(Bloomberg) — The recent recovery of Chinese technology stocks hasn’t just lured bargain hunters. Short sellers are piling in, too.

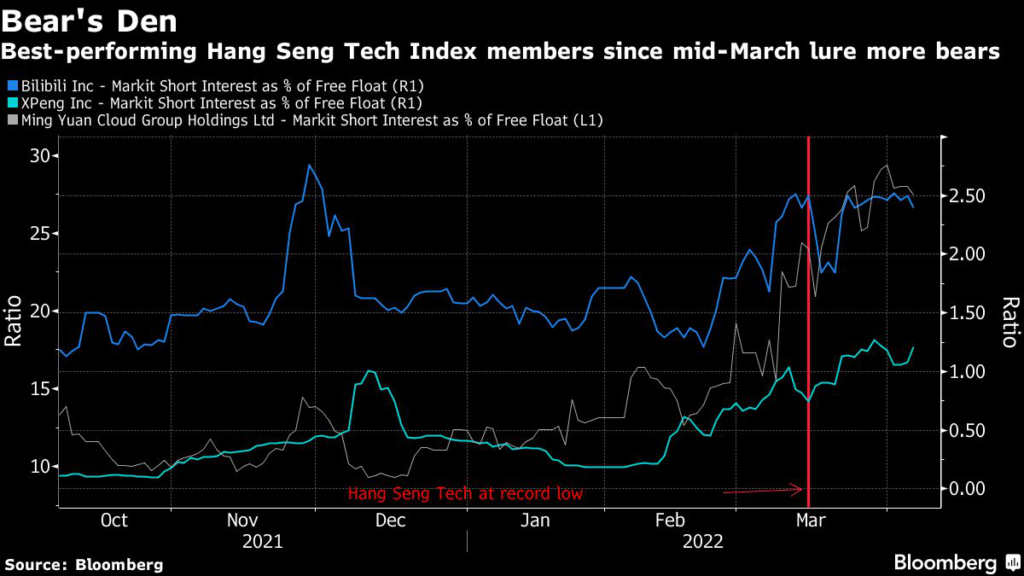

Bearish bets have risen on six out of the 10 best performers in the Hang Seng Tech Index since the benchmark’s record low in March, according to data from IHS Markit Ltd. And four of Hong Kong’s 10 most-shorted stocks are in the tech sector, include online-game company XD Inc. Video streamer Bilibili Inc. has seen short interest jump to near a record high.

Short interest accounts for a tiny portion of most tech companies’ free-floating shares in Hong Kong. Still, the increasing demand for downside protection when stocks rebound reflects how cautious investors are because of Beijing’s new regulations, worsening Covid lockdowns in China and U.S. interest rate increases. It’s already paying off, with the tech index dropping Friday for a third day.

“The tech rally should be short-lived,” said Paul Pong, managing director at Pegasus Fund Managers Ltd., who has been cutting his holdings during the rebound. “We may see recent gains wiped out quickly. U.S. rates could be lifted at a faster-than-expected pace, which is big trouble. Also, China’s regulation keeps coming.”

In the latest example of the regulatory crackdown, China on Friday kicked off a campaign to rein in the potential abuse of algorithms by internet giants, taking aim at the way they serve up ads and content to hook users.

Tencent Holdings Ltd. also said it will shut its game streaming service, more than a year after Beijing blocked its effort to create a competitor to Amazon.com Inc.’s Twitch through a merger.

Although the sector is still up almost 30% from the bottom, market sentiment is fragile. The Hang Seng Tech Index dropped 1.2% Friday and registered its sixth weekly decline in the past eight weeks.

To be sure, short-term volatility of the tech index has fallen to levels prior to the epic rout in early March, when the index plunged 21% in three days. But coping with a new normal of a slowing Chinese economy and tightened regulation looks challenging.

Technology giants including Alibaba Group Holding Ltd. and JD.com Inc. have announced big layoffs in the past three months as they seek to cut cost and stabilize margins. But it may be just a beginning.

“From a company perspective, we believe cost savings will not only be through headcount reduction, but also lower sales and marketing expenses,” said John Choi, an analyst at Daiwa Capital Markets Hong Kong Ltd. “The easy growth phase is over in the China Internet sector and prudent resource management will likely be the new trend.”

The Nasdaq Golden Dragon China Index rose 0.7% at 9:47 a.m. in New York.

Tech Chart of the Day

Top Tech Stories

- Taiwan Semiconductor Manufacturing Co. revenue rose to a record in the first quarter on demand for chips used in smartphones, computers and cars, while a prolonged shortage helped to boost prices.

- Elon Musk, who was added to Twitter Inc.’s board after accumulating a stake in the social network, will join CEO Parag Agrawal at an all-hands company meeting next week to address employee questions.

- The U.S. SEC rejected a request by Meta Platforms Inc. to quash a proposal from Arjuna Capital LLC asking for a third-party evaluation of the potential psychological, civil and human rights harms of the metaverse.

- Atlassian Corp. announced a goal of $10 billion in annual revenue as the provider of productivity and collaboration tools continues its pivot to the cloud and expands its product line to reach a wider swath of corporate business.

- Venture capitalists poured $9.7 billion into rapid-delivery companies globally in 2021, according to PitchBook. A few months into 2022, that optimism seems like a distant memory.

(Updates to add Nasdaq Golden Dragon China Index movement in last paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.