(Bloomberg) — Taiwan’s financial regulator cleared 10 foreign brokerages of misleading investors following a probe into their sales of Taiwan Semiconductor Manufacturing Co. shares.

The Financial Supervisory Commission found the firms, which include Goldman Sachs Group Inc., Citigroup Inc. and UBS Group AG, had committed no wrongdoing in their trading of Taiwan’s biggest company, according to a commission report prepared for lawmakers and seen by Bloomberg.

The FSC launched the investigation last month at the behest of legislators who complained the brokerages had issued reports on TSMC with “buy” recommendations, while their trading desks sold large amounts of the company’s shares between Dec. 1 and March 21.

The brokerages sold TSMC shares at their clients’ request, the report found. Their clients are mostly institutional investors who adjust their asset allocations based on their own global investment considerations, not necessarily following advice of research reports. None of the sales involved the institutions’ proprietary trading, the report concluded.

After scrutinizing 45 research notes issued during the period in question, the regulators found that nine of the brokerages had changed their views on TSMC’s outlook but had updated their research notes in a timely manner in line with stock exchange regulations and the companies’ internal controls.

The companies subject to the probe were Goldman Sachs, Citigroup, UBS, Morgan Stanley, Merrill Lynch, Nomura Holdings Inc., JPMorgan Chase & Co., Daiwa-Cathay Capital Markets Co., CL Securities Taiwan co., and HSBC Holdings Plc.

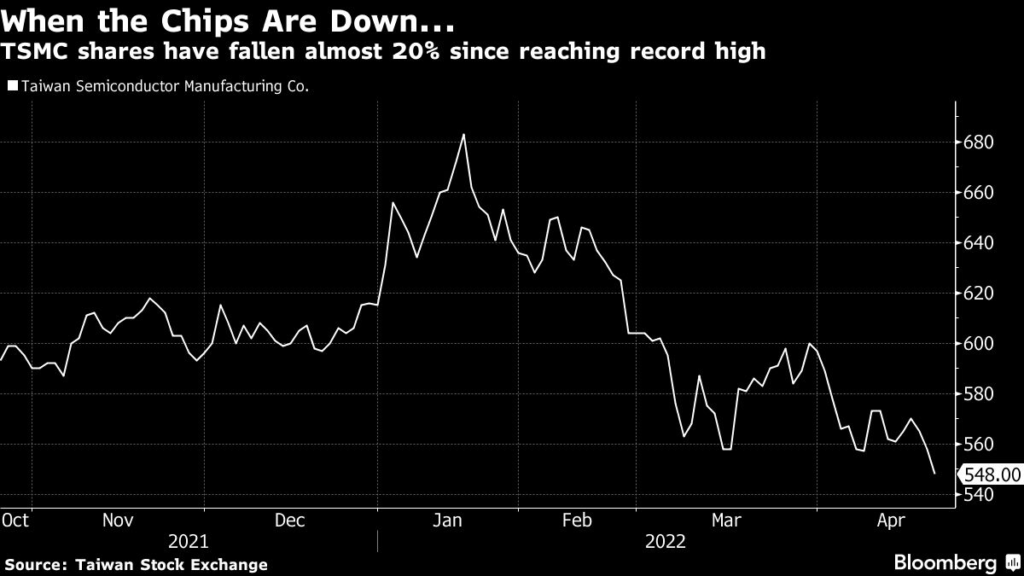

The increased scrutiny of TSMC’s shares has done little to arrest their slide. The shares have fallen more than 7% to NT$547 as of Monday since the probe began in late March. Shares have plunged almost 20% since reaching a record high of NT$683 on Jan. 17.

The declines have been driven by equity outflows out of Taiwan. Foreign investors have pulled a net NT$172.5 billion out of the benchmark market this month.

“Strengthened Management”

In the report, regulators recommended that the two main local stock exchanges do more to explain to investors that the trading data they release include financial institutions’ prop trading and client trading data. The bourses should also strengthen investor education to improve their understanding of research reports.

The FSC also said it will consider strengthening its management of research notes to protect investor rights and maintain trading order.

Taiwan’s regulator is known for keeping a tight grip on financial companies, especially in cases like front-running trades or when retail investors are harmed. Taiwan penalized Deutsche Bank AG and three other foreign lenders last year after a probe into speculation on the surging local currency a year earlier involving grain companies.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.