(Bloomberg) — A rapid 30% recovery from the trough for Chinese technology stocks is still far from convincing some market watchers that the worst is over for the sector.

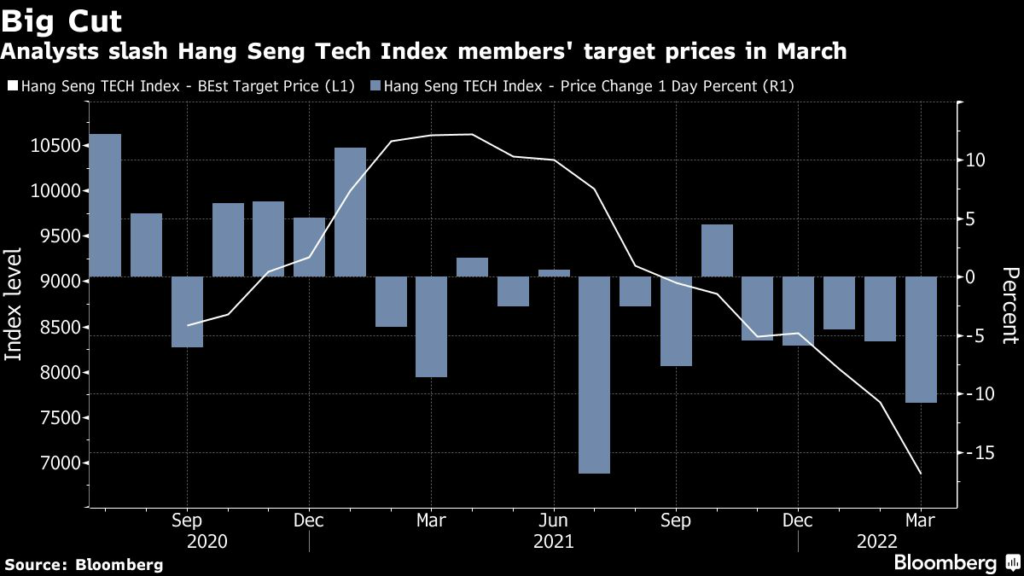

Analysts slashed their target prices for members of the Hang Seng Tech Index in March by the most since July following a sluggish earnings season, according to data compiled by Bloomberg.

Price objectives for internet giant Tencent Holdings Ltd. and online retailer JD.com Inc. came down by more than 10%. Smartphone component maker Sunny Optical Technology Group Co. and software company Ming Yuan Cloud Group Holdings Ltd. had the biggest reductions among index members, down 33% and 30%, respectively.

The Hang Seng Tech Index’s 30% surge since mid-March has lost momentum in the past week. Even as the nation’s top leadership vowed to keep markets stable, Beijing kept rolling out new crackdown measures on the tech sector, including a tax probe and reported tipping limit in the video-streaming industry.

“It’s hard to say the worst is over,” said Mark Po, analyst at China Galaxy International Financial Holdings Ltd. “We’ve seen a near-term bottom, but that doesn’t mean things won’t get worse.”

One bullish sign: Chinese authorities are preparing to give U.S. regulators full access to auditing reports of the majority of the 200-plus Chinese companies listed in New York as soon as the middle of this year, according to people familiar with the matter. The move could head off a wave of delistings and prevent a further decoupling between the world’s two largest economies.

American depositary receipts of Chinese companies rallied in U.S. premarket trading Friday after the report.

To be sure, most analysts remain optimistic on the technology giants despite recent price cuts. For example, only three out of 70 analysts tracked by Bloomberg rate Tencent a sell, and its average target price is still 40% higher than its last close.

“The internet sector is a megatrend of the past that has already become a mature and competitive industry with relatively limited upside and elevated policy risks,” said Ken Xu, chief investment officer of Strategic Vision Investment.

Tech Chart of the Day

The Nasdaq Golden Dragon China Index, which tracks Chinese stocks that trade in the U.S., is still valued 38% above its 2011 trough, as measured by price-to-book ratio. If China manages to head off delistings of many ADRs, the index may not test that low valuation.

Top Tech Stories

- The dominance of tech stocks in the S&P 500 index is set to shrink next year after the benchmark index’s overseer announced revisions that will reclassify the sectors of some major shares.

- Toshiba Corp. shares rose after the Japanese company’s largest shareholder spurred speculation of a takeover bid by U.S. private equity firm Bain Capital.

- Christian Smalls, who started a labor union after being fired by Amazon.com Inc., was on track to potentially win a historic election to unionize one of the e-commerce giant’s facilities in New York.

- GameStop Corp. shares surged as much as 22% in extended trading after the gaming retailer said it plans to ask shareholders for approval of a stock split in the form of a dividend.

- Panasonic Holdings Corp. plans to invest 600 billion yen ($4.9 billion) in fields including automotive batteries and supply chain software that the company sees as core to its growth.

- Google’s billing system for app developers is “unfair and discriminatory,” India’s antitrust regulator said in the initial findings of an extensive investigation, paving the way for potential penalties in future.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.