(Bloomberg) — Bitcoin, in what’s become its motto of late, is starting the week on a tepid note. But crypto fans are looking at a technical signal that’s potentially pointing to a new breakout.

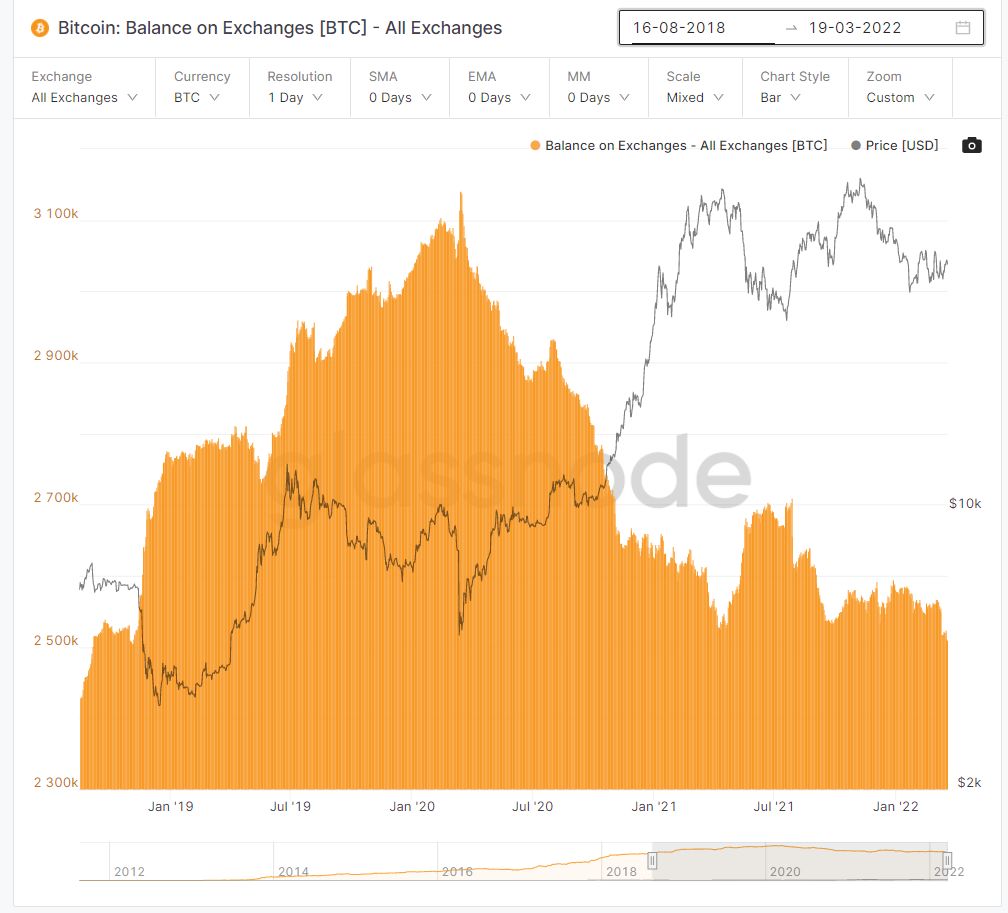

The supply of Bitcoin in private wallets across exchanges has reached a three-year low, according to data compiled by Glassnode.

Though it’s not necessarily the primary price catalyst right now, there’s logic to the idea that might mean the coin is ready to rally, said Stephane Ouellette, chief executive of FRNT Financial Inc.

“If there’s a lot of BTC on exchanges, then people are ready to sell,” he said.

“If it’s off exchange in private wallets, they could be less ready to sell. It’s a way of saying HODLers are more in control,” he said, referring to a crypto-community acronym for long-term devotees.

The largest digital asset by market value was down by less than 1% as of 12:03 p.m.

in New York to trade around $41,229. It’s been glued to a tight trading range for the past few months, unable to break above any of the high points it reached at the start of the year.

Market-watchers have a few explanations, including that speculative juices have been dried up as the Federal Reserve and other central banks start to raise interest rates.

Another is that as long as Bitcoin dawdles below $47,000 — a break-even point for many new investors — it will remain stuck within its tight range because short-term traders will sell at every rally.

Cryptocurrencies have been beset by the same forces that have dented other risk assets, including U.S.

stocks, this year. Investors are worried about an economic slowdown amid rising commodities prices due to the war in Ukraine. Meanwhile, digital coins have come under renewed scrutiny amid a debate around whether they’re of use to anyone trying to skirt sanctions.

The Bloomberg Galaxy Crypto index was down 19% year-to-date as of Friday.

Aoifinn Devitt, chief investment officer at Moneta, says the fact that cryptocurrencies have only been around for a little more than a decade means there’s little history to go off to gauge how it might behave in a shock environment, or one where there’s persistent inflation.

“We’re in this process of discovery now, we’re finding out that it tends to be a very high-risk-reward asset that tends to sell off when risk is off the table,” Devitt said by phone from Chicago.

“Because that process of discovery is going on, there have been these shock-waves that have been coursing through markets, certainly there’s not going to be a flight to safety into cryptocurrencies.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.