(Bloomberg) — In a market gripped by concerns over rising interest rates and soaring inflation, investors are avoiding European food delivery companies, turned off by their steep losses and determined efforts to expand.

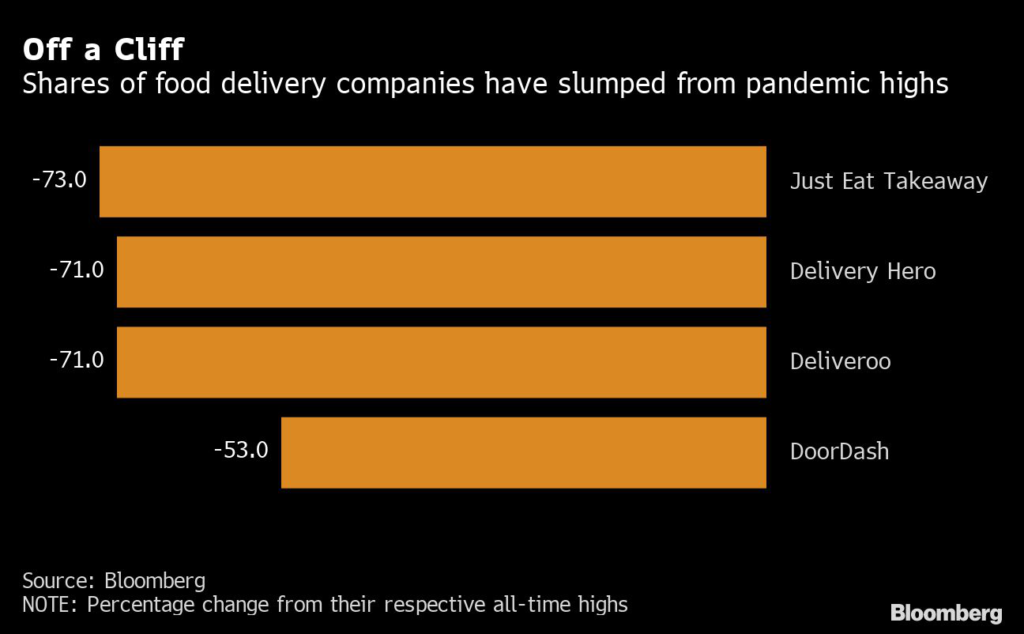

Shares in Delivery Hero SE plunged 59% last quarter, the second-worst performance in Europe’s Stoxx 600 Index. Peers Just Eat Takeaway.com N.V. and Deliveroo Plc dropped more than 35%. The three stocks wiped out a combined $23.7 billion, more than half their market value.

While it’s no surprise when tech stocks struggle in times of rising borrowing costs, the sharp slump in food delivery shares underscores the penalties markets can impose on companies for prioritizing growth when they are yet to turn a profit.

Companies in the sector have done a bad job of adjusting their strategies to the rising cost of capital, Jefferies analyst Giles Thorne said in an interview. “The cost of capital goes up, you don’t make money and you’ve got debt — then that’s how equity gets crushed.”

The fear of losing market share has driven increased spending, even as sliding equity valuations signaled investor disapproval. Just Eat expanded into the U.K. grocery delivery market in December, after previously saying the category lacked scale. Delivery Hero agreed to buy a majority stake in Glovo in a transaction that valued the Spanish delivery startup at 2.3 billion euros ($2.5 billion).

“The Glovo deal continues to baffle us,” HSBC analysts led by Andrew Porteous said in a March 25 note. Delivery Hero expects Glovo to post a loss of 330 million euros in 2022.

Volatility in food delivery stocks will remain high until the sector is closer to becoming self-funding, Thorne at Jefferies said. That remains months — or years — away. Deliveroo, for example, aims to reach breakeven on an adjusted Ebitda basis between the second half of 2023 and the first half of 2024.

‘Punch Drunk’

Challenges are coming at food delivery players from all sides. Inflation is squeezing consumer budgets, while competition is as heated as ever with startups like Getir and Gorillas pushing into rapid grocery delivery. Plus, the rapid growth achieved a year ago will be hard to repeat now that the pandemic-generated sales surge has passed.

Some analysts say the worst may be over, given how much the stocks have fallen. HSBC’s Porteous said caution has been baked into a sector that now looks “punch drunk.” That view is shared by Berenberg analyst Sarah Simon. “Yes, you’re going to have a couple of quarters when growth is less exciting, but we would say that’s already priced in,” she said.

Narrowing losses will take time, but consolidation may provide quicker path to relief.

Signs of thinning competition in some markets may draw back some investors, according to Goodbody analyst David Brohan. The sector is starting to become more rational, he said, with Just Eat ending operations in Norway and Portugal, Deliveroo exiting Spain and Delivery Hero pulling out of Germany for a second time.

“We need to see improving profitability metrics this year,” Brohan said. “We are not just going to continue down this very competitive route where profits are always pushed down the track.”

Food delivery stocks were off to a positive start in the second quarter, with Just Eat rising 7%, Delivery Hero up 6.4% and Deliveroo gaining 2.1% on Friday.

(Adds Friday share price moves in final paragraph, updates chart)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.