(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Investors aren’t buying the Chinese government’s bullish rhetoric and promises of support for an economy paying the price for its stringent Covid Zero strategy.

China reported the biggest contraction in retail sales and the highest unemployment since the early months of the pandemic on Monday. Hours later, the central bank announced 23 measures to cushion the economy, including more loan support to help businesses struggling to cope with damaging lockdowns.

State media followed with a detailed statement on growth, saying annual targets could still be met. Government departments on Tuesday pledged more steps to help companies resume production in key sectors.

The response from local markets was indifference, with the benchmark CSI 300 Index dropping 0.8% in Shanghai on Tuesday, a third day of decline. For investors, the bigger worry is the latest upsurge in Covid cases and more disruptions of the kind that shut down Shanghai for weeks, concerns that have eclipsed authorities’ pledges for market support and policy easing.

“It won’t be a very easy year for the market. The market needs much longer before seeing a broad and sustainable recovery,” Bruce Pang, head of macro-strategy research at China Renaissance Securities, said in an interview on Bloomberg TV. “All the negative factors such as macro slowdown, policy overhang and Covid lockdowns are not yet fading, so that still disrupts sentiment and confidence.”

President Xi Jinping has made clear there will be no change to the Covid Zero policies the country has followed since locking down Wuhan in 2020, which means that a cycle of shutdowns and reopening is likely in cities across the nation for the rest of this year, and possibly even longer.

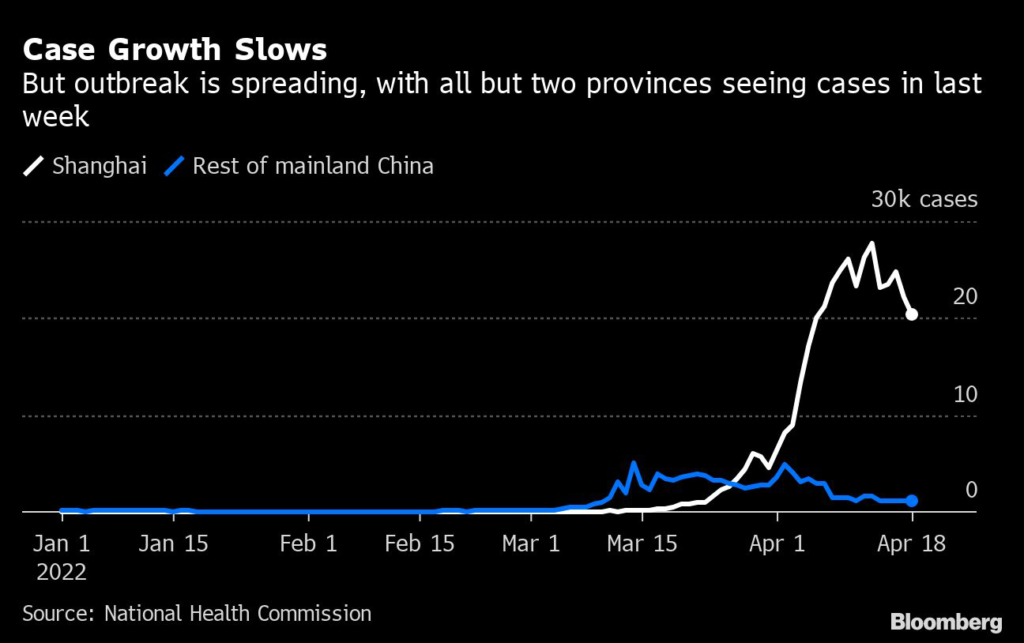

The virus outbreak and stringent controls are now the biggest threat to China’s growth since the pandemic began two years ago, coming on top of a housing market crisis, the war in Ukraine and rising global interest rates. UBS Group AG, Barclays PLC and Bank of America Corp. slashed their growth forecasts for China to below 5%, with the latter outlining a bearish outcome of just 3.5% expansion if lockdowns spread to more economic hubs.

In a sign of what could be in store for the rest of the country, Tangshan, a steel-making hub about 100 miles from Beijing announced Tuesday it was locking down some districts in the city to stop a new virus outbreak, only a week after lifting city-wide curbs.

The government has made repeated promises over the past month that it would support markets, but the results have been disappointing. The People’s Bank of China offered only a modest cash boost to the economy last week, reducing the reserve requirement ratio for banks by a smaller-than-expected 25 basis points. A loosening of property sector controls have also failed to reverse the collapse in home sales.

“At the moment, the market is quite pessimistic as we feel the liquidity injection is far from enough and the policy support are not very positive,” said Kevin Li, portfolio manager at GF Asset Management (Hong Kong) Ltd.

The stunning equities rebound seen in mid-March — when the State Council first vowed to keep the market stable — has petered out, with many investors saying that China loosening its grip on its tight Covid-19 containment policy is key to turning the tide for local shares.

That China’s strict virus-containment policy is the bugbear for markets was evident last Tuesday, when speculation over easing of some curbs helped local shares lure the biggest daily foreign inflows this month. The CSI 300 wiped out early losses to finish the day 2% higher, but since then it has lost all those gains.

The lockdown of tens of millions of people in Shanghai and the surrounding area has had a damaging effect on the national economy, not only by shuttering shops and factories, but also by interrupting critical supply lines between the world’s largest port and the industry in the area.

While local and national governments have promised to get those supply lines back up and running and to restart shuttered factories, the process of testing workers and truck drivers and reopening businesses will take a long time to achieve.

Officials from the Ministry of Industry and Information Technology said at a Tuesday briefing that working groups have been sent to Covid-hit areas including Shanghai to ensure stable production at key companies and the smooth operation of the supply chain.

They will “actively” push for work to resume at major companies by getting local authorities to simplify approvals, use big data to allow more workers to get back to their posts, and strengthen policy coordination to solve logistics problems, a spokesman said.

The comments followed a national teleconference chaired by Vice Premier Liu He on Monday on the subject of keeping supply chains stables. Officials at the meeting called for local governments to relax mobility restrictions for logistics workers at checkpoints, and recognize the results of their Covid tests performed in other regions.

The government also announced the creation of “white lists” of companies in sectors including automobiles, semiconductors, consumer electronics, food, equipment manufacturing and medicine and foreign trade. Firms on the white lists will receive extra help to ensure they can stay open, easing supply chains disruptions, according to a statement.

However, there’s no guarantee that a reversal of the government’s Covid Zero policy would stop the economic slump. If the whole country of 1.4 billion people was hit by outbreaks, the government will have to contend with widespread shutdowns and a potential surge in deaths for the under-vaccinated elderly, as happened in Hong Kong.

“Without major adjustment to the dynamic Covid Zero policy, which targets to cut all community transmission, tight pandemic-control measures will likely be maintained in various forms around the country this year,” Bank of America economists including Helen Qiao wrote in a note.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.