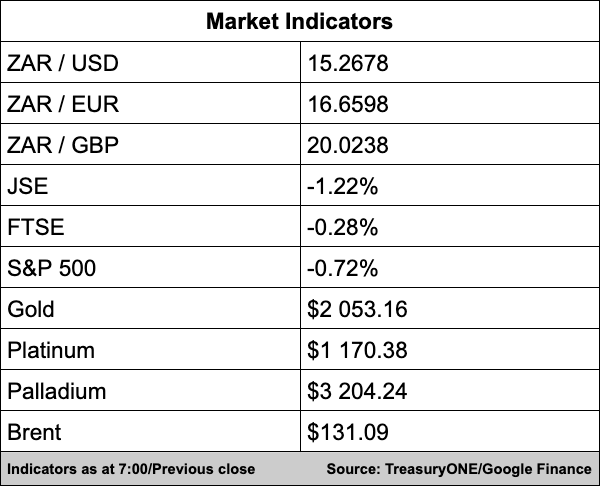

In the markets, the big news overnight was the immediate banning of Russian oil and gas imports into the US by Joe Biden, while the UK announced a phasing out of oil imports out of Russia, reports TreasuryONE.

“The price of Brent surged to $133.15 late in New York last night on the back of the announcements. Currency markets are relatively stable while commodities continue to run hot and equity markets remain on the back foot,” says the forex trading house.

This morning the rand is trading firmer at R15.26 as the dollar loses some ground to the Pound and Euro.

South Africa’s Q4 GDP number showed that the economy grew at 1.7% YoY, exactly on market forecasts.

Gold is currently trading slightly softer at $2,049, while platinum and palladium are both up around 1.0% at $1,165 and $3,210, respectively.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

R2.65bn raised in first round of SA’s radio frequency spectrum auction – TimesLIVE

Eskom’s big Koeberg nuclear power plant problem – MyBroadband

How government can stop a R2/litre petrol price hike in South Africa next month – BusinessTech

Global Business

Joe Biden bans US imports of Russian oil, gas after Ukraine’s pleas – DW

McDonald’s, Coca-Cola Hit Pause on Russia Amid Rising Backlash – Bloomberg

New York Times Moves Staff Out of Russia, While BBC Returns – Bloomberg

Markets

and U.K. Ban on Russian Oil Continues – Investing.com

Asian markets edge up, oil extends gains with focus on Ukraine – AFP

US close: Stocks extend losses as Biden bans importation of Russian oil – Sharecast

Tech

Key Takeaways From Apple’s ‘Peek Performance’ Product Event – Bloomberg

Electric car prices could go up even as fuel prices soar – The Verge

Ukraine and US targeted by cybersecurity attacks in run-up to Russian invasion – The Verge

Video

can easily do without Russian oil: analyst – Reuters

Belarusians in Ukraine to fight Russia – AP

Geopolitical issues weigh on emerging market currencies – Business Day