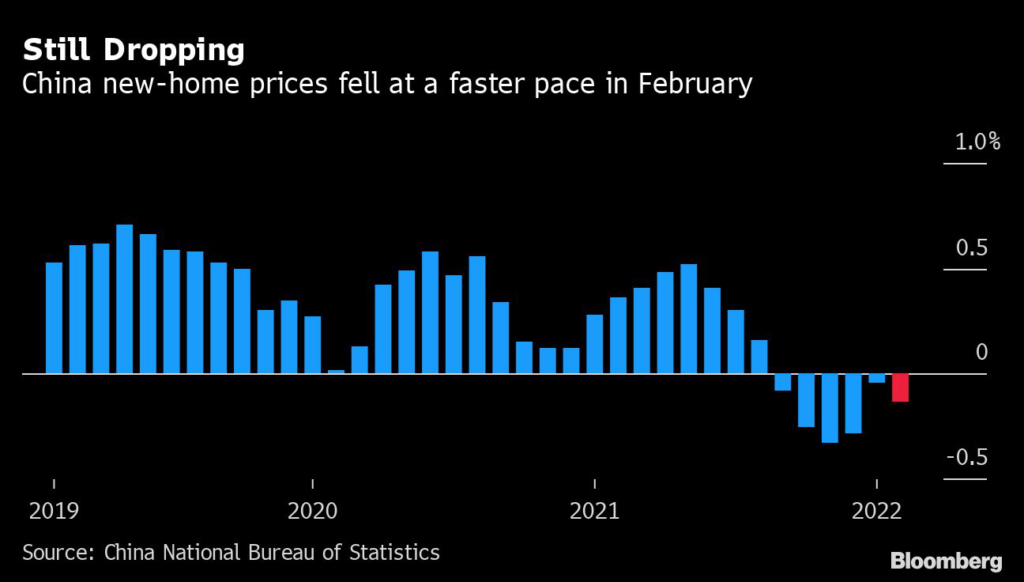

(Bloomberg) — China’s home prices fell at a faster pace in February, as easing measures failed to prevent the property industry downturn from worsening.

New home prices in 70 cities, excluding state-subsidized housing, declined 0.13% last month from January when they dropped 0.04%, National Bureau of Statistics figures showed Wednesday. Values in the secondary market dropped 0.28%, the same pace as January.

A liquidity crisis at developers including China Evergrande Group has led to defaults and fears of contagion that have reverberated throughout the industry and the wider economy. Local governments have recently pivoted to stimulating demand, such as by cutting mortgage rates and down payments.

The measures have done little to revive home sales, which have been falling since July. Sales slid 22% in the first two months of 2022 from a year earlier, National Bureau of Statistics data showed Tuesday. Separate figures from researcher China Real Estate Information Corp. showed a 43% drop in sales at the country’s top 100 real estate companies in the period.

Buyers’ wait-and-see sentiment remains heavy in the home market, which hasn’t bottomed out, CRIC research analysts led by Yang Kewei wrote in a report on Tuesday.

Price trends worsened across large and small cities, following a brief rebound in January. Home values gained at a slower 0.53% pace in the four economically strongest cities. Prices were unchanged in tier-2 cities after rising slightly in the previous month, and in tier-3 locations they slid 0.32%.

A Bloomberg Intelligence index of Chinese real estate shares was little changed on Wednesday morning, after dropping 18% in the previous three sessions during a broader stock market rout.

Mortgage demand also remains weak. Medium and long-term loans to households, a proxy for mortgages, fell for the first time in at least 15 years in February.

Chinese policy makers are closely watching residential prices, which have now fallen for six straight months. Earlier this month, chief banking regulator Guo Shuqing, signaled he’s comfortable with moves being seen in home prices during the industry slowdown — as long as they aren’t too extreme.

“A lot of people borrow to buy properties for the purposes of investment, or speculation,” said Guo, chairman of the China Banking and Insurance Regulatory Commission. “Should property prices drop or other problems emerge, it could turn into a huge financial crisis.”

(Updates with comment from researcher in the fifth paragraph, breakdown of prices in the sixth.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.