The JSE continued its losing into a second day after closing 0.59% down with the All Share Index at 73,351 points.

The top 40 is down 0.52%.

The JSE was lower in morning trade while global peers were mixed as the traders searched for direction on the back of US corporate earnings reports and concerns over the global economic outlook.

Barclays sold a 7.4% stake in Absa bank for R10.5 billion, cutting its holding by half.

Absa fell as much as 6.5% in morning trade before recovering some of the losses to trade down 4.83%.

Anglo American’s production for the first quarter of the year dropped by 10% compared with the comparative period last year.

Anglo American shares slumped 6.56%.

Steinhoff subsidiary Pepco Group had a strong second quarter and half year performance despite the effects of Covid-19 and the war in Ukraine.

Pepco Group owns the PEPCO and Dealz brands in Europe and Poundland in the UK.

Pepco said its revenue in the first half-year ending 31 March 2022, had increased by 17.5% year-on-year to €2.3 billion.

Steinhoff added 1.37% to the share price, to close at R2.97.

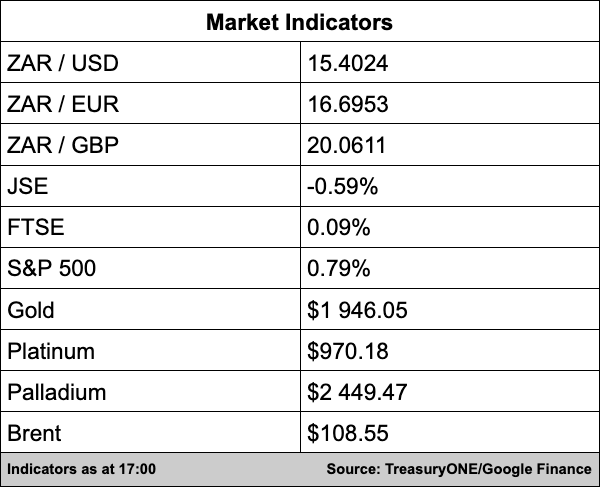

The rand was under pressure for most of the day, after opening at R15.06/$ it has since lost ground against the US greenback and is trading at the R15.40/$ mark.

“We are currently trading disconnected from other EM’s, with the Polish Zloty and Russian Ruble trading stronger.

During the course of March and April, the rand was seen as a “safe haven” and rotation out of the rand could be a reason for the move,” comments TreasuryONE.

Furthermore, “the impact on GDP due to sustained load shedding and damage caused by the floods in KZN are also attributed to a lower than expected March inflation print.”

On the commodity front, platinum was the big mover today while the rest are fairly stable.

“Platinum is currently down 1.3% while palladium is trading flat for the day on $2,445.

Gold traded in a $20 range but settle close to this morning’s open. We have Brent Crude and WTI up 2.28% and 1.8% in the energy sector, respectively,” says TreasuryONE.