(Bloomberg) — Private companies globally are pulling back sharply on raising new funds, as pressure on public markets begins to weigh on the lofty valuations sought by fast-growing startups.

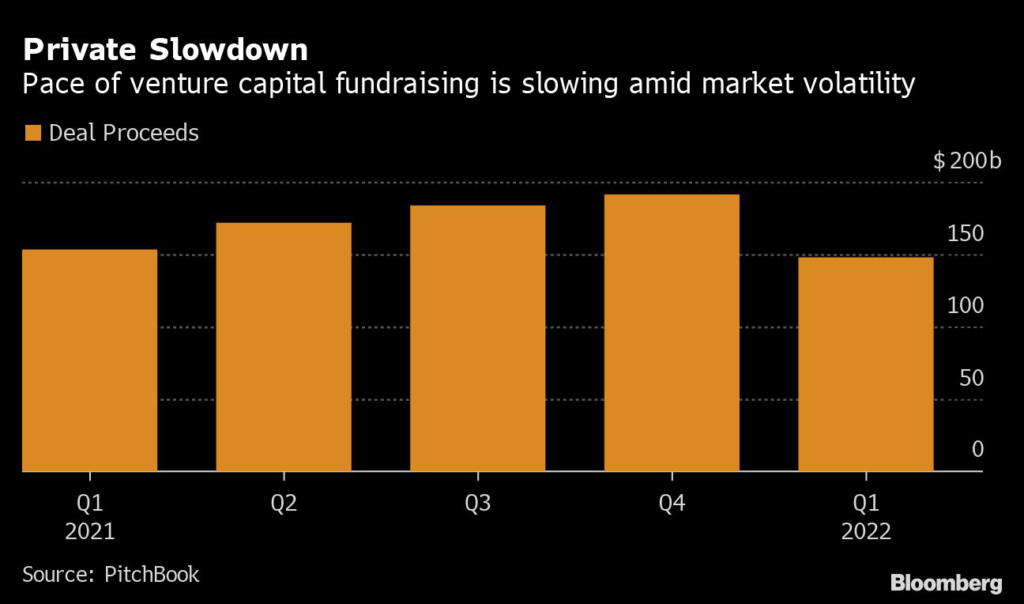

Venture capital transactions raised $148 billion globally in the first quarter, down nearly 25% from the last three months of 2021, according to data provided by analytics firm PitchBook.

Rising interest rates, surging inflation and Russia’s invasion of Ukraine have all put a damper on risk appetite, hitting growth stocks particularly hard. The tech-heavy Nasdaq has tumbled more than 14% from a record high in November, underperforming the 5.4% drop in the S&P 500 Index over the same period.

“The distress in public markets is catching up with private markets,” said Aga Masud, head of private capital markets for Europe, the Middle East and Africa at Bank of America Corp. “A lot of investors are doubling down on their existing investments, rather than putting money in new names.”

Increased Caution

Private capital deals boomed in 2021, reaching $700 billion, the data show. That’s more than the record $655 billion haul for global initial public offering markets last year. But now, the drop in valuations for listed peers is making it harder for startups to justify lofty price tags.

And with IPO markets worldwide largely closed off to blockbuster deals for the time being, private market investors are becoming more cautious about the tickets they write.

“Private market valuations are in large part driven by exit opportunities,” said Isabelle Freidheim, founder and chairman of growth equity and investing firm Athena Technology Acquisition Corp. “Downward pressure on valuations in the public markets affects the private market and is being felt.”

To be sure, some startups still command sky-high valuations. Cryptocurrency firm Blockchain.com and Turkish grocery-delivery company Getir were valued at more than $10 billion each in recent funding rounds. And Swedish payments firm Klarna Bank AB is weighing plans to raise new money at a valuation of roughly $50 billion to $60 billion.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.