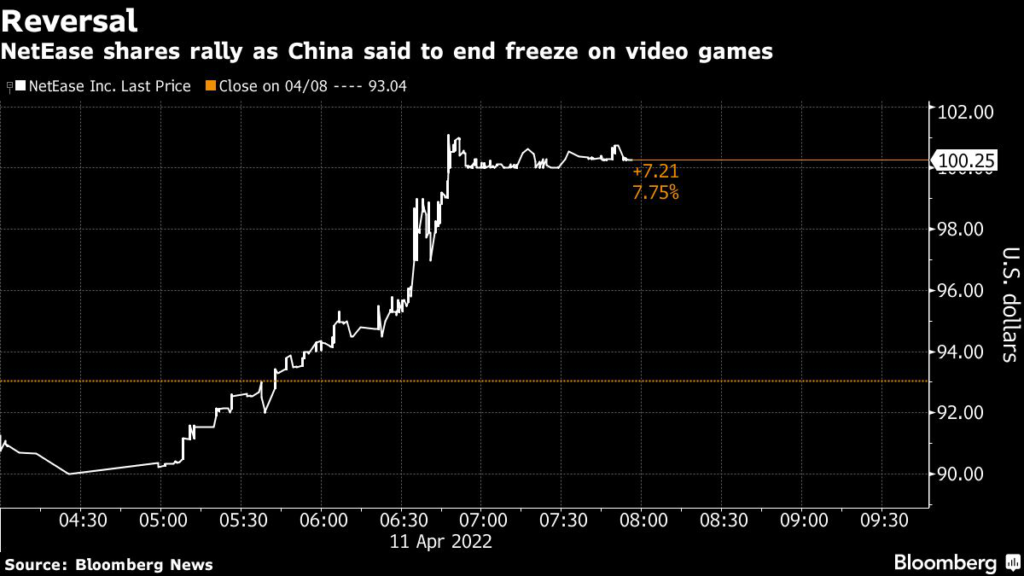

(Bloomberg) — Shares of Chinese video-game makers and live-streaming platforms rallied on Monday, after China approved the first batch of new video game licenses since July.

Video-game streaming site Bilibili Inc. closed 7.2% higher, and its peer DouYu International Holdings Ltd. rose 2.4%. NetEase Inc. pared advance to 2.1% as the mobile game giant was absent from a list of titles published by China’s National Press and Publication Administration.

Read more: China Ends Game Freeze by Approving First Titles Since July

Chinese live-streaming stocks have taken a hit in the past week as Beijing vowed to crack down on any tax-related crimes such as tax evasion in the sector. The closure of Tencent Holdings Ltd.’s game streaming site Penguin Esports and a campaign to rein in potential abuse of algorithms at internet companies also weighed on investor sentiment.

Industry leader Tencent Holdings Ltd. was also noticeably absent from the list of 45 titles that included a Baidu Inc. game, XD Inc.’s “Flash Party” and iDreamSky Technology Holdings Ltd.’s “Watch Out For Candles.”

“Investors see the news as a positive sign that regulation in the gaming industry is going to be eased,” said Henry Guo, an analyst at M Science in New York. “Even though industry leaders like NetEase and Tencent don’t have any games included in the current list, they can benefit from the improving policy environment.”

The Nasdaq Golden Dragon China Index slid 1.2% on Monday, extending its losing streak to five sessions. Concerns over a slowdown in economic growth in China also hurt the cohort, as Covid caseload set a fresh record in Shanghai amid a stringent lockdown.

The Chinese government “is very modestly easing back its tech regulatory scrutiny,” Vital Knowledge founder Adam Crisafulli wrote in a note this morning. The main overhang facing Chinese equities are concerns over rising Covid cases and Beijing’s zero-tolerance approach toward the virus, he said.

(Updates prices)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.