The JSE slumped 2.42% down today with heavyweights Naspers and Prosus lending the bourse no help due to their exposure to the Chinese market. The All Share ended on 71,904 points.

Naspers and Prosus plunged 13.12% and 11.42% respectively after taking on heat due to Prosus’s 29% stake in the Chinese firm Tencent. The Chinese tech and entertainment conglomerate is facing a record fine after China’s central bank found the firm’s WeChat Pay had violated anti-money laundering rules.

The Wall Street Journal reports that the payment platform was allowing the illicit transfer of funds for activities such as gambling.

Prosus was down 13% by midday while Naspers had lost 14% from its share price. The slump was further compounded by panic selling in Hong Kong on Monday over concerns for Beijing’s close relationship with Russia and renewed regulatory risks.

Casino and gaming group Sun International (0.38%) said it returned to profit for the year ended December following the easing of covid restrictions and an uptick in local travel for leisure. The group recorded headline earnings of R295 million compared with a loss of R409 million in 2020. The group decided not to declare a dividend.

Banking group Absa (2.51%) reported its profits have more than tripled with headline earnings per share jumping 193% to R21.47 for the year ended December.

Banking peers Standard Bank (0.42%), FirstRand (2.49%), Capitec (1.82%), and Nedbank (0.75%) all traded in the green.

British American Tabaco (-3.29%) joined an ever-growing list of companies that have decided to pull out of Russia due to the invasion of Ukraine. The group said only 3% of its revenue is derived from its business in Russia and Ukraine, adding its growth guidance for 2022 has been cut from between 3% and 5% to between 2% and 4% following the exit from Russia.

Johan Rupert’s Remgro said it would release its December year-end figures next week with headline earnings expected to rise between 134.4% and 144.5% due to the recovery the business has experienced following the impact of Covid-19. The Remgro share price added 0.41% on Monday.

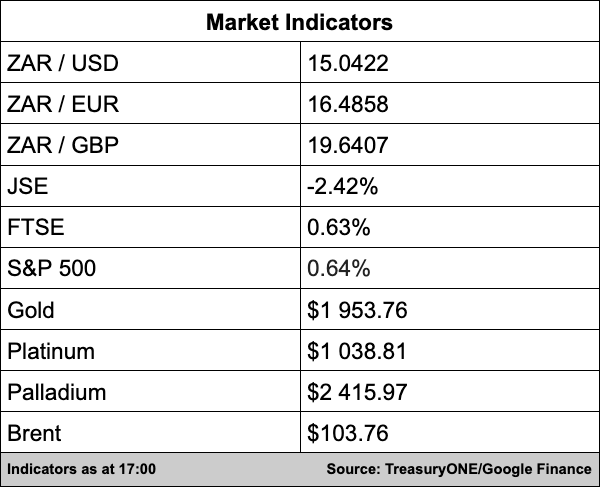

In the currency markets, the rand remained stable throughout the day but struggled to break below the R15.00/$ level. The local unit stayed between the R15.00/$ and R15.10/$ range while other emerging markets followed a similar pattern. With the US Fed set to announce a rate hike this week, the rand and other Ems could come under pressure.

On the commodity front, there is significant pressure following the easing of supply concerns due to the Russian invasion of Ukraine. Palladium was down as much as 15% at one stage and over $1,000 lower compared to last week’s high.

“Currently, the metal is still down 14% and remains on the back foot. Platinum had a better day if compared to palladium, still above the $1,030 mark and down 3.8%. Gold is down 1.4% for the day, but this move is more likely linked to the market’s expectation of a hawkish Fed,” comments TreasuryONE.

Brent crude is down 7% from this morning’s opening price and is currently trading at $104.40 a barrel.