(Bloomberg) — China’s finance regulators should ease up on their efforts to rein in developers’ debt to help them ride out the latest Covid wave, a former central bank official said.

The outbreak may “severely” hit home sales and impede a recovery, Sheng Songcheng, a former director of the People’s Bank of China’s statistics and analysis department, said in an interview Tuesday.

Lockdowns in key cities are worsening the housing slowdown that emerged last year when a cash crunch among developers shattered confidence among homebuyers.

Authorities last month pledged to support the industry, which has been battered by a crackdown on excessive leverage.

“We should be on high alert for a vicious cycle led by developers’ liquidity crisis,” said Sheng, now a professor at the China Europe International Business School in Shanghai.

“The deleveraging can be appropriately slowed considering the current home market situation.”

Sheng said regulators should allow banks to keep providing loans to developers that breach debt metrics known as the “three red lines,” at least temporarily, as long as builders refrain from piling up borrowings in the next six months, he said.

Authorities introduced the limits in late 2020 to curtail excessive borrowing and speculation in the industry.

Developers face restrictions on fresh borrowing if they breach them, according to state media reports.

Sheng also called for allowing banks more time to comply with a separate rule that caps their real estate lending.

A requirement imposed at the start of 2021 gives lenders four years to meet the limit. Sheng suggests banks to be given another six to 12 months.

In addition, Sheng urged local governments to continue to relax restrictions on purchasing homes to shore up demand.

Banks in several cities have been lowering mortgage rates and cutting down-payment requirements to arrest the housing slump.

“All local governments should strike a balance between local policies based on city specifics and the national guidelines in a flexible way, as long as they can keep the bottom line of controlling property risks,” he said.

Read a Bloomberg Intelligence note on mortgage easing

New-home sales dropped in March at the fastest pace since the current slump began in July, government figures showed this week.

Ten provinces either in full or partial lockdowns, including Shanghai and Guangdong, saw their steepest decline in transactions since at least 2013, according to Bloomberg calculations based on the data.

The figures probably don’t capture the full impact on sales because the lockdowns intensified toward the end of the month.

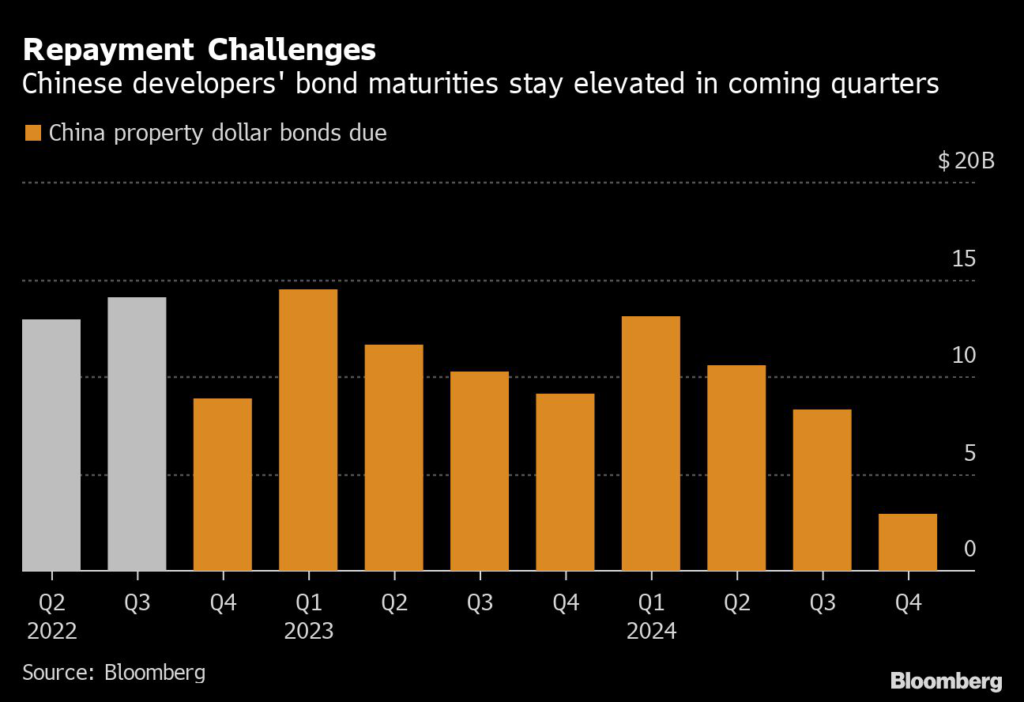

Sheng also warned that a wave of offshore debt maturing this quarter adds to liquidity risks.

Chinese developers face $13 billion in payments on dollar bonds in the current quarter and $14 billion in the third, according to data compiled by Bloomberg.

Still, Sheng emphasized that the long-term policy target to reduce leverage in the property industry should remain.

“It’s essential to establish a firewall between the real estate sector and financial markets, as well as avoid systemic risks tied to property,” Sheng said.

“Both the caps on developers’ borrowings and banks’ lending to builders are effective tools for deleveraging, and they should be kept.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.