(Bloomberg) — The pound hit the lowest since November 2020 when the U.K. was in a coronavirus lockdown as three separate reports suggested the economic recovery is faltering.

S&P Global’s PMI for both services and the whole economy fell to a three-month low in April, while consumer confidence sank to its lowest since the recession in 2008. Retail sales fell more sharply than expected in March.

The figures add to evidence that a cost-of-living crisis is starting to drag down activity. Consumers are struggling with a surge in energy bills, higher taxes and the strongest inflation in three decades, and that’s starting to constrain the outlook for the rest of the year.

“Higher prices and the associated rising cost of loving were often cited as a principle cause of lower demand, with Covid continuing to affect many businesses,” said Chris Williamson, chief business economist at S&P Global.

The weak figures triggered a sell-off in sterling, which tumbled more than 1% against the U.S. Dollar and the euro, and plumbed a 1 1/2-year low against the greenback of $1.2857.

The pound is on track to post its biggest one-day loss against the euro since December 2020, as growing signs of a sluggish economic recovery prompt investors to pare back expectations that the Bank of England will raise interest rates quickly.

The readings will feed into debate about how quickly policy makers should move to calm inflation, which at 7% is more than triple the target. Investors anticipate another increase in interest rates next month, bringing the key lending rate to 1% for the first time since the global financial crisis more than a decade ago.

BOE policy maker Catherine Mann on Thursday raised the prospect of a bigger jump in interest rates to control inflation. She also said she’s focused on how well demand holds in determining how to vote in May.

She noted that data suggested “consumers were forward-looking, which would translate into a period of softer demand growth, perhaps even retrenchment.”

“Mann put the cat amongst the pigeons yesterday by suggesting the BOE could accelerate its pace of tightening if the economy withstood the cost of living crisis,” ING analysts wrote in a note. “Today’s soft U.K. March retail sales release is a notch against such an outcome.”

What Bloomberg Economics Says …

“The U.K.’s composite PMI fell in by more than forecast in April, suggesting momentum is slowing as high inflation hits consumer spending and drags on growth. The PMI is likely to deteriorate further in coming months, as the squeeze on the cost-of-living tightens. Bloomberg Economics expects GDP to contract in 2Q and the economy to flirt with recession in the second half of the year.”

–Ana Luis Andrade, economist. Click for the REACT.

S&P’s composite PMI fell to 57.6 in March, the lowest in three months and below the reading of 58.7 anticipated by economists. Services fell, while manufacturing output reached a two-month high. The report showed manufacturing orders stalled and the highest increase on record for prices at the factory gate.

U.K. retail sales plunged more than forecast, with the volume of goods sold in stores and online down 1.4% last month, the Office for National Statistics said. Economists had expected a decline of 0.3%.

A separate survey by GfK showed that U.K. consumer confidence sank for a fifth-straight month in April, with Britons more pessimistic about the outlook for their personal finances and the general economy than during the depths of the financial crisis. Bloomberg Economics said the figures were synonymous with recession.

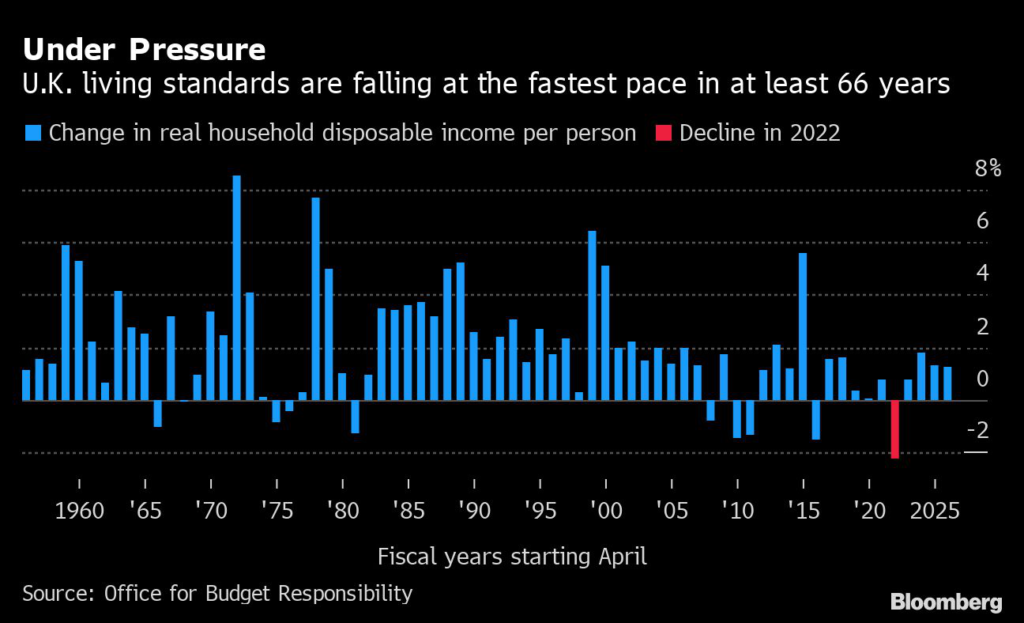

Wages are increasingly falling behind the rate of inflation. Households suffered a further blow this month when energy bills and payroll taxes rose sharply. Together, the shock is forecast to deliver the biggest blow to living standards in at least six decades.

The plunge in retail sales was led by sales of food, clothing and footwear, and auto fuel. Record-high petrol and diesel prices, driven up by the war in Ukraine, led people to make fewer non-essential journeys.

Online sales also declined sharply to 26% of total sales, the lowest proportion since February 2020, as people cut discretionary purchases.

The impact was partially offset by increased sales of household goods, thanks to sales of DIY and second-hand items, itself a possible sign of Britons economizing.

Consumers are also facing the prospect of more expensive mortgage costs as the Bank of England raises interest rates in an effort to tame inflation.

A separate ONS survey found that 87% of adults reported their cost of living had increased over the past month, up from 83%. Some 88% said the reason was an increase in the price of food.

The outlook for retail sales and the broader economy will depend on the willingness of households to use savings built up during the pandemic to cushion the blow.

That’s not an option for poorer families, who will be forced to borrow to maintain their living standards or buy fewer goods and services. Economists in a regular Bloomberg survey put the chance of a recession in the coming year at 30%, the highest it has been since early 2021.

“Retailers are themselves squeezed between rising costs of operations, exacerbated by the situation in Ukraine, and weaker demand from customers,” said Helen Dickinson, chief executive of the British Retail Consortium. “Higher global commodity prices, rising energy and transport costs, and a tight labor market, are all taking their toll.”

(Updates market reaction.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.