Asian markets were marginally higher on Wednesday while oil began recovering after a downgraded IMF global growth forecast for 2022 had sent crude prices plunging.

The International Monetary Fund slashed its outlook by 0.8 percentage points, largely over inflationary crises linked to the Ukraine war and the coronavirus pandemic — prompting a five percent dive in oil prices on Tuesday.

“The economic effects of the war are spreading far and wide — like seismic waves that emanate from the epicenter of an earthquake,” IMF chief economist Pierre-Olivier Gourinchas said in a report.

Oil prices began to recover Wednesday, however, and Asian stocks also mostly rose following a positive lead from Wall Street, where US stocks rallied on the back of promising housing-starts data and solid corporate earnings.

Both main contracts climbed, but crude has suffered major shocks this year, from the war in Ukraine to the raging coronavirus outbreak in China, where the economy has been battered by anti-Covid restrictions.

Tens of millions are still barred from leaving home in economic centre Shanghai and tech hub Shenzhen, where a Covid-19 outbreak has broken down supply lines and shuttered businesses.

“China continues to stay wedded to deleveraging parts of the economy while attempting to add stimulus in a targeted sector manner,” said Jeffrey Haley, senior market analyst at Oanda.

“However, the Shanghai lockdown and fears its Covid-zero policy will crimp growth this year continue to weigh on markets that clearly want more of the usual cast-of-thousands stimulus measures from years past.”

– Netflix shares plunge –

The Shanghai Composite Index was the biggest loser among major Asian markets, dropping 1.35 percent at the close.

Hong Kong — which plummeted on Tuesday over concerns about Beijing’s ongoing tech-sector crackdown — also ended down, with Chinese banks keeping lending rates unchanged.

“China disappointed markets that were looking for more comprehensive stimulus measures as it left both its one and five-year Loan prime Rates (LPR) unchanged,” Haley said.

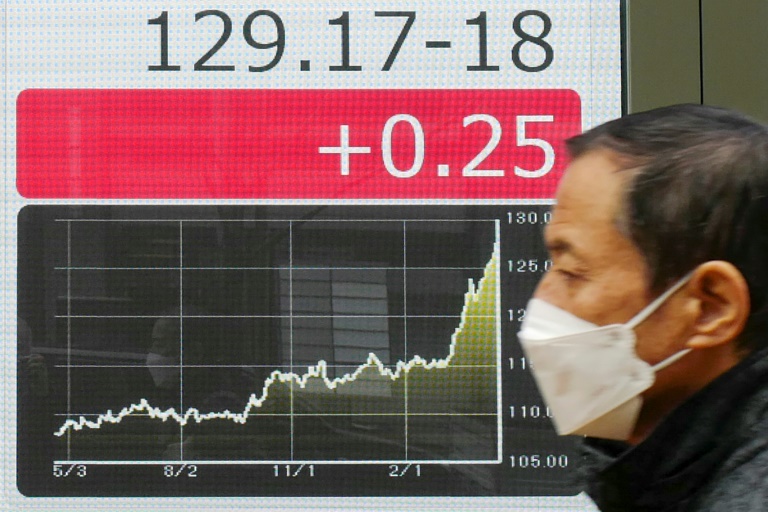

Tokyo gained 0.86 percent, buoyed by a cheaper yen. Jakarta, Sydney and Taipei all inched upward while Seoul was flat.

Despite the rally on Wall Street, there are concerns about the impact of the earnings report from Netflix showing a drop in subscriptions in the first quarter of the year.

This was the first such drop for Netflix in a decade and hammered the streaming giant’s shares, which dropped by a quarter of their value in after-market trading.

Analysts have said this could dent Tuesday’s gains when US markets open.

After closing lower on Tuesday over the IMF announcement, Europe’s major markets opened the day in positive territory, with London, Paris and Frankfurt all slightly up.

– Key figures around 0830 GMT –

Tokyo – Nikkei 225: UP 0.86 percent at 27,217.85 (close)

Shanghai – Composite: DOWN 1.35 percent at 3,151.05 (close)

Hong Kong – Hang Seng Index: DOWN 0.40 percent at 20,944.67 (close)

Dollar/yen: DOWN at 128.63 yen from 128.89 yen

Euro/dollar: UP at $1.0810 from $1.0796

Pound/dollar: UP at $1.3005 from $1.2998

Euro/pound: UP at 83.10 pence from 82.98 pence

Brent North Sea crude: UP 1.32 percent at $108.67 per barrel

West Texas Intermediate: UP 1.40 percent at $104.00 per barrel

New York – Dow: UP 1.5 percent at 34,911.20 (close)

London – FTSE 100: UP 0.12 percent at 7,610.32 points (close)

burs-ssy/cwl