(Bloomberg) — China’s largest Covid-19 outbreak in two years continues to spread despite an extended lockdown of Shanghai’s 25 million people, with the restrictions weighing on a fragile economy and straining global supply chains.

There were 26,087 new daily infections reported in the Chinese financial hub Sunday, an all-time high. Residents have been locked down for weeks now, with frustration building among the population as they struggle to get access to food and medical care.

Elsewhere, the southern metropolis of Guangzhou is implementing a series of restrictions after local authorities warned the 20 cases they found last week could be the tip of the iceberg. The city is a trading hub and infections and similar containment measures across China are an increasing drag on the world’s second-largest economy, with consequences for global growth, supply chains and inflation.

Shanghai’s struggle with the virus means other local governments may become more sensitive to flare-ups and step up mobility controls even when cases are low, according to Tommy Xie, head of greater China research at Oversea-Chinese Banking Corp. “The Chinese economy may have to brace for more short-term disruptions in the coming months,” Xie wrote in a report Monday.

Read more: Shanghai Eases Lockdown for 43% of City’s Housing Complexes

Economists now predict the economy will expand 5% this year, below the official target of around 5.5%. Analysts at Morgan Stanley have cut their growth forecasts this year on the lockdown impact, while Citigroup Inc. has warned of risks to growth in the current quarter.

Chinese stocks plunged Monday over Covid concerns, rising global interest rates and persistent regulatory headwinds. The Hang Seng Index declined 3% Monday in Hong Kong, as did China’s benchmark CSI 300 Index.

China’s slowdown is already having a ripple effect across the region. Activity among Hong Kong’s private businesses slumped further into contraction in March, as lockdowns in mainland China weighed on new orders, according to the S&P Global purchasing managers’ index. Taiwan’s exports to China also decelerated in March from February.

Logistics Logjam

“China’s worst Covid outbreak may lead to delays and higher prices, which could stall recovery and further add to global inflation,” said Bruce Pang, head of macro and strategy research at China Renaissance Securities Hong Kong Ltd.

The Shanghai Shipping Exchange Shanghai (Export) Containerized Freight Index, a measure of freight rates, has declined to 4,349 on April 1 from a peak of 5,110 in early January. The drop indicates an easing in exports, according to Pang.

China’s exports are forecast to have expanded 13% in March, economists forecast ahead of data due this week. That would be an acceleration from 6.2% in February but slower than the 30% growth recorded for the full year of 2021. Exports are expected to slow down later this year due to a high base and as factories in other countries reopen.

Containers are piling up at Shanghai, China’s biggest port, as the lockdown in the city has led to a shortage of trucks to clear imports. It’s also disrupted business operations in the city, with companies like chip giant Semiconductor Manufacturing International Corp. struggling last week to secure trucks to ship out finished goods.

Many individual housing compounds in the city were locked down earlier in March, and then the city banned movement in the eastern part — home to the financial district and numerous industrial parks — on March 28 and then in the west from April 1. The case numbers have surged despite those controls, but about 95% of the virus cases are now among people already under isolation, data from the municipal government on Monday showed.

Looser Lockdown

In a sign of tentative easing, Shanghai’s authorities said Monday that people living in housing complexes which have had not infections in the past two weeks will be released from lockdown and allowed to move around their neighborhood. City officials didn’t say how many people were covered by the the policy, but this is the first sign of a path out of the weeks-long crisis.

Other cities across the country are also seeing rising cases, with 21 of China’s 31 provinces reporting cases Sunday. Wuhan city, the site of the first outbreak more than two years ago, reported 12 asymptomatic cases Sunday and announced Monday morning that people would have to show a negative Covid test to ride the subway.

Guangzhou has shut schools until April 17 and will conduct mass-testing and several districts have closed indoor entertainment venues. The local government is also requiring people to have a negative nucleic acid test before leaving the city.

Cities in more than 10 provinces have shut some entrances and exits to highways in order to strengthen Covid checks of people entering their cities, local media Jiemian reported Saturday. Many highway checkpoints are stopping drivers based on their travel history, forcing them to detour or turn back and disrupting logistics.

Logistics in the Yangtze River delta area around Shanghai has not been smooth, the Ministry of Transport said Saturday, in a statement. The ministry ordered that no Covid testing checkpoints be set up in the main lanes of highways so that transport is smooth.

In a sign of growing unhappiness with these kind of restrictions and lockdowns, European companies in China last week asked the government to eased the Covid Zero policies, saying that it was causing “significant disruptions” to logistics and production in supply chains across China.

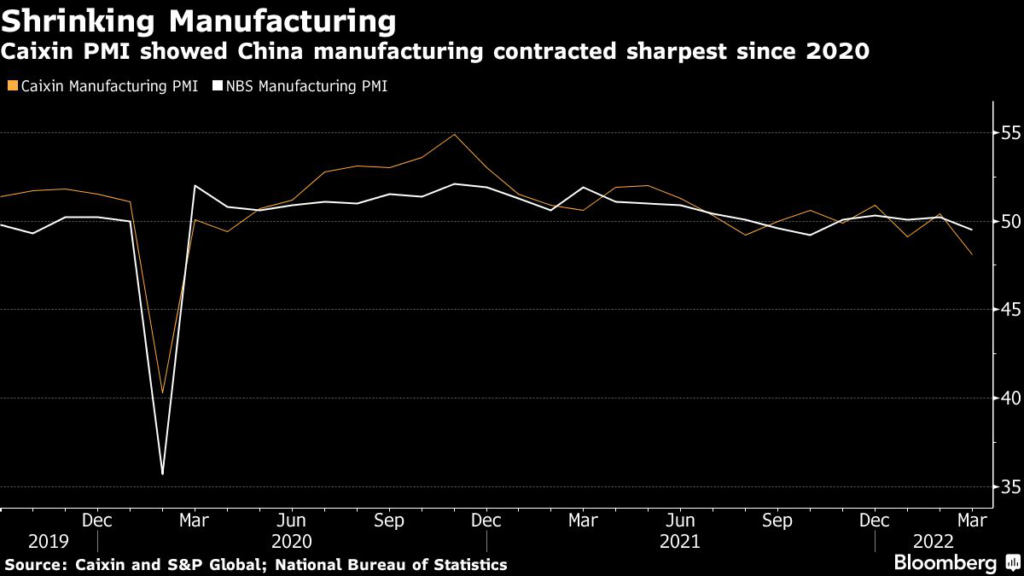

The disruptions to business is showing up in various indicators. Factory activity in March in China fell to its worst level since the pandemic’s onset two years ago, according to the Caixin Manufacturing Purchasing Managers’ Index, a private survey focusing on smaller export-oriented businesses. The official PMI also indicated a contraction in both manufacturing and services sectors in March.

The hit to consumption from lockdowns and more residents staying home instead of shopping or traveling continues to get worse. Data Monday showed a 10.9% plunge in vehicle sales in March from a year earlier, after a gain of 4.7% in February.

Tourism revenue over the Qingming festival, the three-day national holiday last week, declined by 31% from last year to 18.8 billion yuan ($3 billion), according to official data. That’s equivalent to 39% of the pre-pandemic level in 2019, the Ministry of Culture and Tourism said.

Price Pressures

The lockdowns have also pushed up vegetable prices, which surged 17.2% on year in March, compared to a drop of 0.1% in February. In addition, there’s rising concern that mobility restrictions are threatening spring planting of crops in the Northeastern region, the nation’s most important source of rice, soybeans and corn.

This means “the risk of food shortage may rise in the second half, adding further pressure to the worsening global food shortage caused by the ongoing military conflict in Ukraine,” Nomura Holdings Inc. economists led by Lu Ting said in a note Monday. Rising food and energy price inflation may limit the space for the People’s Bank of China to cut interest rates despite the rapidly worsening economy, Nomura wrote.

(Updates with some Shanghai compounds lifting lockdown in 13th paragraph, EU Chamber letter in 18th paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.