Naspers had more than R100 billion wiped from its market valuation yesterday with investors panic selling tech stocks on the Asian market following a report in the Wall Street Journal that Chinese conglomerate Tencent was facing a record fine.

At one point, the JSE heavyweight’s share price was down 15% while subsidiary Prosus, which owns a 29% stake in Tencent, also battled significant losses.

Naspers and Prosus shares have now lost more than half of their value since a year ago. Wilhelm Hertzog, portfolio manager at Rozendal Partners, told Fin24 that investors were starting to place pressure on Naspers and Prosus to unbundle the stake in Tencent to others and shareholders.

Over in Hong Kong, Tencent slumped 10% to its lowest level in two years. The fine relates to the company’s WeChat Pay platform, which allegedly violated Chinese anti-money laundering regulations by allowing the transfer of funds for illicit actions like gambling.

But large fines said to run into the millions of yuan are not the only reason for a massive selloff in tech shares like Tencent. The Chinese government announced a large Covid-19 lockdown to curb the spread of the virus, which hit the technology centre of Shenzhen.

Tech shares were already under pressure due to heavy losses brought on by tougher domestic and US regulatory oversight, which included the risk of being kicked off Wall Street, reports Bloomberg.

While Chinese shares were also significantly affected by a report that Russia had asked the government in Beijing for military supplies in pursuit of its invasion of Ukraine.

The US and China held talks on Monday regarding Russia’s request for military supplies with Washington keen to have the Chinese exert some pressure on the Russians to bring about an end to the war. But there are fears that Beijing will undermine the process and overtly supply Moscow while giving worldwide sanctions the middle finger.

But come Tuesday morning and Chinese tech shares had rebounded and erased the 7.2% losses that came on Monday.

“The sudden bounce mid-morning came as China’s economic data beat estimates, lifting sentiment and suggesting resilience before the country’s Covid-19 outbreak forced lockdowns in major cities. Broader benchmarks such as the Hang Seng Index and CSI 300 also pared losses after the data dump,” reports Bloomberg.

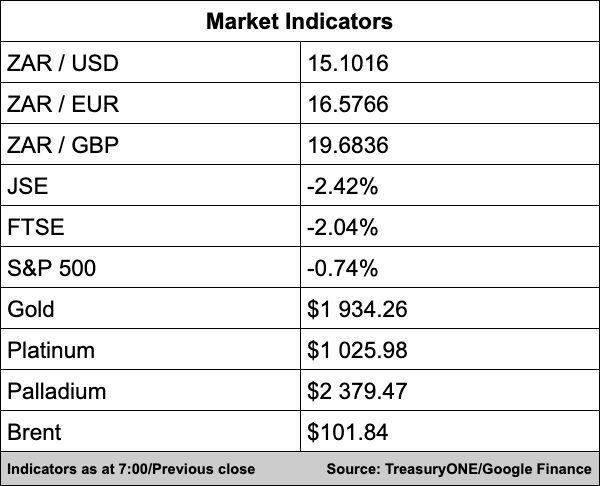

In the currency markets, the dollar remained steady yesterday even while US bond yields spiked, and commodity prices took a beating. The rand is trading flat this morning at R15.10/$ and is likely to stay within the R15.00/R15.20 to the dollar range for now.

On the commodity front, it was a bloodbath yesterday with gold falling by 1.7%, platinum down 4.5% and palladium was down a massive 16.2% before closing 14.6% weaker on the day, comments TreasuryONE.

“This morning sees Gold a further 1.0% weaker at $1,932, Platinum down another 0.35% at $1,026, while Palladium is trading 1.0% stronger at $2,410. Brent crude corrected by a further 5.5%, closing at $106.90 last night as markets eyed the Russia/Ukraine talks and concerns over reduced demand out of China. This morning we have Brent down further at $102.00 while WTI is trading at $98.18.”

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Covid Spurs South Africa’s Discovery to Seek Low Income Clients – Bloomberg

Russia’s war is going to make South African kotas and slap chips more expensive – Business Insider

Facebook to be prosecuted in South Africa – BusinessTech

Global Business

Silicon Valley Tries to Disentangle Itself From Russian Money – Bloomberg

Lyft Adds Temporary Surcharge to Rides as U.S. Gas Prices Spike – Bloomberg

Boeing 737 MAX jet headed toward China completion plant – source – Channel News Asia

Markets

Asian Stocks Down, “Can’t Catch a Break” Over Soaring Inflation – Investing.com

Palladium’s Wild Rally at Risk From Recession Later This Year – Bloomberg

Oil Extends Slump Below $100 With Retreat Gathering Momentum – Bloomberg/DM

Tech

Google Chooses 15 New Startups for its Startups Accelerator Africa – IT News Africa

SpaceX Starlink app topped download charts in Ukraine after Elon Musk sent terminals to the country – Business Insider

Motto to launch a new electric bike subscription service in Paris – Tech Crunch