(Bloomberg) — Cryptocurrency trading conducted in rubles on exchanges appears to continue to decline while regulators remain adamant that digital assets are being used by Russians to evade sanctions.

As of March 18, ruble-denominated crypto trading volume had dropped by more than half from a recent peak at roughly $70 million on March 7, according to data from blockchain-analytic firm Chainalysis. At around $7.4 million, the ruble trading volume only counts as a fraction of volume globally. Bitcoin’s daily total volume averages between $20 billion to $40 billion.

European Central Bank President Christine Lagarde said Tuesday that there are signs showing Russians are trying to bypass sanctions by using cryptocurrencies. Lagarde didn’t provide specific examples.

The data only shows potential crypto activities conducted by Russian investors on crypto exchanges, said Madeleine Kennedy, Chainalysis’ senior director of communications. It does not include all transactions conducted on blockchains.

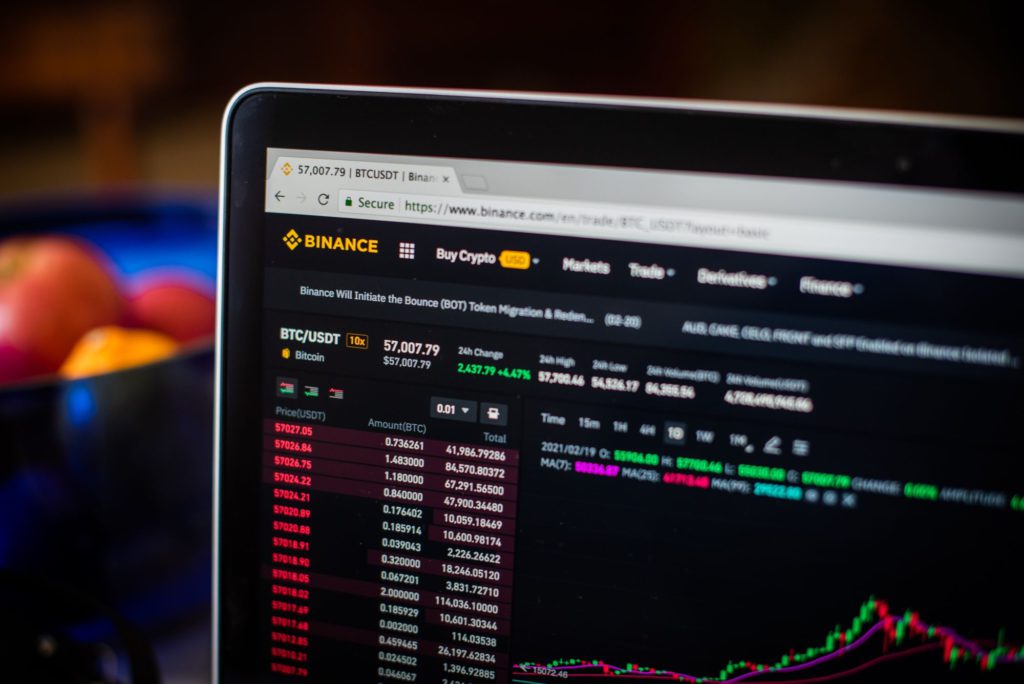

Data provided by crypto data firm Kaiko also shows that ruble-denominated Tether stablecoin activities, the most popular ruble trading pair, is down from a March 7 peak of roughly $38 million. Less than $5 million worth of RUB/USDT volume was reported on March 22, according to Kaiko. The firm also noted that there are only three global crypto exchanges, Binance, Yobit, and LocalBitcoins, offering ruble-denominated crypto trading pairs.

Crypto forensics firm Elliptic previously said it had found a digital wallet that may be linked to sanctioned Russian officials and oligarchs and passed the information to authorities. The firm’s co-founder said that crypto is not able to facilitate sanctioned entities or individuals any large-scale evasion.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.