(Bloomberg) — Bitcoin’s negative correlation with commodity markets is providing more fodder for critics of its suitability as a hedge for inflation.

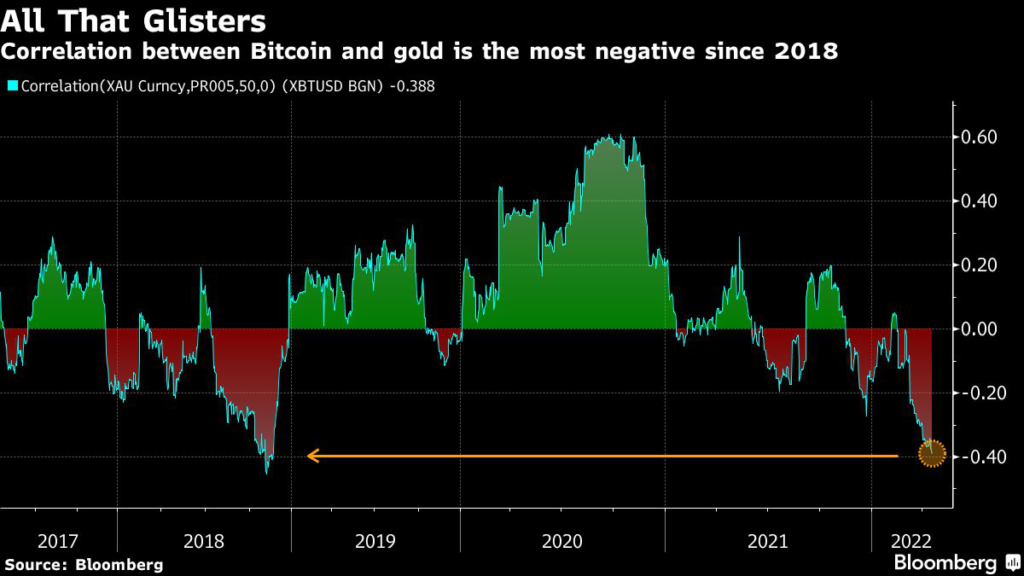

A 50-day correlation coefficient for Bitcoin and gold is around minus 0.4, the lowest since 2018, while a similar measure for the token and the Bloomberg Commodity Spot Index is also negative and at a multi-year nadir. A reading of 1 implies assets are moving in lockstep and minus 1 the reverse.

So while demand for portfolio buffers against price pressures catalyzed commodity performance this year, Bitcoin has gone the other way — leaving backers of its store-of-value narrative with a tougher story to sell.

“It could well be that as Bitcoin is tested in a high inflation, rising rate environment for the first time, investors are choosing tradition over a new frontier,” said Jeffrey Halley, senior market analyst at Oanda Asia-Pacific Pte. “Gold has been an inflation hedge for millennia.”

Bitcoin advocates remain undeterred, arguing the cryptocurrency will prove its worth in time partly thanks to a capped supply of 21 million tokens.

MicroStrategy Inc. founder Michael Saylor said in a recent Bloomberg Television interview that he can’t think of “anything better to position our company in an inflationary environment than to convert our balance sheet to Bitcoin.”

For now, Bitcoin remains tightly correlated with the Nasdaq 100 index — and investors have ditched the token and the technology-heavy gauge in 2022, fearful that sharply tighter U.S. monetary policy will hurt risk appetite.

The Nasdaq 100 is down about 15% this year, while the world’s largest cryptocurrency has shed some 16%. The token fell 3.3% as of 11:55 a.m. Monday in London, dropping to a one-month low of about $39,000.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.