The JSE closed Thursday just under 1% up as risk appetite starts to return to the market and the ongoing peace talks between Ukraine and Russia could potentially yield a positive income. The All Share Index ended on 74,124 points.

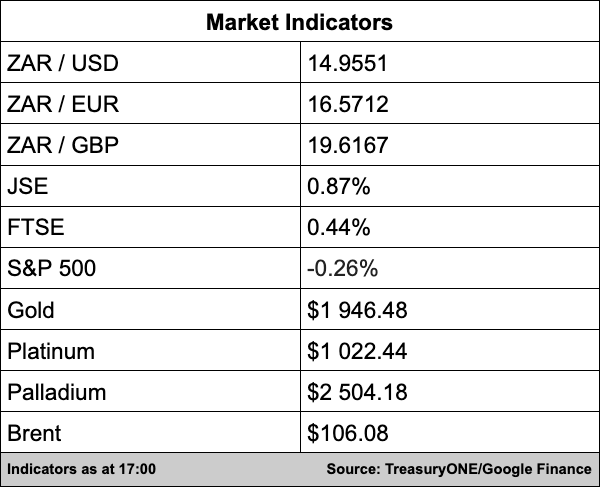

In the currency markets, the rand remained within a tight range for most of the day and tested the R14.90/$ level before rising higher again. But the local unit has pushed back strongly and is currently trading at R14.89/$. Most emerging market currencies have been on the front foot today as risk sentiment starts to improve.

On the commodity front, nickel resumed trading today on the London Stock Exchange but was closed again due to glitches in the trading system.

Gold has bounced off the lows we saw after the Fed meeting, climbing back to $1,945 and currently up 1% for the day. Palladium has been trading within the $2,350 and $2,500 band for a couple of days now as traders assess the risk’s poised by supply shortages due to sanctions on Russia.

“Today has been no different, and the metal gained a couple of percentage points to settle just below the top end of the range. Platinum is flat for the day and is currently quoted at $1,025. Today, we have seen a big move in oil prices, with both WTI and Brent Crude up over 7%.”

Brent is currently trading at $106 a barrel.

On the JSE, billionaire Patrice Motsepe’s investment vehicle, African Rainbow Capital (6.02%) said its intrinsic value rose 14% in the six months to end December 2021 to R14 billion. The rise in value is attributable to its investee companies some of which include local players TymeBank and mobile data network Rain.

Montauk Renewables (6.42%) said its revenue rose 48% to $148.1 million (R2.2 billion) for the half-year in 2021 but it posted a headline loss of $2.94 million from earnings of $3.8 million. Profits came under pressure due to costs related to its listing on the Nasdaq earlier last year.

Property group Raven asked to be suspended from the JSE and the London Stock Exchange on Thursday due to the Russia-Ukraine war. The company said it was deeply saddened by the war in Ukraine and that it made it impossible for the business to properly assess its financial position and inform the market accordingly. The group also asked to be suspended from the official list of the International Stock Exchange and the Moscow Stock Exchange.

Some of the biggest gainers today were Northam Platinum (8.19%), DRD Gold (7.92%), Harmony (5.33%), Amplats (4.7%), Steinhoff (4.39%) and Sibanye Stillwater (4.61%)