(Bloomberg) — Dealmaking activity is heating up in technology, a sign that big companies flush with cash are seeing bargains in the sector as the Nasdaq 100 Index hovers near a bear market.

Alphabet Inc.’s Google agreed this week to pay $5.4 billion for Mandiant, a cybersecurity company that Microsoft Corp. had also reportedly been in talks with. The deal follows reports last month that Cisco Systems Inc. held negotiations with data-software company Splunk Inc. and Microsoft’s $69 billion agreement in January to buy video-game maker Activision Blizzard Inc.

“This kind of activity means valuations are getting to a point that companies find attractive,” said Mark Lehmann, chief executive officer of JMP Securities, referring to both corporate and private equity buyers. “The playing field is very ripe and names that are down 50% aren’t going to stay down 50%.”

Technology stocks have been pummeled as investors prepare for the Federal Reserve to embark on a series of interest rate hikes in an effort to fight inflation. The tech-heavy Nasdaq 100 has dropped 19% this year and some formerly high-flying companies like Atlassian Corp. and Zscaler Inc. have fallen more than 45% from 2021 records.

That’s creating a compelling backdrop for megacap tech companies to go hunting for deals. Apple Inc., Amazon.com Inc., Alphabet and Meta Platforms Inc. were sitting on about $600 billion in cash and equivalents as of Dec. 31, according to data compiled by Bloomberg.

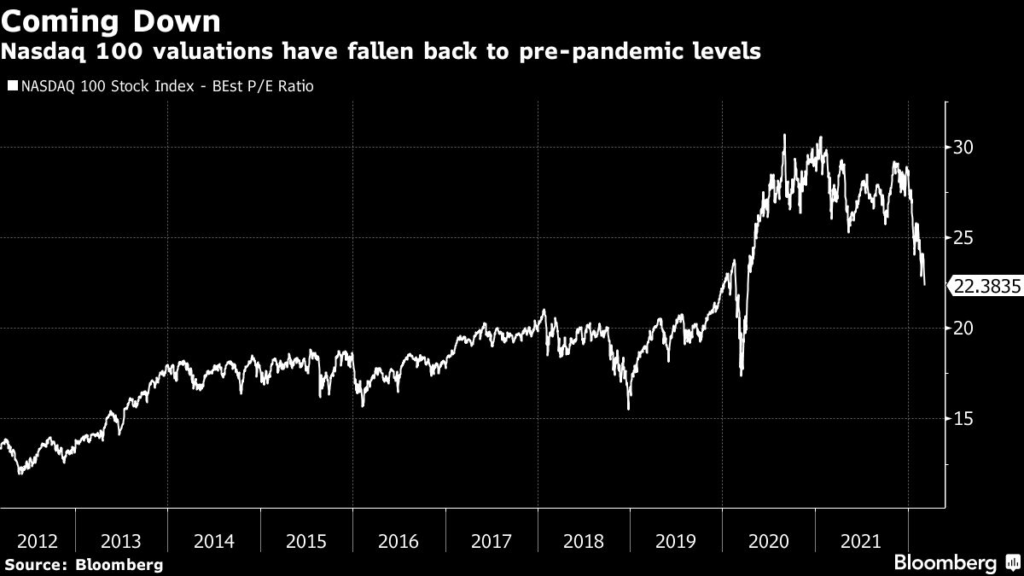

The selloff has pushed the average valuation in the Nasdaq 100 to pre-pandemic levels at 22 times projected profits. While that’s still elevated relative to the average of the past 10 years, it’s down about 25% from the peak in 2020.

The combination of rich balance sheets and cheaper valuations is likely to fuel even more acquisitions, which should help support stock prices, said Mitch Rubin, chief investment officer at RiverPark Advisors LLC.

“The opportunity to buy innovative companies on the cheap is a great benefit to incumbents who either aren’t positioned well or want to buy on a discount,” he said. “This is going to create a good floor for prices and introduce another reason for stocks to not go down much further.”

Tech Chart of the Day

The recent rout in Amazon.com Inc. shares has widened the gap versus analyst targets to $1,400, meaning brokers expect a 52% jump from current levels — the widest since 2018. Every single analyst who covers Amazon recommends buying the stock, the only such unanimity among big tech peers.

Top Tech Stories

- U.S. authorities are investigating trading in Activision Blizzard Inc. options by Barry Diller and other investors just before Microsoft announced an acquisition of the video game studio. IAC/InterActiveCorp Chairman Diller said the Justice Department contacted him regarding the trades. He denied wrongdoing, saying he had no knowledge of the impending deal and merely spotted a bargain in the market

- Dating app Bumble Inc. gave a full-year revenue forecast that beat Wall Street’s average estimate, giving investors relief after the omicron surge and the war in Ukraine weighed on the company’s prospects. The shares gained as much as 25% in extended trading

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.