(Bloomberg) — For all the euphoria in technology stocks after the Federal Reserve meeting, the bond market is sending a message to investors: Buy shares in companies that will fare well even if the U.S. tips into a recession.

The Nasdaq 100 Index rallied 3.7% Wednesday, far outpacing the gain in the broader market, after the central bank raised interest rates, as expected. While the Fed decision contained no hawkish surprises, it did trigger a reliable indicator that a recession may be in the offing: The yield on five-year U.S. Treasury notes rose above the 10-year yield, the first such inversion since March 2020.

Some investors are already adding tech stocks that can absorb growth shocks, while warning that the sector overall is unlikely to outperform if the U.S. economy contracts. That means the Nasdaq 100’s bear market may not be over by a long shot.

“We want to have some exposure and there are some secular tailwinds in technology that will persist even in a recession, things like 5G and more data moving to the cloud,” said Jason Benowitz, senior portfolio manager at Roosevelt Investment Group, citing Amazon.com Inc. and Marvell Technology Inc. as stocks he likes. “These things are going to happen whether or not the economy goes into recession.”

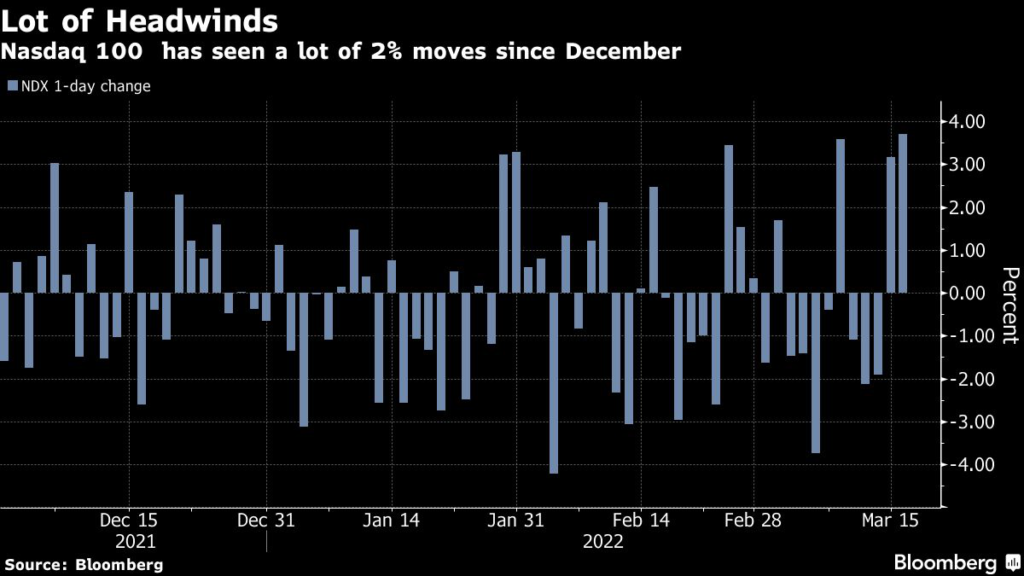

Rising recessionary risks are dashing any hopes that bargain-hunters will trigger a sustained rally as valuations hover near pre-pandemic levels. There’s been extreme volatility in Nasdaq 100, with many 2% moves since early December amid soaring inflation, central bank policy tightening and the economic fallout from Russia’s invasion of Ukraine.

“It is OK to be patient and sit on some cash,” said Paul Christopher, head of global market strategy for Wells Fargo Investment Institute. “This has the sense of being an oversold market, but you need a catalyst, and what is that going to be if the 10-year yield is rising and growth is slowing?”

Indeed, a survey of Bank of America Corp. clients showed that cash levels surged to the highest since April 2020, while exposure to equities fell to the lowest in nearly two years. Most investors in that survey also expect global equities to slump into a bear market this year as the growth outlook has tumbled to the lowest level since the 2008 financial crisis.

The euphoria is already fading a bit Thursday: the Nasdaq 100 sank as much as 0.9% in early trading.

Tech Chart of the Day

The Nasdaq Golden Dragon China Index jumped 33% Wednesday, the most ever, after officials promised to ease a regulatory crackdown and support property and technology companies. But there’s plenty of catch up to be done as the index is still down about 65% since its peak in February 2021.

Top Tech Stories

- India’s Paytm had its price target cut further by a Macquarie Capital Securities (India) Pvt. analyst who was early to predict the company’s troubles

- The U.S. accounting watchdog is insisting that Beijing provide complete access to audits of Chinese companies that trade in New York, setting a high bar for any deal that allows the firms to maintain their American listings

- Germany is looking to grant Intel more than 5 billion euros ($5.5 billion) in public funds to build a massive semiconductor plant, part of the European Union’s effort to build up domestic chip production, officials familiar with the negotiations said

- Box Inc. gave a forecast for annual revenue growth of as much as 17% in 2025 as the content management software provider works to drive higher sales and improve margins following a bitter proxy fight

- Chip startup SiFive raised $175 million from investors such as Intel Corp. and Qualcomm Inc., giving it enough funding to work toward going public

(Adds stock details in fourth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.