(Bloomberg) — Meta Platforms Inc. and Netflix Inc. may have a hard time turning around the slumps that have wiped more than a third off their market value this year, as ongoing business headwinds and a weak macroeconomic backdrop keep investors at bay despite historically cheap multiples.

The two internet giants were among the most high-profile disappointments of the last earnings season, with slowing growth at both companies sparking selloffs that erased hundreds of billions of dollars in value. With fresh results around the corner, analysts are showing they remain skeptical by trimming their price estimates. The average target for both has fallen to their lowest since 2020, according Bloomberg-compiled data.

Netflix shares fell 1.1% on Thursday, while Meta dropped 0.4%.

This reporting season comes at a time when inflation and rising bond yields have underlined concerns that the economy could be headed toward a recession.

While this has weighed on tech broadly, Netflix and Meta suffered bigger selloffs. The streaming giant’s growth has slowed more than Wall Street forecast amid mounting competition for viewers, while Meta’s Facebook also is struggling to draw new users at the same time that it’s investing billions to expand in the so-called metaverse.

“The outlook is incredibly uncertain, and when the market is as uncertain as it is right now, investors will favor names with more certain fundamentals,” said Tavis McCourt, institutional equity strategist at Raymond James. “This isn’t the kind of environment where, if you disappoint, you can expect to bounce back quickly.”

Netflix investors’ caution about subscriber growth was amplified after the video-streaming company pulled out of Russia following the country’s invasion of Ukraine.

For Meta, analysts continue to see headwinds stemming from a changed privacy policy at Apple Inc., which has diminished the Facebook parent’s ability to target ads. Meta “is likely to see another rocky quarter” given this issue, RBC Capital Markets wrote in a note.

Netflix has shed more than 40% so far this year while Meta lost 36%. Both are among the worst-performing members of the Nasdaq 100 Index, which is down 13% in 2022.

The selling has both stocks trading at a discount to their historical averages. Netflix now sells for 29 times forward earnings, less than half its five-year average. Meta is at less than 15 times estimated profits, cheaper than the S&P 500 Value Index.

Michael Cuggino, president and portfolio manager of the Permanent Portfolio Family of Funds, said he had “nibbled a little” on Meta shares given the valuation, though broader concerns were keeping him from buying more aggressively.

“The valuation is reasonable, especially for a growth tech name, but the uncertainties are real,” he said in a phone interview, citing Apple’s policy and the weaker backdrop for equities in general. “The biggest X factor is a recessionary environment where ad budgets are significantly reduced.”

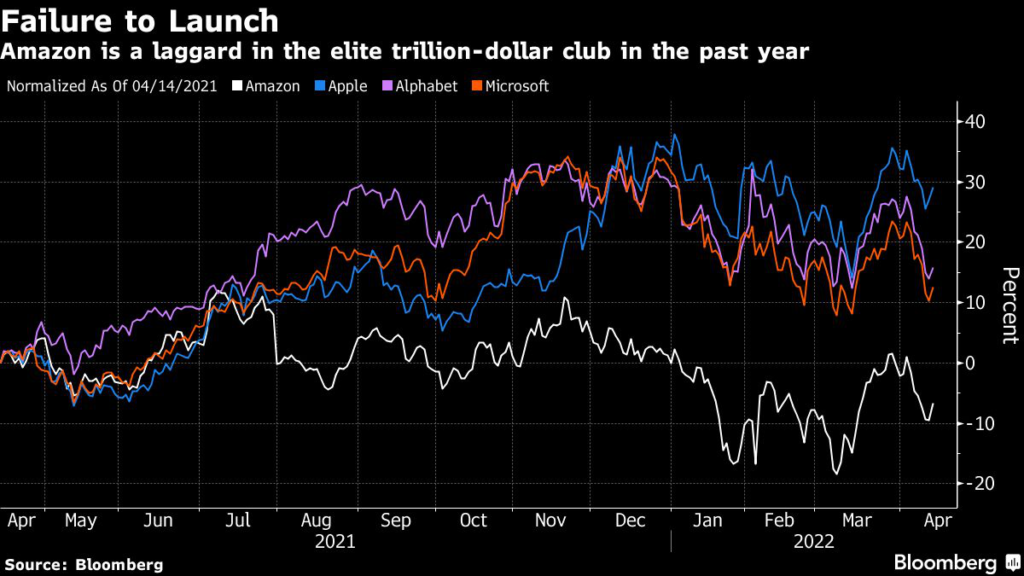

Tech Chart of the Day

Shares of Amazon.com Inc. have lagged behind those of fellow trillion-dollar megacaps Apple, Microsoft Corp. and Alphabet Inc. over the past year as the e-commerce giant faced tough year-over-year comparisons to 2020, when Covid-induced lockdowns boosted sales. It also launched a $10 billion buyback program — the smallest repurchase authorization in the trillion-dollar club. However, the stock has recently received retail investor interest after Amazon announced a 20-for-1 stock split last month.

Top Tech Stories

- Taiwan Semiconductor Manufacturing Co. raised its sales outlook for the year after quarterly earnings jumped 45%, helped by solid demand for chips used in everything from smartphones to cars

- China’s top anti-graft watchdog was among the agencies involved in a recent inquiry into links between Jack Ma’s Ant Group Co. and state-owned Chinese companies, according to people familiar with the matter

- Tens of thousands of staff at China’s main iPhone manufacturing base will have to go undergo mandatory Covid-testing on Thursday, a potential risk to global supply of Apple’s signature device

- Blackstone Inc.’s growth investing team committed more than $1 billion of financing to Europe tech companies over the last year, and it has plans to increase that further.

- A federal judge cut to $15 million a staggering $137 million in damages awarded by a jury in a racial discrimination case against Tesla Inc. over abusive conduct toward a former elevator operator at its northern California factory

- Synopsys Inc., the biggest supplier of software used to design semiconductors, is under investigation by the U.S. Department of Commerce for possibly passing key technology to banned Chinese companies, according to people familiar with the matter

(Updates to market open.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.