(Bloomberg) — The Chinese yuan has been making inroads in the world of cross-border payments in recent years, but a pair of data points due this week will reveal whether the country’s sudden industry crackdowns have dented international trust in the currency.

The Society for Worldwide Interbank Financial Telecommunication, also known as Swift, and China’s foreign-exchange regulator will both announce figures this week that together paint a picture of the yuan’s role in international trade and investment. Previous data through June showed a steady increase in its use but that was before a regulatory crackdown escalated in July.

The authorities scaled up their anti-monopoly attacks against the nation’s largest technology companies, banned profits in the after-school tutoring industry, and launched a critique of online gaming. The unexpected onslaught pummeled stocks and bonds, and fueled concern global investors will trim back yuan assets in their portfolios and step back from adopting the use of yuan in international trade.

“The outflows last month could have dented renminbi usage,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd., using the official name for the yuan. At the same time, “the renminbi’s share in global payments should still reach a new high before year-end as index inclusion brings new inflows and China adopts more renminbi usage in trade,” he said.

The share of yuan payments via Swift increased to 2.46% in June, just under the peak reached in March that was the highest level since a shock devaluation in August 2015. The percentage of cross-border transactions that were conducted in the currency increased to 42.3% in the same month, close to January’s record high of 43.8%, according to Bloomberg calculations based on data from the State Administration of Foreign Exchange.

Since the devaluation, China has since worked to revive the yuan’s popularity, urging greater use of the currency in trade and easing exchange-rate controls and intervention. A rapid flood of capital flowing into its markets has helped too. The yuan has advanced 6.9% over the past 12 months, the third-best performing major currencies tracked by Bloomberg, trailing only the South African rand and the Mexican peso.

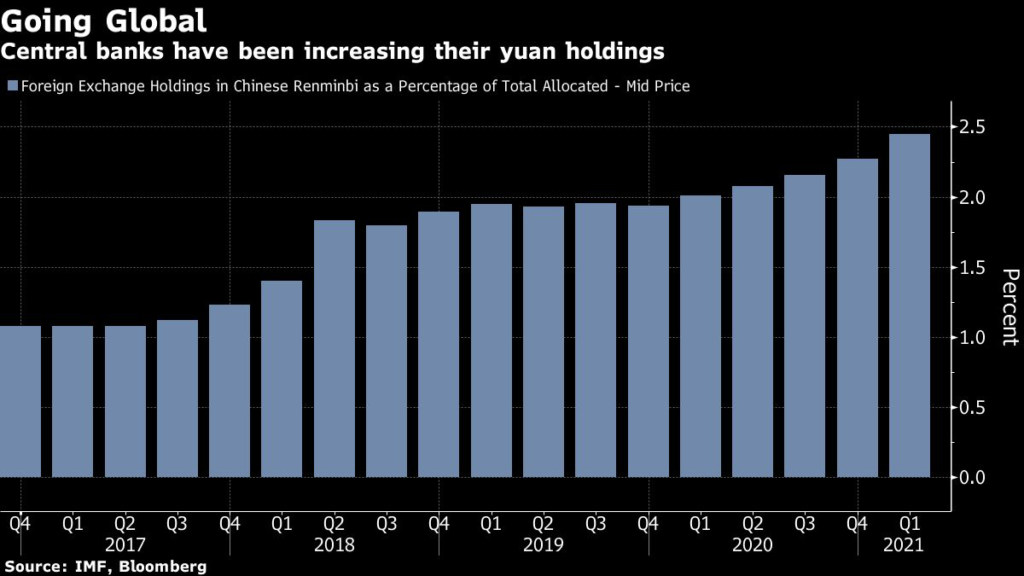

Global funds boosted holdings of Chinese government bonds to a record in July despite that month’s market turmoil, and inflows are expected to continue as some of the securities will be included in FTSE Russell’s flagship global index this October. About 30% of central banks are planning to increase exposure to the yuan in the next 12 to 24 months, three times the proportion reported last year, according to a survey by Official Monetary and Financial Institutions Forum, a London-based think tank.

“Although China’s crackdown may not be over, global demand for its Treasuries may be intact,” said Stephen Chiu, Asia currency and rates strategist at Bloomberg Intelligence. “The allure of China’s Treasuries may not be hurt by such local, idiosyncratic events given their relatively high yields compared to the bonds of other major governments.”

Proof of the yuan’s increasing adoption is emerging across a broad swath of industries, notably commodities.

While the dollar remains the key currency for the trade of raw materials, more firms are turning to the yuan to cater to clients based in China, which is the world’s largest importer of commodities. Rio Tinto Plc, the world’s biggest iron-ore producer, says it has conducted 12 seaborne transactions in yuan within the past two years. Vale SA, the second-biggest miner, conducts spot sales at Chinese ports in the domestic currency.

International foreign-exchange services firm Ebury says yuan use is rising across its client base. Payments into China using the currency increased by 20% in the past year, Sydney-based corporate dealer Patrick Idquival said. The shift has been so pronounced the company set up a desk for “renminbi relations.”

Though yuan internationalization has been growing, there’s a long way to go as the currency’s share of global payments via Swift and central bank reserves still pales in comparison to the greenback.

“The improvements in secondary liquidity for both the yuan and Chinese securities including bonds and equities have made it a much better investment currency,” said Becky Liu, head of China macro strategy at Standard Chartered Plc in Hong Kong. “We need more breakthrough of renminbi-denominated pricing of commodities in the next stage.”

(Updates to add yuan’s performance in sixth paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.