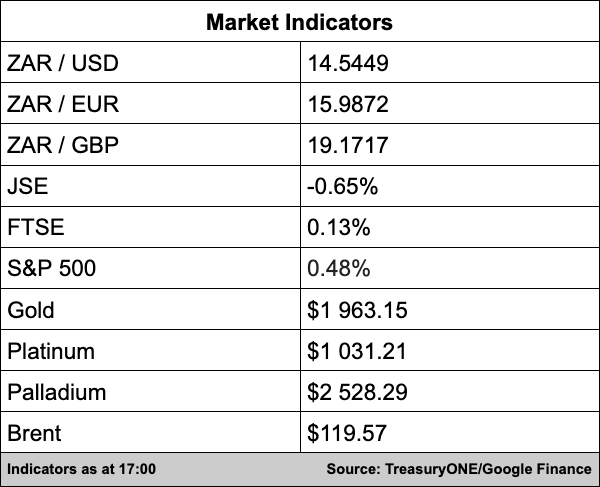

The rand broke below the R14.70/$ level for the first time since October 2021 and continued its onward march to settle below the R14.60/$ mark, where it is currently trading.

“The rand has gained just over 1.3% for the day against the dollar and is currently the second to the Brazilian Real for the strongest EM year to date. On the EUR/ZAR cross, the rand breached below the R16.00 handle for the first time since January 2020 with the euro still struggling against the dollar,” comments TreasuryONE.

The local unit has benefited from the SARB’s commentary, which was more hawkish than expected with the possibility of a 50 bps rate hike on the cards at one point before the SARB announced a 25 bps hike earlier today to increase the repo rate to 4.25%.

The SARB has revised headline inflation to 5.8% during 2022, upwards from 4.9% previously. They also mentioned that they expect economic growth to be 2% versus the previous 1.7% for this year.

“Overall expectation is that the hiking cycle will remain intact for future meetings. The market has taken this commentary in its stride with the SARB being a lot more hawkish than expected, while the dollar is still on the front foot against its peers,” says TreasuryONE.

On the commodity front, there is still stability in the sector with most commodities trading stronger for the day. Gold is trading above $1,960, platinum at $1,030 and palladium is at $2,515 while Brent crude lost almost 1.6% for the day and is currently trading at just under $120 a barrel.

On the JSE, there were concerns in the morning session that the bourse might struggle to find a clear path on Thursday given the mixed picture in the Asian markets.

The bourse lost its footing in the late afternoon trade to close 0.65% down with All Share Index on 74,350 points.