(Bloomberg) — China’s retail traders are resorting to bleak online humor as they contend a roller-coaster stock market that’s been one of the worst performers in the region this year.

You can get past a security checkpoint asking for “green” Covid-19 health codes by flashing a stock app, one joke goes — green indicates losses in China. Looking for a smooth ride out of stock market rout? Working as a driver for Didi Global Inc. will give you “greater peace of mind,” says a hiring ad for the ride-hailing app circulated by investors.

While many equity traders across the world were caught off-guard by Russia’s invasion into Ukraine, those in China have been beaten harder with regulatory uncertainties at home and the risk of Beijing’s overture toward Russia bringing U.S. sanctions.

Read: Wild Ride in China Stocks Triggers Memories of 2018 Meltdown

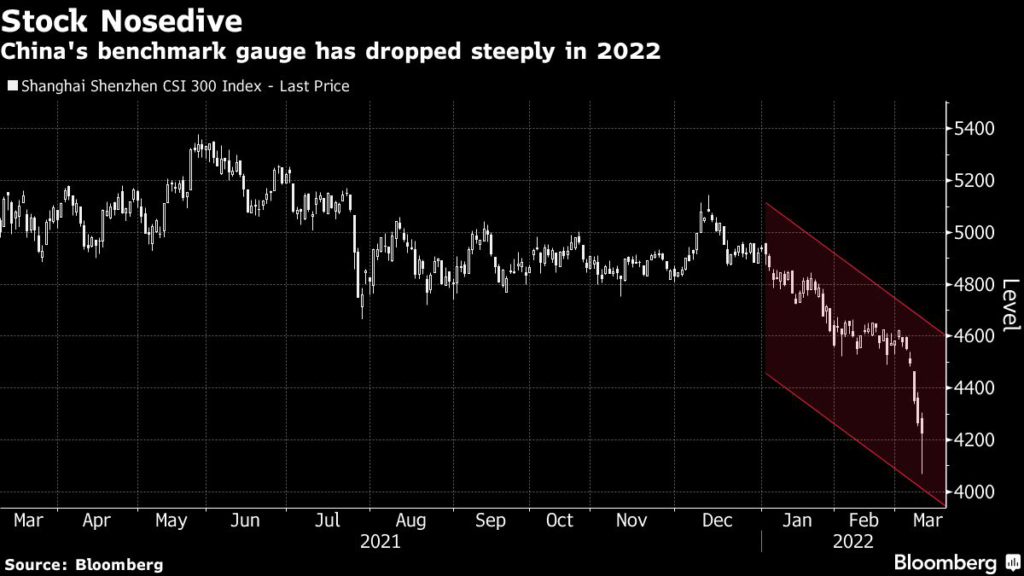

China’s benchmark CSI 300 Index has plunged more than 13% so far this year, even after Thursday’s 1.6% gain which tracked a global rebound. The smaller, tech-heavy ChiNext Index has shed some 20%. That comes as benchmarks in South Korea and Japan are down around 10% or less during the same period, with global shares sliding less than 11%.

“Russia and Ukraine need to reach a truce soon,” said one user on China’s twitter-like Weibo. “A-share investors are running out of cash to fund this war.”

Corporate China may be trying to help ease investor angst, too. Liquor giant Kweichow Moutai Co. and Semiconductor Manufacturing International Corp. were among firms that released their two-month operating figures earlier this week, a rare practice that may be an intention to show strong company fundamentals. China Tourism Group Duty Free Corp. and Inner Mongolia Yili Industrial Group Co. joined the pack on Thursday.

Individual investors account for the majority of China’s equity trading volume, which stands close to 1 trillion yuan ($158 billion) a day. The number of mom-and pop investors have steadily increased over the decades to near 200 million as of end-January, accounting for more than one in ten citizens.

Some big-name strategists had expected China’s stock market to outperform this year, thanks partly to the central bank’s easing stance. That prospect is also dimming as rising inflation risk from the war in Ukraine makes an aggressive easing less likely in China.

Traders also say the recent stock selling could have been exacerbated by stop-loss orders by quant funds, which have been rapidly on the rise in recent years, and large corporate clients pulling out of funds to stem losses.

“Though the worst of the panic may have subsided in the short term, it will still take time before larger buyers return, while any relief rally will just be an excuse to sell for funds who bought the dip,” said Yu Yingbo, investment director at Shenzhen Qianhai United Fortune Fund Management Co. “A broad rally in China stocks this year is now out of the question.”

(Updates with closing prices and corporate announcements)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.