As if our pockets haven’t taken enough enemy fire in the battle against soaring food and fuel costs and rising inflation, today we could face another attack when the SA Reserve Bank monetary policy committee (MPC) the outcome of its latest meeting.

The MPC will wrap up its three-day meeting before announcing its decision with near certainty that it will hike interest rates to combat rising inflation.

The only real question remaining is just by how much the MPC will hike the rate, 25 or 50 basis points?

The last time the MPC met in January, the world hadn’t yet been thrown into turmoil by the Russian invasion of Ukraine, but the inflation outlook was anything but cheerful reading.

The MPC said in its January statement, “The risks to the inflation outlook are assessed to the upside.

Global producer price and food price inflation continued to surprise higher in recent months and could do so again.”

Indeed, producer price and food inflation continue to soar amid the Russian invasion and the rate hike will come after the consumer price index (CPI) numbers that were printed yesterday at 5.7% year-on-year, coming in slightly lower than the expected number of 5.8%.

The CPI printed unchanged from January’s number but bread and maize meal prices were significantly up with petrol and diesel prices up by a third over the past year.

And if oil prices do shoot up to $150 a barrel, as is being predicted by veteran commodities trader Doug King, South Africa’s consumer inflation could hit 7% year-on-year in May.

But that is an unlikely scenario reports Mail & Guardian, citing Investec chief economist Annabel Bishop, who has warned, however, that high oil prices as a result of major oil producer Russia attacking Ukraine and the sanctions that have been imposed upon it, risk pushing SA’s consumer inflation rate to more than 6% year-on-year in April.

Meanwhile, finance minister Enoch Godongwana says government wants to help cushion the blow of rising oil prices for the months of April and May.

Godongwana was answering questions in parliament yesterday, where he said the treasury was in discussion with the department of mineral resources and energy to bring temporary relief through immediate action on rising fuel costs but did not reveal what would be done.

Fuel prices are at a record high at over R21/l with an expected further R2 increase on the cards for April.

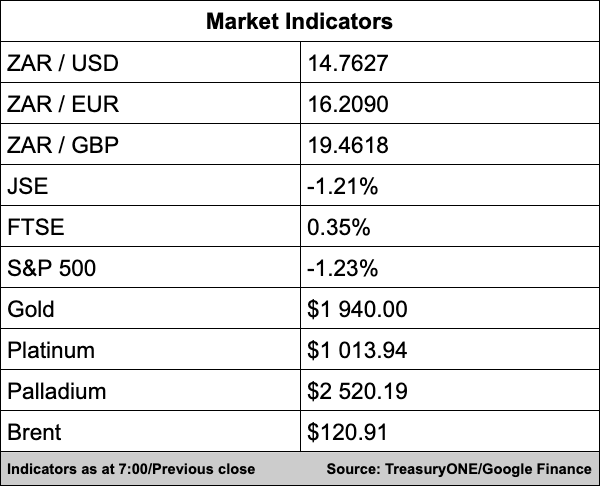

In the markets, the rand has consolidated its position below the R14.85/$ mark and looks to be moving toward the R14.50/$ level as “exporter inflows far outstrip importer demand even at these stronger levels,” comments TreasuryONE.

“The rand is currently quoted at R14.77 ahead of the SARB’s interest rate decision later today.

The market is pricing in a 25-basis point hike, which could provide further support for the rand,” says the forex trading house.

On the commodity front this morning, gold is trading softer at $1,939, platinum is lower at $1,014, and palladium is up at $2,526.

Supply concerns have pushed the price of brent back above the $120.00 level.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

‘He couldn’t fix it with R3.5bn’ – Minister dismisses former Post Office CEO’s buyout offer – Fin24

Amazon HQ developer to fight back after court halts R4.5bn construction – Fin24

Tax hikes are looming for South Africa – BusinessTech

Global Business

Crew on oligarch’s R1.26bn yacht are catching and braaing fish, as no one will sell them fuel – Business Insider SA

TotalEnergies not in jeopardy by quitting Russian oil contracts-CEO – Reuters

U.S.

Oil Stockpiles Dropped by 2.5M Barrels Last Week: EIA – Investing.com

Markets

Asian Stocks Down, Cools Recent Rally Over Ongoing Inflation, Ukraine Worries – Investing.com

Oil sees further gains on sanctions talk, while equities slip – AFP

Ruble rises after reports Putin will require ‘hostile’ nations to pay for gas in Russian currency – Business Insider

Tech

Tencent Declares ‘Reckless’ Era for Tech Is Over as Growth Tanks – Bloomberg

Russian Hackers Targeting Humanitarian Efforts, Ukraine Says – Bloomberg

Vinny Lingham’s new start-up, Waitroom, is the anti-Zoom – Tech Central SA

Russia-Ukraine War

Ukraine Update: Russia Expels Diplomats, Wants Rubles for Gas – Bloomberg

US accuses Russia of war crimes for ‘indiscriminate attacks’ on civilians and ‘other atrocities’ in Ukraine – Business Insider

Biden heads to Europe to bolster West’s unity, toughen Russia sanctions – AFP