(Bloomberg) — The Chinese government’s pledge of support for embattled developers ignited a frenzied rush for stocks and bonds.

But three weeks later, the frantic rally is testing the limits of investors’ patience as Beijing has yet to spell out details of how the government would relax curbs to prevent a disorderly collapse in the property market.

The market has been showing the first signs of doubt during a spell of exuberance for an industry that’s been crippled by crackdowns and mountains of debt that crushed large developers including China Evergrande Group and Shimao Group Holdings Ltd.

It’s a sobering reality check as China braces for the fallout from its worst coronavirus outbreak, which has locked down major economic hubs from Shenzhen to Shanghai.

A Bloomberg stock gauge of the country’s developers rose 1.6% Friday, putting its advance since mid-March at 42% — more than seven times that posted by the benchmark CSI 300 Index.

Chinese offshore junk bonds, dominated by builders, also remain on pace to rise for a third week and build on their biggest weekly gain of 2022, a Bloomberg index shows.

The recent weakness has amplified calls for more-aggressive policy action.

Authorities have so far rolled out only piecemeal measures, such as not expanding a property tax trial, reduced mortgage rates and better access to loans for builders in some cities and provinces.

“The government cannot afford to wait longer to stabilize the sector,” Citigroup Inc.

economists led by Xiangrong Yu wrote in a note this week. Potential options include relaxation of purchase restrictions to attract talent to cities and some forbearance on restrictions like the “three red lines.”

Citigroup’s China property equity analysts this week separately wrote that the second quarter is a “critical time” and the “last chance to shoot the silver bullet.”

China kicked off its latest crackdown on the real estate sector in 2020, as high leverage and surging home prices threatened financial and social stability.

As part of his “common prosperity” agenda, President Xi Jinping has said houses are for living in, not speculation.

However, the economy has taken a hit in recent months as real estate has weakened, prompting Beijing to shift its focus to stabilizing growth.

The industry accounts for about a quarter of the economy.

As part of the shift, Premier Li Keqiang last month announced plans to set up a financial stability fund to “defuse risks and potential dangers” as well as adopt measures to keep home prices stable.

The People’s Bank of China is leading the effort to raise several hundred billion yuan for the fund, which will focus on backstopping troubled financial institutions, Bloomberg News reported last week.

The fund’s key mandate will be rescuing financial institutions, but it may indirectly help large firms in other sectors including real estate, according to people familiar with the matter who asked not to be identified discussing a private matter.

Home sales have fallen year-over-year each month since July, according to government data. The slump deepened in March, with sales falling a combined 53% for China’s 100 biggest developers, according to preliminary data from China Real Estate Information Corp.

That’s the steepest decline this year.

“We might not see the light at the end of the tunnel for distressed developers until there are more aggressive measures, a package for them to meaningfully shore up their liquidity,” said Bloomberg Intelligence analyst Kristy Hung.

“Rolling back curbs might not be meaningful in boosting their cash flow if buyers are balking at making a purchase from projects from brands at risk of non-completion.”

There are signs that state firms are increasingly stepping up to play a bigger role.

Cash-strapped Kaisa Group Holdings Ltd., which defaulted late last year, unveiled a strategic tie-up this week with a state-controlled builder and one of China’s major bad-debt managers, spurring a rally in the developer’s dollar bonds.

Though such pacts help boost sentiment, they may not be enough for a lasting fix, said Jenny Zeng, co-head for Asia Pacific fixed income at AllianceBernstein.

“For the market rally to sustain, we need to see recovery in physical sales,” she said.

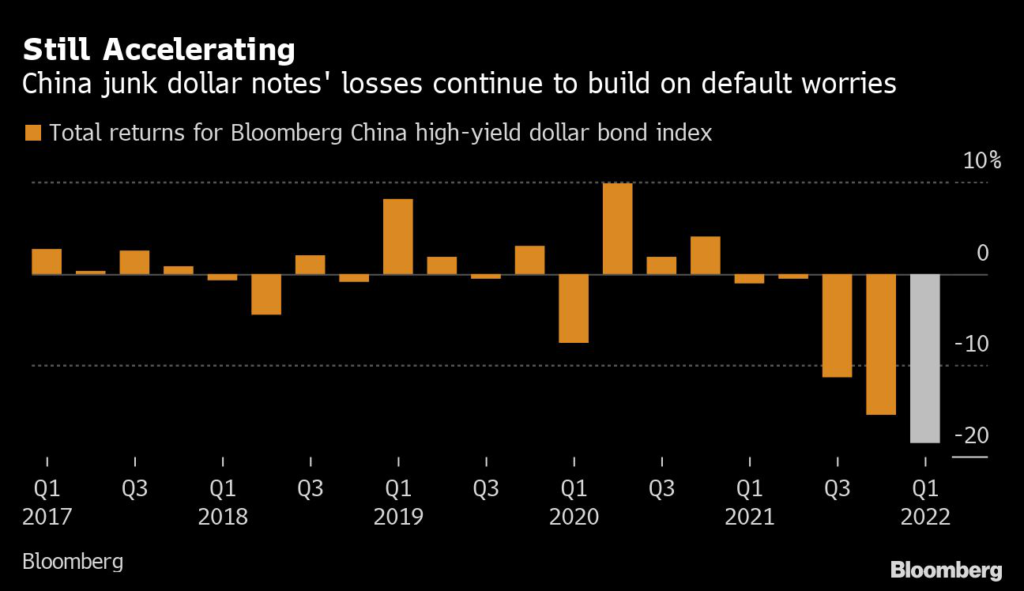

Bond Losses

In the meantime, losses in riskier developers’ dollar bonds continue to pile up even with the recent rebound.

More than half of Chinese high-yield developer dollar bonds were trading below 30 cents on the dollar at the end of March, according to Bloomberg Intelligence. Trading volumes remain muted, credit traders say, and yields are at about 20%, making it prohibitively expensive for the majority of developers to consider issuing new debt repay upcoming maturities.

On the other hand, state-owned developers are better placed.

They sold a record 227.2 billion yuan ($35.7 billion) of local bonds in the first quarter of this year, more than five times the amount from their private-sector peers. State-backed firms and stronger private developers also helped spur a 27% jump in March home sales from the previous month.

Despite the strong headwinds, developers have been favorites in the recent rally.

Greenland Holdings Corp., Seazen Holdings Co. and China Vanke Co. have been the biggest stock gainers in the CSI 300 Index since March’s bottom, each gaining at least 40%.

The property downturn and surging Covid cases mean the turning point for real policy actions may be nearing, according to Citigroup economists.

While Yu and his colleagues wrote they are cautiously constructive on China’s economic outlook if pledged pro-growth policies occur in a timely and coordinated manner, “policy implementation is a different story and is yet to be seen.”

(Updates market moves in third, fourth and second-to-last paragraphs.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.