(Bloomberg) — The Taiwan dollar is set to advance after its biggest quarterly loss in nearly four years as the island’s robust economy reinforces the case for more rate hikes.

Australia & New Zealand Banking Group Ltd. expects the Taiwan dollar to rise to 27.9 per greenback by the end of the third quarter. It slumped to 28.79 per dollar on Tuesday, its lowest since December 2020, due to heavy outflows from local shares. However, its surge in the following session by the most in a year signals a recovery may already be underway.

Strong exports growth supports the case for the island’s central bank to follow the tightening path of the Federal Reserve, which would help the Taiwan dollar to recover from the recent drop, according to Khoon Goh, head of Asia research ANZ in Singapore. The Taiwan central bank may lift rates to 2% by next year, he said.

Taiwan’s central bank surprised markets by raising its benchmark interest rate by 25 basis points on March 17 to 1.375%, the biggest increase since 2007. It also raised the growth forecast for the year to 4.05% from its previous estimate of 4.03%. Swap traders are now betting that it may hike by a further 50 basis points this year.

A potential easing of geopolitical tensions is also likely to boost the Taiwan dollar, which is seen as a proxy for the risks stemming from the war in Ukraine, given the fraught relationship between Taiwan and China. It was little changed at 28.58 per dollar in Thursday after rising as much as 0.8% in the previous session on hopes of a de-escalation. It’s still down over 3% this quarter, most since the three months ended June 2018.

Cautious Outlook

The Taiwan dollar could face risks from aggressive policy tightening by the Federal Reserve and knock-on effects of Covid-led lockdowns in China. The chairman of the world’s biggest chipmaker, Taiwan Semiconductor Manufacturing Co., warned on Wednesday that the demand for consumer electronics including smartphones, PCs and TVs has been hurt by China’s lockdowns.

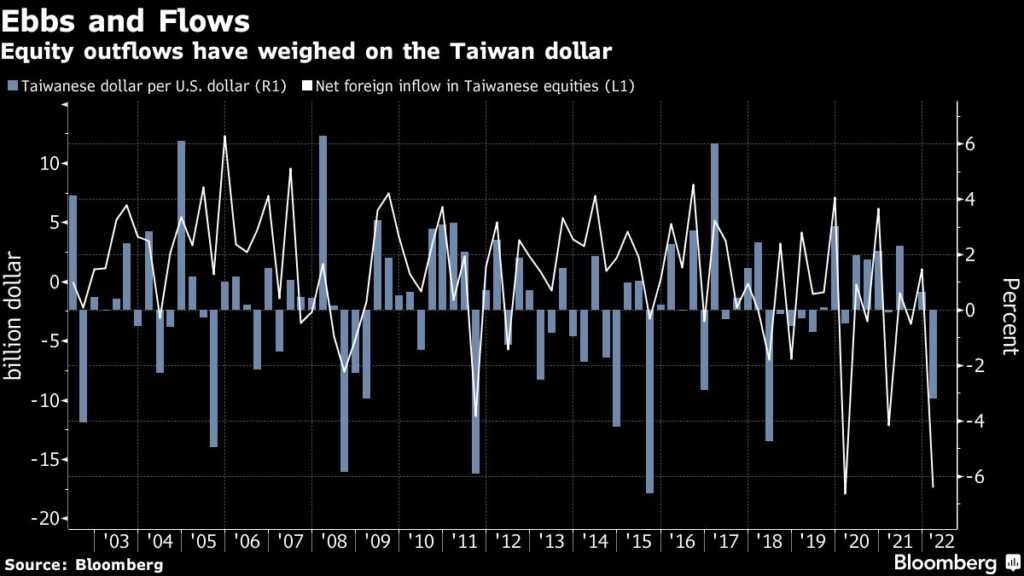

“U.S. dollar strength upon higher U.S. yield continues to hurt lower carry currencies like the Taiwan dollar, while equity outflow trend also continues to hurt the currency,” says Stephen Chiu, chief Asia FX & rates strategist at Bloomberg Intelligence. He expects the island’s currency to consolidate and hover just below 29 per dollar in the coming weeks.

However, Malayan Banking Bhd. expects mild gains. “Unlike previous stellar years, Taiwan dollar is not likely to outperform peers,” said Christopher Wong, senior foreign exchange strategist at Maybank. He it expects it to rise to 28.4 per greenback at end-June and 28.2 at the end of September.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.