(Bloomberg) — For years, Apple Inc. has been at the forefront of multi-billion dollar stock repurchases among technology mega-caps. According to Citigroup Inc. analyst Jim Suva, it may be about to raise its game.

In a note published Tuesday, Suva estimated that the iPhone maker might announce a buyback of $80 billion to $90 billion, while also increasing its dividend by 5% to 10%. All eyes will be on its second-quarter results due after the closing bell on April 28.

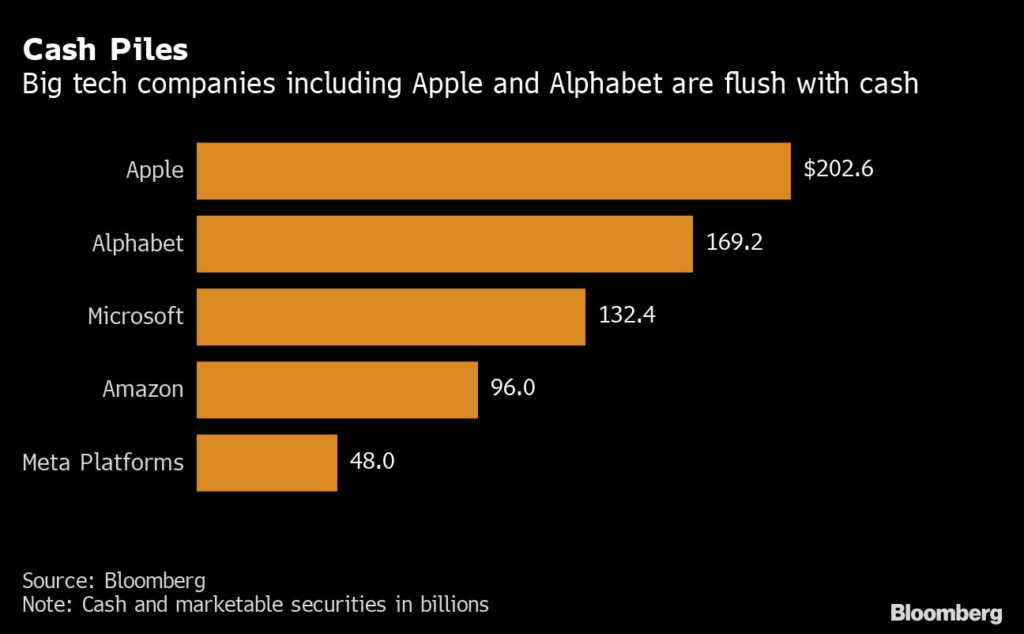

With their coffers filling fast, companies including Alphabet Inc. and Microsoft Corp. have been looking for ways to employ excess cash. Apple’s repurchases have totalled $274.5 billion, including $20.4 billion in the December quarter alone. Yet the company still has cash of more than $200 billion on the balance sheet, and with authorization to purchase up to $315 billion of stock, has scope to do a lot more.

Apple shares have fared better than peers this year, falling 6.7% versus the 14% drop of the tech-heavy Nasdaq 100 index. That’s despite reports of production difficulties that Suva says “could provide a near-term stock pullback which we would use as a buying opportunity.”

According to the Citi analyst, the company’s current market value does not reflect potential new product category launches such as augmented reality/virtual reality headsets and the Apple car.

Apple shares rose as much as 1.6% in early trading Tuesday as U.S. stocks advanced after a report showed core inflation increased less than forecast in March. The Nasdaq 100 index was up 1% at 9:35 a.m. in New York.

(Updates to add shares.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.