(Bloomberg) — China’s lockdowns to contain the country’s worst Covid outbreak since early 2020 have battered the economy, stalling production in major cities like Shanghai, and halting spending by millions of people shut in their homes.

The restrictions are intended to eradicate any trace of the virus in the community, but they’ve also pressured everything from manufacturing and trade to inflation and food prices.

Premier Li Keqiang has repeatedly warned of risks to economic growth, telling local authorities on Monday they should “add a sense of urgency” when implementing existing policies.

The government is holding firm to its Covid Zero approach for now: President Xi Jinping said this week that “prevention and control work cannot be relaxed.” But it’s a strategy economists say will push growth down to 5% this year, below the official target of around 5.5%.

Here’s a deeper look at how the lockdowns are impacting critical sectors across the world’s second-largest economy.

Commodities Hit

China posted sluggish commodities imports in March, as elevated prices due to the war in Ukraine and tightening virus restrictions took their toll on demand.

Natural gas purchases were worst affected, dropping below 8 million tons to their lowest level since October 2020.

Crude and coal purchases were also running well behind last year’s schedule.

Chinese demand for jet fuel is projected to drop by 25,000 barrels per day from a year earlier, a 3.5% fall, according to the International Energy Agency.

The IEA previously expected 10,000 barrels per day of growth. The number of daily flights in China, as averaged over seven days, has fallen below the lowest level seen in 2020, with less than 2,700 active flights on Tuesday, according to Airportia, a real-time flight tracker.

The number of passenger trains has also dropped to about 3,000 a day, which is only 30% of the normal level, according to a post on WeChat by China Railway.

China’s domestic metals fabricators are facing hurdles to transport raw materials and finished products, which have led to output cuts. Six out of twelve copper-rod plants in Shanghai’s neighboring provinces surveyed by Shanghai Metals Market earlier said they either have halted or plan to halt output.

The researcher also predicted a rise in aluminum inventories.

Meanwhile, Chinese buyers have slashed liquefied natural gas purchases in the world’s biggest LNG importer as prices soar and domestic demand stalls.

Imports in the first quarter fell 14% from the same period last year, according to shipping data, and private companies are spurning offers to use once-highly coveted slots at state-owned receiving terminals.

Port Congestion

Shanghai’s city-wide lockdown has created congestion at the world’s largest port, with queues of vessels building there and at other stops handling diverted shipments.

The number of container ships waiting off Shanghai as of April 11 was 15% higher than a month earlier, according to Bloomberg shipping data.

A shortage of port workers in Shanghai is slowing the delivery of documentation needed for ships to unload cargoes, according to ship owners and traders.

Meanwhile, vessels carrying metals like copper and iron ore are left stranded offshore as trucks are unable to send goods from the port to processing mills, they said.

Data on Wednesday also showed the lockdowns having a notable impact on imports, which fell 0.1% on year in March, the first contraction since August 2020.

Manufacturing Woes

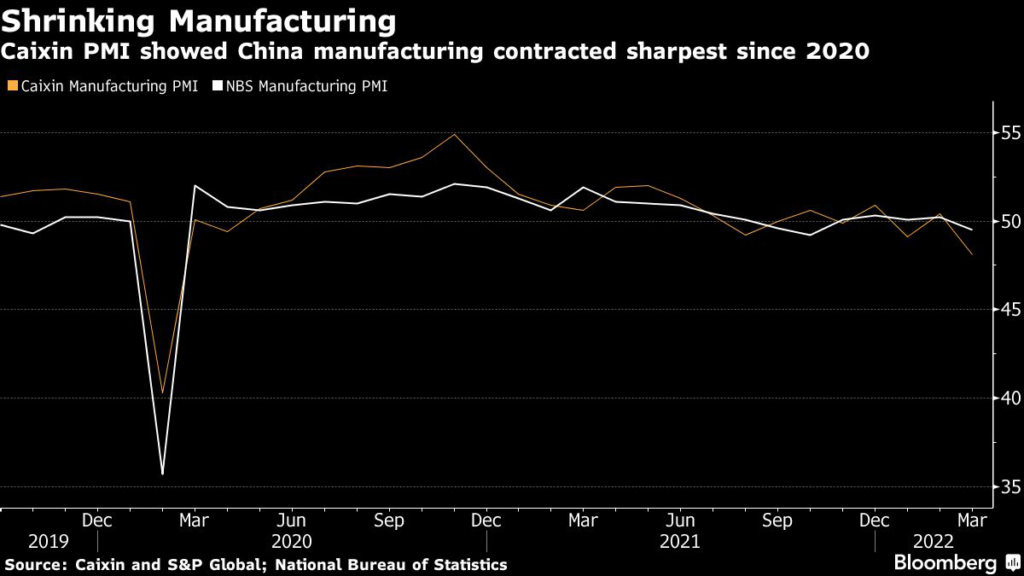

China’s purchasing managers surveys show manufacturing contracted in March, with small and medium-sized firms particularly shaken by operational snags.

The Caixin index, based on surveys of smaller, export-oriented businesses, dropped to its worst level since the start of the pandemic two years ago.

Some large manufacturing firms have been able to keep operations going by adopting a so-called closed loop system, in which employees were kept at factory locations and tested regularly.

However, those protocols aren’t perfect: One member of a European Union trade group said last week that work can be “very, very difficult,” even with permission to operate amid restrictions.

Solar companies are seeing a “severe impact” on both panel production and installations, according to a survey conducted by the Shanghai Solar Energy Society.

Wafer production has been suspended in some factories in the coastal region close to Shanghai, driving up prices in recent weeks, Jefferies analysts said in a note.

The restrictions are also causing major headaches for China’s 17.3 million truckers who keep store shelves full while also connecting the nation’s ports with its manufacturing hubs.

The logjam is preventing crucial deliveries from reaching companies, stalling production in key industrial regions, with the impact likely to continue rippling across the economy even as cities move to loosen lockdowns.

Trucks dominate China’s local transportation, hauling about three-quarters of total freight, according to data from the Ministry of Transport.

But Covid Zero orders are creating difficult conditions for the truckers themselves, as drivers have been hampered by the need to undergo compulsory mass testing being conducted in cities like Shanghai and the need to show negative Covid results at multiple checkpoints.

Tech Disrupted

Some technology companies have suspended production as China’s restrictive policies weigh on a sector already contending with a shortage of components.

Most major tech manufacturers — from Semiconductor Manufacturing International Corp.

to Taiwan Semiconductor Manufacturing Co. and iPhone maker Foxconn Technology Group — froze operations in the early days of Shanghai’s outbreak. Many have since resumed after setting up closed-loop systems.

As of Wednesday, more than than 30 Taiwanese companies including Pegatron Corp.

and Macbook maker Quanta Computer Inc. had halted production in eastern China’s electronics hubs because of Covid rules.

Logistics jams are constricting shipments of components, draining inventories to the point where some manufacturers including Pegatron, Wistron Corp.

and Compal Electronics Inc. are down to just a few weeks’ stocks, consultancy Trendforce estimates. The ongoing global supply crunch could worsen if local manufacturing is disrupted, constraining stock of computers and gaming consoles to smartphones, servers and electric vehicles.

Automotive Pain

Overall passenger vehicle sales slid 10.9% last month, suggesting pressure in the massive car market.

Some automakers are hitting production snags because of lockdowns.

Tesla Inc.’s Shanghai factory has been shut down since March 28 because of restrictions in the city. The plant typically produces more than 2,000 cars every day, according to an estimate earlier this month from Dan Ives, an analyst at Wedbush Securities Inc.

Volkswagen AG was also forced to suspend production in Shanghai this month, while Chinese EV upstart Nio Inc.

said Saturday it halted production and delayed deliveries because many suppliers had to close shop.

Auto parts maker Robert Bosch GmbH said Monday it shuttered two of its factories in China and operated closed-loop systems at two others, adding that it was seeing “temporary effects on logistics and supply chain sourcing.”

Construction Snags

Domestic sales of excavators — a leading indicator for construction — plunged almost 64% in March from a year ago, indicating strain in the sector.

China’s home sales slump also deepened last month: The 100 biggest companies in the debt-ridden property industry saw a 53% drop in sales from a year earlier, according to preliminary data from China Real Estate Information Corp.

The decline was the steepest this year.

Steel rebar inventory in China suggests construction activity “may have shifted to a lower gear,” according to analysis published last week by David Qu, an economist covering China for Bloomberg Economics.

Inflation Risks

The lockdowns have driven up food costs and may endanger the nation’s ability to secure enough grains for the year as the curbs complicate China’s important spring planting season.

Fresh vegetable prices jumped 17.2% on year in March, compared to a drop of 0.1% in February, data from the National Bureau of Statistics showed this week.

Chinese farmers in some parts of the northeast, which produces more than a fifth of China’s national grain output, have had to contend with restrictions that prevent them from plowing their fields and sowing seeds.

(Adds details about President Xi Jinping’s visit to Hainan, train journeys and supply chain snags facing truck drivers.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.