(Bloomberg) — China is facing a temporary hit to factory production and a lingering consumer slump amid the strictest Covid controls since the initial outbreak two years ago.

Company statements and high-frequency indicators suggest a drop in output and spending in March after China imposed lockdowns in key cities like technology hub Shenzhen and Changchun, a center for automakers. Official activity data won’t be available for several weeks still.

With President Xi Jinping pledging to reduce the economic damage of his Covid Zero strategy, China has taken steps to end the shutdown in Shenzhen within a week and avoid putting Shanghai under full lockdown despite a flareup of Covid cases in the city. That suggests an attempt by officials to minimize the fallout, especially for factories.

For consumers, the hit to confidence may last longer as people remain wary of traveling and shopping. Unemployment is already on the rise while daily Covid cases continue to top 4,000.

“Consumption may still be subdued and only recover mildly after the outbreak is brought under control,” said Liu Peiqian, China economist at NatWest Group Plc. The services sector and tourism will find it difficult to fully revive as sustained and synchronized easing of travel policies is unlikely, she added.

Goldman Sachs Group Inc. estimates that districts designated middle and high-risk virus areas, meaning they’re facing some form of restriction, now exceed 30% of China’s gross domestic product. If a four-week lockdown was imposed in these areas, annual GDP would be reduced by 1 percentage point, the bank’s economists including Hui Shan wrote in a note Wednesday.

Here’s a look at what the early signs tell us about the likely economic fallout from China’s Covid controls:

Sentiment Slump

An index measuring activity in China’s emerging industries fell to 49.5 in March, below the 50-level that separates expansion from contraction, according to survey results published by China Logistics Information Index (Beijing) Co. and a research institute linked to the Ministry of Science and Technology. Covid curbs caused supply chain crunches and the impact of the Covid outbreak was the worst since February 2020, according to the report.

The survey covers companies in seven high-tech industries like green technology, bio-tech, high-end equipment manufacturing and new energy vehicles.

A separate poll of sales managers across various industries showed a third of firms were affected by the virus resurgence in March, according to data company World Economics. Still, the figures show a big portion of business activity has or soon will have recovered from past Covid outbreaks. The services sector was the hardest hit, with an index measuring staffing falling to an 18-month low.

Operation Halt

The shutdown in Shenzhen halted Apple Inc.’s supplier Hon Hai Precision Industry Co., known as Foxconn, though it was allowed to partially resume last week even though the city was still barring residents from leaving home. In Changchun, which remains under lockdown, automakers like Toyota Motor Corp. and Volkswagen AG have stopped production.

At least 28 companies listed on mainland exchanges, including electronic component producers, petrochemical firms and environment equipment suppliers, announced a suspension of business operations in March. While many didn’t disclose the direct impact, a few reported that the halted production lines contributed to half of their total revenue. Three of the companies had restarted some production by Tuesday.

Goldman Sachs analysts said the most affected businesses in the five provinces of Jilin, Shanghai, Guangdong, Jiangsu and Shaanxi were those in industries like chemical raw materials and chemical products, transportation equipment including automobiles, and timber and wood products.

The logistics industry is another major concern, with the Goldman Sachs analysts expecting disruptions to the sector and ports to be “potentially much worse” than what was seen in early 2021 and last summer.

Delivery across nearly half of the country was restricted as of March 17, leaving online vendors reeling from plunging shop visits and orders, and an increase in refund requests, according to an article published Saturday by e-commerce information exchange platform Paidai.

Empty Carriages

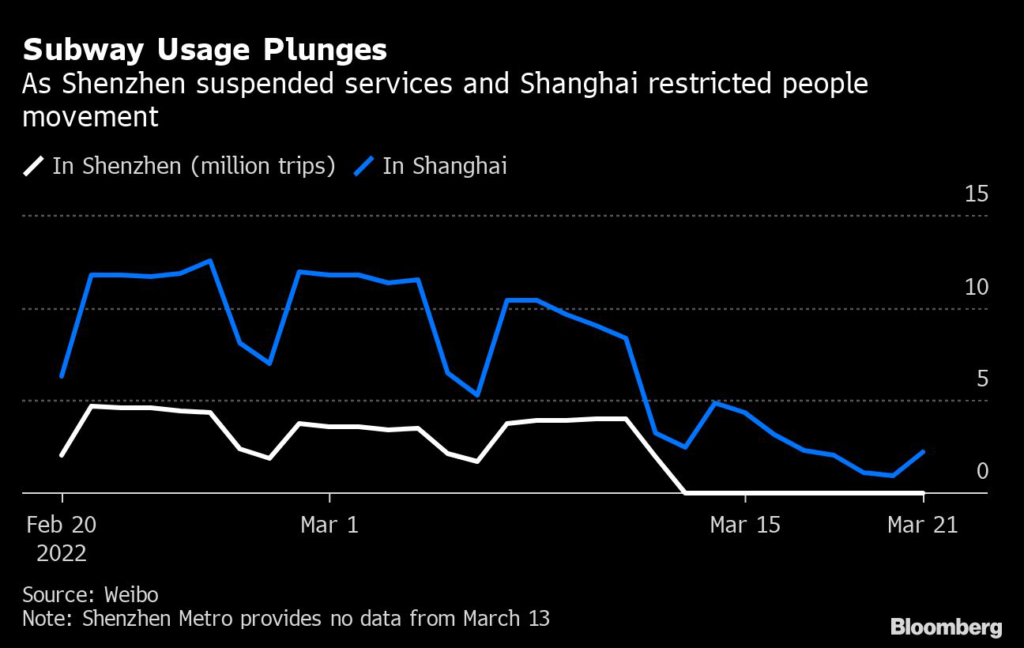

Subway ridership in Shenzhen dropped to zero last week as public transport networks in the southern technology hub were halted and 17.5 million residents were ordered to limit their movements. The number of passengers using the subway in Shanghai also decreased rapidly.

Tourism Drops

Hotels and tourism suffered as many regions restricted residents from moving around in order to contain the spread of the virus. Hotel occupancy rates dropped in the first two weeks of March in Shanghai, Shenzhen and Jilin province, latest figures from hospitality data and analytics company STR show.

Across China, the average hotel occupancy fell to 44% in the seven days through March 12, down from 52.9% two weeks earlier and 59% for the same period last year, according to STR figures.

The catering industry is also bearing the brunt of social-distancing rules. Business volumes recorded by the restaurant management system of Delicious No Wait (Shanghai) Information Technology Co. tumbled 44% in the week of March 18 from the last week of February, China International Capital Corporation analysts wrote in a Monday note. Delicious No Wait covers more than 100,000 eateries, according to the firm’s website.

Quiet Cinemas

Moviegoers declined sharply as cinemas faced some of the most draconian Covid-controls. Box office revenue in the first three weeks of March came in at 710 million yuan ($111 million) nationwide, down 58% from the value in the same period last year, according to Bloomberg calculations based on figures from ticketing company Maoyan.

Keeping Covid in check may be a “political necessity” before a key Communist Party meeting in autumn, Ernan Cui, an analyst with Gavekal Dragonomics, wrote in a note.

“The intensified focus on controlling Covid is clearly at odds with the recent signals coming from other government officials about the need to support economic growth,” Cui said. “Most likely, the government will end up accepting that falling short on its 5.5% GDP growth target for 2022 is inevitable given shocks like these.”

(Updates with analyst’s comment in final two paragraphs.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.