We start this morning with the latest news from KwaZulu-Natal, where dozens of people have been killed following brutal storms that caused flooding in the province. Heavy weather has battered the region on Monday and Tuesday to the point that failing infrastructure just couldn’t hold any longer and wilted under the immense pressure.

It has led to multiple drownings, landslides, power outages, water shortages, and flooding of bridges, homes and businesses with the wet weather set to continue through the Easter weekend. Civil society and humanitarian groups have called for urgent interventions in areas affected by flooding, particularly in informal settlements, which have been hit hardest.

President Cyril Ramaphosa is set to visit KZN today to inspect the damage while the provincial executive council has called for a declaration of a state of disaster.

Meanwhile, Eskom extended load shedding through to Friday following further breakdowns of units. CEO André de Ruyter said the flooding in KZN was adding to the power utility’s woes and making it difficult to keep the electricity switched on.

Eskom said in a worst-case scenario there would be 100 days of load shedding in winter, based on historical data and scenario planning. The power utility said it had looked at the probability of there potentially being between 12,000 and 15,000 megawatts of power unavailable during the winter months.

Parliament has cleared former health minister Zweli Mkhize of allegedly benefitting from the irregular Digital Vibes tender. The announcement came from the joint committee on ethics and members’ interests, “in a narrow technicist interpretation of Parliament’s code of conduct,” writes Marianne Merten for Daily Maverick.

The Special Investigating Unit argued before the Special Tribunal that the R150 million Digital Vibes contract was a money-laundering scheme designed to siphon funds to Mkhize’s family while also ensuring they would not be held accountable for any possible blowback.

In international news, police have launched a manhunt for the gunman who opened fire in the New York City subway yesterday, injuring more than 20 people in a rush-hour attack that has prompted new calls to combat violence in the city’s subway system.

Police said the gunman may have acted alone and opened two canisters in a train car releasing smoke into the air before pulling out a Glock 9 mm semi-automatic handgun and firing off 33 rounds at the other passengers.

Police have so far identified Frank James as a person of interest in the case.

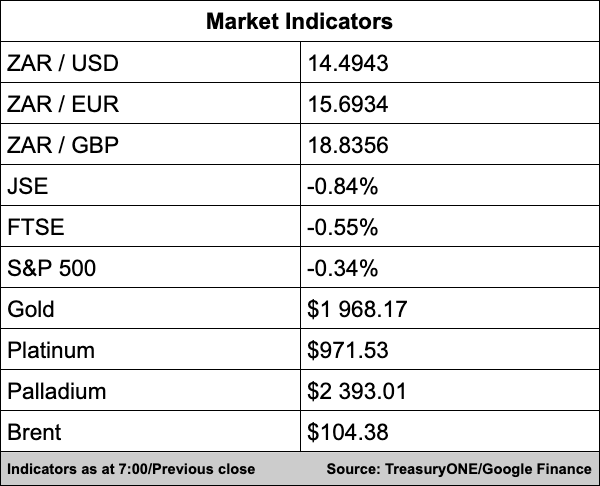

In the markets, despite the US CPI printing at a 41-year high of 8.5% yesterday, the Core CPI, which strips out food and energy inflation, came out below expectations and raised hope that the US inflation had peaked.

The dollar gave up some ground when the data was released but fought back to close stronger on Tuesday. Emerging market currencies, with the exception of the rand and Mexican peso, also weakened from firmer levels.

“The rand firmed to near R14.45 levels before closing at R14.50 last night as it continues to show surprising resilience and strength in the face of the strong dollar,” comments TreasuryONE.

This morning the local currency is trading unchanged at R14.50/$ while it is firmer against the euro and pound too.

On the commodity front, gold is holding steady this morning at $1,969 while Platinum is 0.7% up at $972 and Palladium 3.0% up at $2,397.

Brent crude closed over 5% higher last night with China easing Covid-19 restrictions in Shanghai and production slowing down in Russia. Brent is currently trading at $104.50 a barrel.

Here’s what we’re reading:

SA Business

UPL toxic chemical waste leaks on to Durban beaches again in heavy rains – Daily Maverick

Gordhan and Godongwana step up public spat over SAA – Fin24

Uber competitor DiDi seemingly ditches SA following driver strike – Fin24

Global Business

Twitter investor sues Elon Musk for failure to promptly disclose his shares – The Guardian

Apple Poised to Boost Buybacks by $90 Billion, Citi Says – Bloomberg

The race to roll out ‘super-sized’ wind turbines is on – CNBC

Markets

Gold Down Over Latest U.S. Inflation Data – Investing.com

Asian Stocks Mixed, Investors Continue to Gauge Inflation Risk – Investing.com

Oil back above $100 as Putin vows to continue war – BusinessTech/Bloomberg

Tech

Russian Hackers Tried Damaging Power Equipment, Ukraine Says – Bloomberg

YouTube says working to fix disruption – Reuters

Robinhood lists shiba inu coin, other popular altcoins as trading app looks to boost crypto offerings – Business Insider