(Bloomberg) — Demand for semiconductors has never been higher, with industry sales increasing by more than 20% each month for almost a year now. Yet chip stocks are one of the worst-performing sectors in the U.S. market this year.

That paradox reflects the cliff that investors see looming for the economy and the stock market because of a toxic combination of surging inflation and higher interest rates. Chips, used in everything from cars to computers to factory equipment, are seen as one of the sectors in technology that’s most tied to the cycles of the economy.

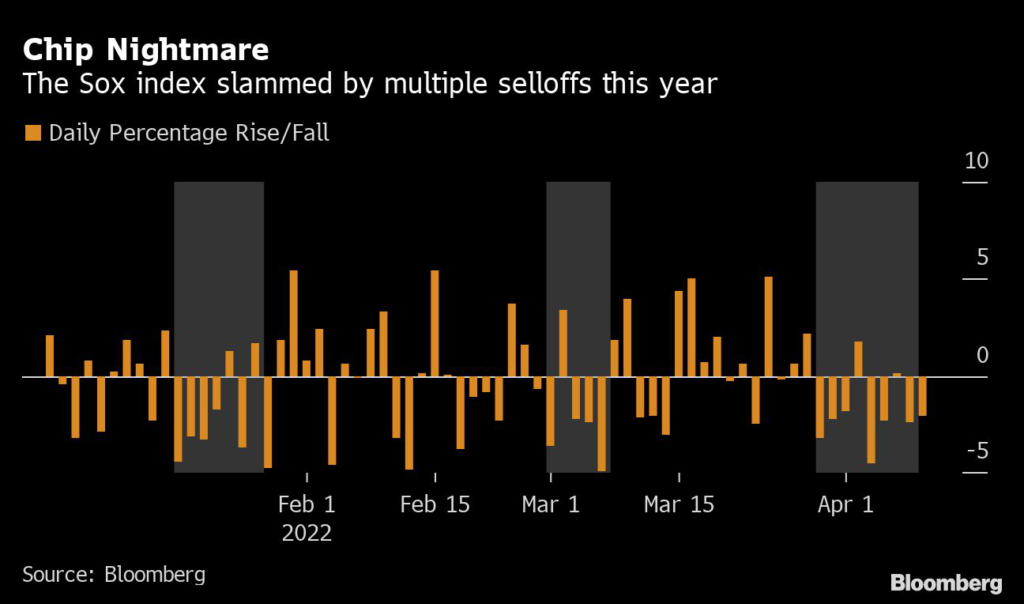

The Philadelphia semiconductor index, known as the Sox, has shed 23% this year after gaining at least 40% in each of the past three years. The decline has wiped out about $750 billion in market value.

“The thinking is, ‘Uh oh, the economy might be going south, so let’s sell the heck out of the semis,’” said Kim Forrest, chief investment officer and founder of Bokeh Capital Partners. “When the downturn comes, I think there will be a softening but I don’t think there will be a big collapse like there used to be.”

Investors have been spooked by surging yields on U.S. Treasury bonds and hawkish comments by Federal Reserve officials eager to tamp down inflation. The Nasdaq 100 Stock Index fell 2.4% Monday, adding to losses sustained last week that have erased more than $1 trillion in market value from the tech-heavy benchmark in the past five sessions.

However, the index was up 1% on Tuesday, snapping a two-day drop after a report showed core inflation increased less than forecast in March.

If there’s trouble brewing, it’s not yet registering with analysts on Wall Street. Since the start of the year, estimates for profit growth at semiconductor companies this year have increased by about 4 percentage points to 18%, according to data compiled by Bloomberg Intelligence. That compares with earnings growth of 10% for the S&P 500 Index.

Chips have become so critical for an expanding range of products that there’s unlikely to be a massive pullback in orders, according to Forrest.

Lockdowns in China have disrupted manufacturing, but chipmakers have yet to estimate the loss that the latest Covid-induced restrictions will have on their businesses.

And a chip shortage is yet to ease, helping to boost prices.

Last week, one of Apple Inc.’s most important suppliers, Taiwan Semiconductor Manufacturing Co., reported record first-quarter revenue. Analog Devices Inc. said its current quarter sales would exceed its previous forecast range, indicating that demand remains strong and downplaying concerns that customers are stockpiling inventory.

“The consensus right now is to be negative on chips but we’re not seeing that in the fundamentals,” said Daniel Morgan, a senior portfolio manager at Synovus Trust. “I’m more optimistic.”

Tech Chart of the Day

The markets have had a rough start to 2022, but the Philadelphia semiconductor index has had it worse. The chip benchmark has closed down in more than half of the sessions this year, with 27 declines of greater than 2%.

Top Tech Stories

- Alphabet Inc.’s Google will tighten approval for personal loan apps made available in the Philippines to fight illegal and abusive lending practices, the U.S. Securities and Exchange Commission said.

- IPhone assembler Pegatron Corp. suspended production at its Chinese plants in Shanghai and Kunshan as the country’s policies to control the worst virus outbreak in two years disrupt global supply chains.

- Some Microsoft Corp. customers, and some of its fiercest rivals, are making a bold claim that the software giant is again using its sway over one market to thwart competition in another.

- Tencent Holdings Ltd. surged more than 5%, joining the rest of China’s gaming industry in a rally after regulators approved the country’s first batch of new titles in more than eight months.

- For years, Apple Inc. has been at the forefront of multi-billion dollar stock repurchases among technology mega-caps. According to Citigroup Inc. analyst Jim Suva, it may be about to raise its game.

- Deliveroo Plc’s customers ordered less than expected at the start of this year, a setback for the company as it aims to sustain momentum from the pandemic and reach closer to profitability.

- Intel Corp. announced the opening of a $3 billion extension to its D1X plant in Oregon, an investment aimed at speeding up technology development needed to regain leadership of the chip industry.

(Updates shares in paragraph six.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.