(Bloomberg) — With Bitcoin settling back in a narrow trading range after a mid-March rally, investors searching for clues as to where it is headed next may want to take a look at what the options market is signaling.

Demand for call options that give the right to buy the cryptocurrency in the future has climbed this month as Bitcoin’s spot price rallied. Bitcoin edged lower for a third day to around $45,900, and is up about 10% in March.

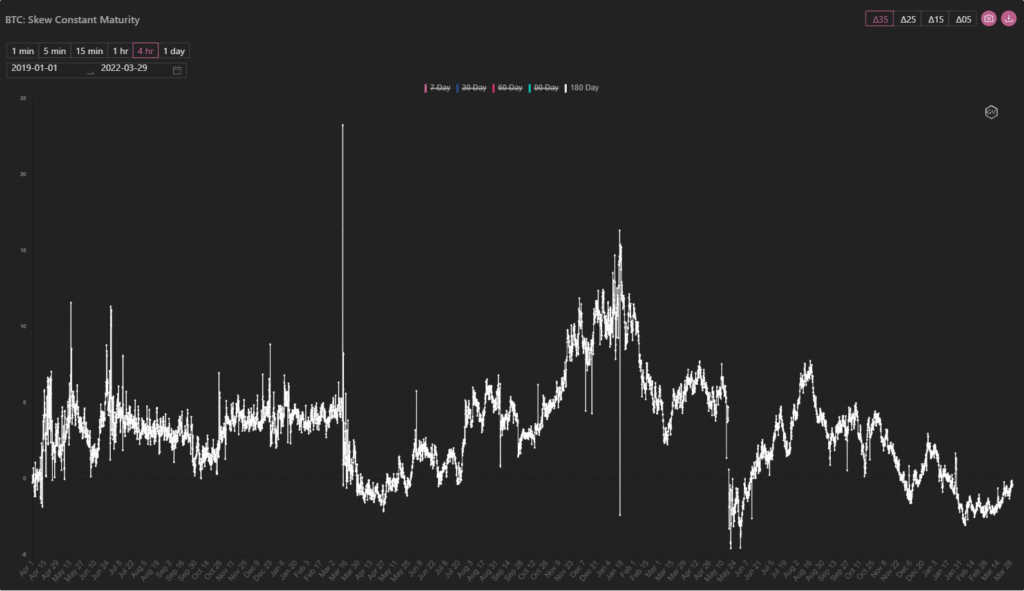

The 180-day Bitcoin call option implied volatility is trending higher relative to put options, reversing a two-month trend, according to crypto derivative analytics firm Genesis Volatility.

“Short-term options are starting to reflect a more neutral ‘skew’ and that the futures basis has started to go up, as appetite for leveraged exposure increases,” said Greg Magadini, chief executive of Genesis Volatility.

The Bitcoin options market’s skew — or implied volatility of calls minus puts — has been negative since January, which means premiums for put options are higher than call options. Trader tend to hedge future price slumps with out options and capture upside with call options from anticipation of a rally in the spot market. The skew turner positive on Wednesday.

However, it could be too early to tell if the recent uptick will sustain.

“Investors are paying more for calls than for puts, but the slight bounce over the past few days is not yet to be significant in terms of a sentiment change,” said Noelle Acheson, head of Market Insights at Genesis Trading.

Options traders can measure demand for options with implied volatility, which doesn’t indicate the directions of impending price volatility but the degree of price turbulence over a specific period of time. The skew in the chart, which equals call options implied volatility minus put options implied volatility, is a measurement that compares demand between these two types of options.

(Update the description of the skew in the fifth paragraph and the chart to reflect the latest market shift.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.